Nazara Technologies faced a sharp market sell-off this week, with shares tumbling nearly 7 per cent intraday to Rs 1,302.45. The fall wiped out around Rs 916 crore in investor wealth, as Parliament passed the Promotion and Regulation of Online Gaming Bill, 2025. The legislation changed the scenario across gaming companies, particularly those perceived to have exposure to real money gaming (RMG).

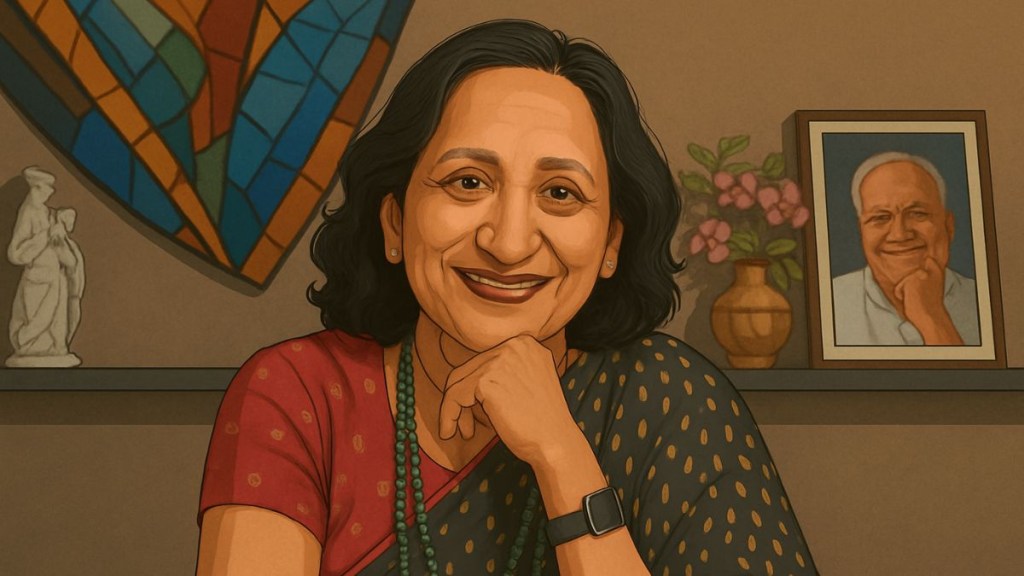

Rekha Jhunjhunwala’s timely exit

FinancialExpress.com, in its July 25 Stock Insight report, noted that investor Rekha Jhunjhunwala had already exited her stake in Nazara Technologies Ltd by June 2025, well before the latest regulatory turmoil. At the end of March 2025, she held a 7.06 per cent stake, amounting to 61.8 lakh shares. By June, however, she sold her entire holding at an average price of around Rs 1,225 per share, netting nearly Rs 334 crore.

Her decision not only insulated her portfolio from the ongoing turbulence but also marked the closure of her late husband Rakesh Jhunjhunwala’s legacy in the company, where he once held 10.82 per cent. Rekha continues to be one of India’s most influential investors, with stakes in 25 listed companies worth over Rs 40,000 crore, according to Trendlyne.

However, other marquee investors remain invested in Nazara. Market veteran Madhusudan Kela holds 10.96 lakh shares (1.18 per cent), while Zerodha co-founder Nikhil Kamath, through Kamath Associates, owns 15.04 lakh shares (1.62 per cent). Their exposure has raised questions about whether they will stay the course or trim their holdings as regulatory uncertainty deepens.

Nazara’s indirect exposure through Moonshine Technology, the operator of PokerBaazi, has particularly rattled markets. Though Nazara clarified that Moonshine’s revenue is not consolidated into its financials, the association was enough to spark a wave of investor caution.

Brokerage downgrades and market perception

Reflecting this sentiment, ICICI Securities has downgraded Nazara to ‘reduce’, slashing its target price from Rs 1,500 to Rs 1,100. The brokerage assigned zero value to its earlier Rs 400 estimate for Moonshine in light of the proposed ban. However, it shows that Nazara’s other verticals such as gamified early learning, publishing, and gaming arcades remain unaffected.

Nazara has also stressed that RMG contributed nothing to its Q1 FY26 revenues and that it does not expect any material impact on reported revenue or EBITDA. Yet, the market’s reaction underscores how even indirect linkages to real money gaming can erode confidence.

What do we know about Nazara Technologies?

Nazara Technologies was founded in 1999 and listed in 2021. It is among India’s first gaming companies to make a global mark, with presence in markets such as Africa and North America. Its revenues grew at a compound annual rate of 46 per cent from FY20 to FY25, touching Rs 1,624 crore last year. Despite achieving net profits of Rs 51 crore in FY25, the company logged operating losses of Rs 114 crore.

At present, the stock trades at a steep price-to-earnings ratio of 198x, which is well above the industry median of 98x. This valuation premium may come under scrutiny if regulatory headwinds persist.

Meanwhile, the Nazara’s management has outlined a growth strategy which includes global expansion through acquisitions, strengthening eSports and gaming IPs, and leveraging artificial intelligence for efficiency. While the company remains optimistic about FY26, the regulatory overhang poses significant challenges.