Havells has announced the acquisition of Lloyd Electric’s consumer durable business. Under the terms of the deal, Havells will acquire (i) right to use “Lloyd” brand and (ii) consumer durable business which is engaged in sourcing, assembling, marketing and distribution of consumer durables including air conditioners, TVs, washing machines and other household appliances. ACs/TVs/Washing machines constitute c.65%/25% /10% of revenue. The business has TV assembling operation and will source ACs & Washing machines from Lloyd Electric and other manufacturers initially.

Acquisition EV of R16 bn does not look excessive prima facie: For 9MFY17, revenue of acquired business was R12.4 bn and Ebitda was R750m. According to Havells, FY17 revenue and Ebitda is expected to be c. R18.5 bn and R1.1 bn. In FY16, the acquired business had revenue growth of c.59% y-o-y. However Ebitda margin at c.6% is low especially compared to Havells’ Ebitda margin of 13-14%. Acquisition EV/Ebitda of c.15x on current year Ebitda does not appear excessive especially given scope for margin improvement, growth opportunity and scope for some synergy benefits.

You May Also Want To Watch:

[jwplayer GoMM56DZ-DE6UeepY]

For funding the acquisition; some debt may be needed: As of Dec 2016, Havells had net cash of R14.2 bn. Factoring in some continuing need for working capital and capex to close the acquisition, it may need to borrow R5-6 bn.

Marginally negative to neutral for PAT and EPS: Given

R16 bn of acquisition EV and FY17 Ebitda of R1.1 bn, acquisition may be negative for FY18e PAT/EPS. However actual impact will also depend on management’s ability to reduce costs and achieve synergies while achieving growth.

Sizeable distribution reach but is up against much bigger competitors: Acquired business has 10,000+ direct /indirect dealer network spread across India, 34 sales branches, 486 authorised service centres and 31 company owned service centres. However in key segments it operates, it does compete against much bigger rivals with larger balance sheets, manufacturing capabilities. Overcoming this challenge will be crucial for success of acquisition.

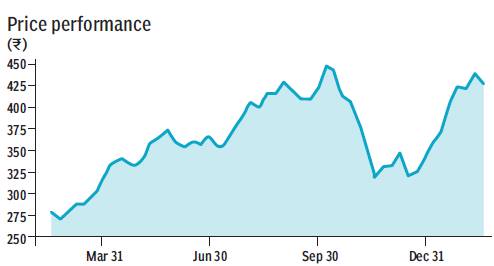

Valuation: Our target price of R401 is based on 35x March 2018e EPS, based on the ~10% premium over average trading multiple over FY15-FY16 to reflect higher earnings growth, strong cash flows and balance sheet health. We peg Havells P/E at 35x due to superior RoE profile (22% RoE) and visibility of earnings (18% EPS CAGR over FY16-FY18e).