The Securities and Exchange Board of India has banned Gensol Engineering Ltd (GEL) and its promoters Anmol Singh Jaggi and Puneet Singh Jaggi from accessing the securities markets until further notice. The ban comes in the wake of serious allegations of fund diversion and corporate governance lapses.

In a 29-page interim order released Tuesday, the markets regulator also restrained the two promoter-directors from holding any directorial or key managerial positions in the company during the ongoing investigation. Sebi further directed Gensol to suspend its recently announced stock split.

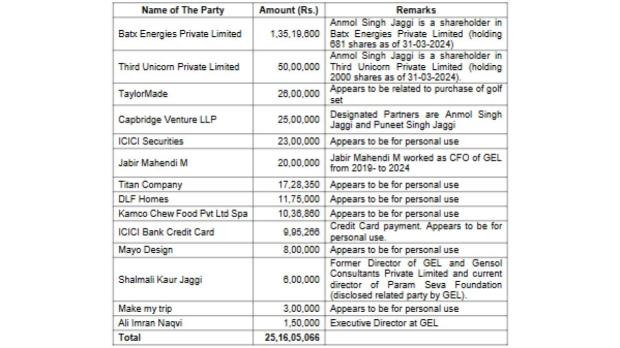

The order stated that funds diverted from Gensol were used by entities linked to promoters for personal benefit. Notably, Rs 42.94 crore from a broader loan taken by Gensol was ultimately routed through promoter Anmol Singh Jaggi-controlled Capbridge Ventures to purchase a luxury apartment in DLF Camellias. Additionally, Jaggi allegedly used Rs 50 lakh from the misused funds to invest in Ashneer Grover’s startup, Third Unicorn and for other personal expenses, including travel.

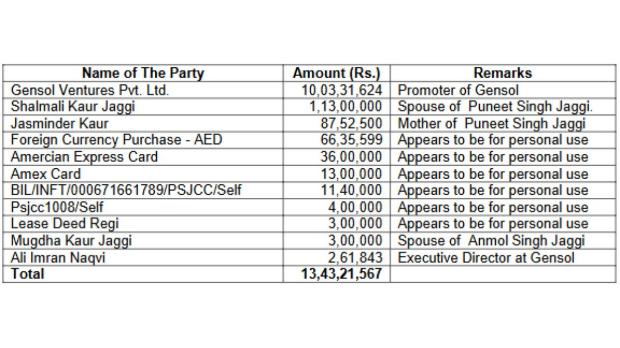

An analysis of the bank statements of Puneet Singh Jaggi revealed that a significant portion of the funds received from Wellray, amounting to approximately rs 13.55 crore, were primarily transferred to related parties, family members or used for personal expenses. Several transactions appeared to be for personal use, including foreign currency purchases worth Rs 66.36 lakh, payments to American Express cards totaling Rs 49 lakh and other self-related transfers totaling over Rs 18 lakh.

When did SEBI start investigating Gensol?

The crackdown comes in response to a complaint filed in June 2024, which raised red flags about share price manipulation and misappropriation of company funds. Sebi’s probe has revealed what it describes as “prima facie findings of fraudulent fund diversion” by the Jaggi brothers, who are the primary beneficiaries of the siphoned money.

According to the order, the loan funds obtained for the purpose of purchasing electric vehicles were instead rerouted through a web of transactions to finance the purchase of a luxury apartment. Gensol had received a loan of Rs 93.88 crore from the Indian Renewable Energy Development Agency (IREDA), which was then transferred to Go-Auto Private Ltd. Of this, Rs 50 crore was moved to CapBridge Ventures LLP, a firm significantly influenced by both promoters, ultimately Rs 42.94 crore was paid to DLF for a high-end apartment in The Camellias, Gurugram.

‘Complete breakdown of internal controls’, says SEBI

Sebi has accused the company of submitting forged conduct letters purportedly issued by its lenders, with the intent to mislead not just the regulator, but also credit rating agencies, institutional lenders and investors.

“There is clear evidence of a complete breakdown of internal controls and corporate governance norms,” said Sebi. “The Company’s funds were routed to related parties and used for unconnected expenses, as if the Company’s funds were promoters’ piggybank. The result of these transactions would mean that the diversions mentioned above would, at some time, need to be written off from the Company’s books, ultimately resulting in losses to the investors of the Company,” the official order read.