Similar to Q1, ACC posted another solid set of results in Q2CY21. Despite the impact of COVID-19 restrictions on volume (-14% q-q), standalone Ebitda at Rs 8.7 bn (+2% q-q, +67% y-o-y), came in 15% /20% above our / Bloomberg consensus estimates. The key reason for the beat was once again lower per unit opex (+2% q-o-q). And there was once again favourable inventory change (Rs 2.1 bn or ~Rs 310/t). With lower costs and blended realisation rising 5.5% q-o-q, per unit Ebitda at Rs 1,279 (+19% q-o-q) was at a record high. For H1, standalone Ebitda/normalised PAT were up 56%/ 92% y-o-y, driven by 31% y-o-y higher volumes (aided by low base) and 19% y-o-y higher per ton Ebitda at Rs 1,171.

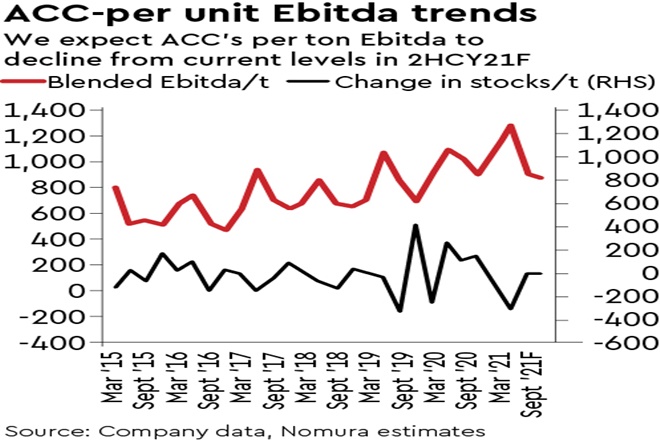

With rising input costs, onset of monsoon, record Ebitda/t unlikely to sustain: With ~5% y-o-y higher cement realisations, cost-saving initiatives and favourable inventory changes, ACC’s blended Ebitda/t in H1CY21 was up sharply. We expect ACC’s Ebitda/t to decline significantly in H2CY21F, for CY21F Ebitda of Rs 1,021/t .

Raise CY21F/22F core Ebitda by 10%/5%: With lower opex in H1, we raise CY21F core-Ebitda by 10%, while our CY22F core Ebitda increases by 5%. With higher Ebitda and lower depreciation, our CY21F/CY22F earnings increase by 14%/9%. We expect sharp 34% y-o-y increase in CY21F earnings. We continue to value ACC at 10x core Ebitda, but roll forward to Jun-23F (from Dec-22F). Driven by higher core Ebitda and roll-forward, our TP increases to Rs 2,215 (from Rs 1,930), implying 3% upside. With margins likely to have peaked, we maintain Neutral.