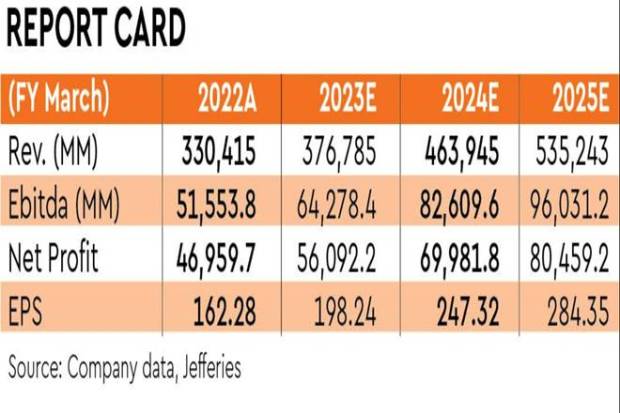

Bajaj‘s 2Q EBITDA and NP grew 31-40% y-o-y and were 11-14% above JEFe led by better-than-expected ASP and margins. EBITDA per vehicle rose 10% q-o-q to an all-time high despite q-o-q lower share of exports in volumes. Bajaj expects Indian motorcycle industry to grow at low-single-digit in festive season. Exports should also improve from 2Q lows, but outlook remains weak amid FX and USD availability issues in key markets. We raise FY23-25 EPS by 5-6% and retain Buy.

Good margins despite weak exports: Bajaj’s Q2 EBITDA and NP grew 31-40% y-o-y. Volumes grew just 1% y-o-y as 30% growth in domestic was largely offset by 25% fall in exports. ASP, however, rose 3% q-o-q led by price hikes and favourable FX. Gross profit per vehicle was flattish q-o-q despite share of higher-margin exports in volumes falling 23ppt q-o-q.

Also read| Tata Communications, Zee Entertainment, ACC, Tata Coffee, GMDC, V-Mart Retail, L&T Tech stocks in focus

Premium bike demand better than entry: Bajaj said that Indian motorcycle demand seems to be bottoming out, but trends are diverging across segments. Demand for entry level bikes (up to 110cc) is declining sharply especially in rural areas, while the mid and premium segment (125cc and higher) is growing. Bajaj expects industry volumes to grow at low-single-digits in the ongoing festive season. Bajaj’s motorcycle market share had dipped from 18% in FY22 to 13% Q1FY23, pulled down by chip shortages, but has improved to 20% in Q2FY23 (1HFY23: 17%) as chip shortages have eased.

Exports to improve from Q2 lows, but outlook weak: Bajaj’s export volumes (two-wheeler and three-wheeler) fell 25% y-o-y in Q2 as currency depreciation and poor USD availability impacted demand in several markets. Two-wheeler ban in Lagos in Nigeria, a key export market, also impacted exports. Improving margin outlook: Bajaj said raw material cost inflation in Q2 was at the lower end of its expected range of 1-1.5% q-o-q, which it was able to offset through price hikes. We expect 17.4-17.9% EBITDA margin in 2HFY23-FY25E (Q2: 17.2%).

Also read| Infosys Rating: Add | Renewed focus on cost efficiency

EV portfolio expansion ahead: Bajaj’s E2W Chetak volumes have ramped up from 6.3K units in Q1 to 9.8K in Q2. It expects Chetak’s volumes to reach 6K/month by March. It also plans to launch 3-4 new products in next 18 months to cater to different use cases. Bajaj is looking to expand Chetak’s presence to 85 cities by year-end.

Maintain Buy: We raise FY23-25 EPS by 5-6%, on slightly higher margins. Despite the near-term headwinds in exports, we continue to like Bajaj as we expect a strong revival in Indian two-wheeler demand ahead. Bajaj’s 18x/14x FY23E/FY24E PE are reasonable and 4-6% dividend yield is attractive. We retain Buy with Rs 4,200 PT (earlier Rs 4,100), although we prefer TVS and Eicher in two-wheelers.