BIL’s Q3FY22 revenue at Rs 20. 8 bn, +39% y-o-y, was largely in line with our and consensus estimates. However, Ebitda at Rs 5.1 bn, +7% y-o-y, was ~7% below our/consensus estimates. Ebitda margin disappointed at 24.4% (Nomura: 27%, consensus: 26%) on rising commodity (RM/sales +186bps q-o-q) and higher marketing (+Rs 100 mn)/fuel expenses (other expense/ sales +108bp q-o-q). Q3 volumes were at ~70.3k tons, up 18% y-o-y (in line).

Commentary: Demand remains robust across geographies; however, capacity constraints will limit volume run rate to ~70-72k tons per quarter. The company maintained its FY22F volume guidance of 275k-285k tons. New capacities should come on-stream by Q3FY23F, with FY23F exit capacity at 360k tons. BIL continues to gain market share. Costs: It has taken ~2-3% price hike in Q3FY22 and nothing yet in Q4FY22. The company expects another 2-3% cost increase in Q4 and looks to sustain current margins. It maintains its target of 28-30% Ebitda margins over the medium term.

Our view: We note that global agriculture crop prices remain elevated and will continue to drive near-term demand. Commentary from global peers like Titan and Michelin also indicates strong outlook. This should drive pricing power as well over a period. However, given the cyclical nature of the commodity, we expect growth to normalise in FY23F (structural industry growth of ~3-4% y-o-y).

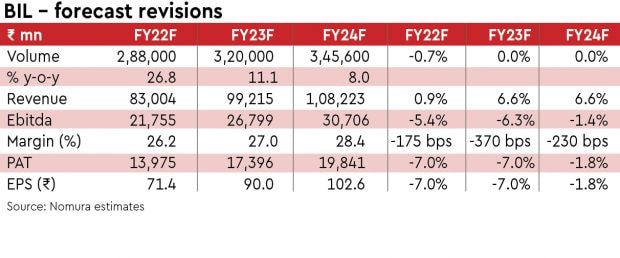

Overall, we raise our revenue estimates by ~1-7% due to price hikes, but lower Ebitda margins to 26.2%/27%/28.4% (28%/ 30.7%/30.7% earlier) over FY22-24F to factor in rising commodity/fuel costs. This still implies ~Rs 89k Ebitda per ton in FY24F (unchanged, from Rs 72k now). Thus, we revise our EPS estimates by -7%/-7%/-2% for FY22F-24F.

Valuation: New TP of Rs 2,246, based on 14x FY24F EV/Ebitda

The stock is down by ~17% in the past one month (Sensex -6%) and we believe current valuation at ~12.8x FY24F EV-Ebitda is fair, given the outlook. We maintain our 14x target FY24F EV/Ebitda, and roll forward to Mar-24F (from Dec-23F) to arrive at a higher TP of Rs 2,246 (Rs ,233 previously).

Thus, we upgrade the stock to Neutral. In the tyre sector, we prefer Apollo Tyres (APTY IN, Buy).