Benchmark indices Sensex and Nifty extended their winning streak to 10 consecutive years in 2025, delivering returns of 9.06% and 10.51%, respectively. Looking ahead, top domestic and global brokerages are projecting an upside of 10-26% in 2026.

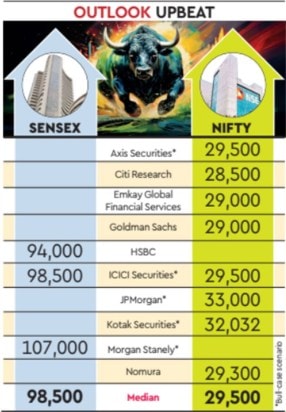

Brokerages see more headroom for Sensex and Nifty in 2026

The median of analyst estimates for the end of 2026 stands at 98,500 for the Sensex and 29,500 for the Nifty. On the last day of 2025, the benchmarks closed at 85,220.60 and 26,129.60, respectively.

For the Sensex, estimates range from a low of 94,000 to a high of 107,000 in a bull-case scenario. For the Nifty, targets range from 28,500 on the downside to as high as 33,000 in the bull case.

Rate cuts, GST, capex boost

Brokerages expect GST rationalisation, potential rate cuts, benign inflation, and a favourable monsoon to support near-term growth, while infrastructure spending and capital investments could drive the longer-term outlook.

Moderating valuations have also created a more favourable set-up for 2026. At the same time, analysts have flagged emerging risks such as geopolitical tensions, rising trade protectionism, and currency volatility while outlining their market projections for the year ahead.