Genus Power Infrastructures (GPIL) is a leading smart meter solutions provider in India, with a total manufacturing capacity of 10mn meters p.a. It is the largest listed smart electricity meter company in India and provides end-to-end services including set-up of Advanced Metering Infrastructure (AMI) and Facility Management Systems (FMS) post implementation. With >25% pan-India market share in meters – its market share among private discoms is >65% – GPIL is set to become one of the largest beneficiaries of upcoming smart meter installation drive under the Rs 3-trn revamped distribution sector scheme (of which 50% is for smart meters).

The scheme targets installation of 100mn and 250mn prepaid smart meters by Dec’23 and Mar’25 respectively, replacing conventional meters and structurally transforming the financial dynamics of the power sector. With only 2.8mn smart meters installed as of Aug’21, we believe the opportunity size is huge though the pace of execution is key. We initiate coverage with a Buy rating and TP of Rs 117.

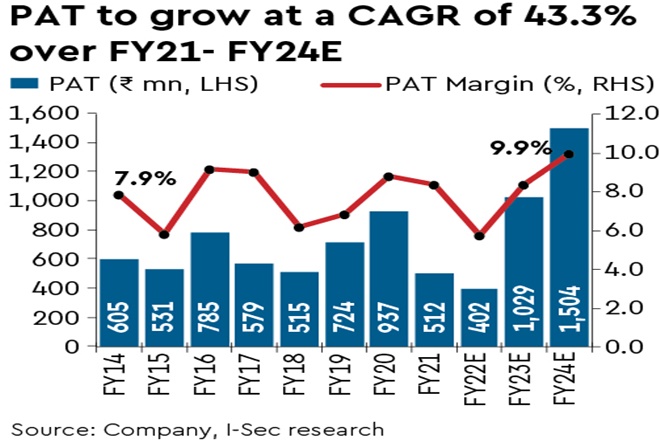

Valuations and risks: We value GPIL at 20x FY24E EPS of Rs 5.8/share and initiate with a Buy rating and target price of Rs 117. At CMP of Rs 63/share, the stock is trading at 10.7x P/E and 1.5x P/B on FY24E basis. Key risks: (i) further lockdowns affecting project implementation and supply chains; (ii) slower than anticipated pick-up in tendering activities;

(iii) non-cooperation by states in implementing the revamped distribution sector scheme; (iv) significant increase in commodity prices.