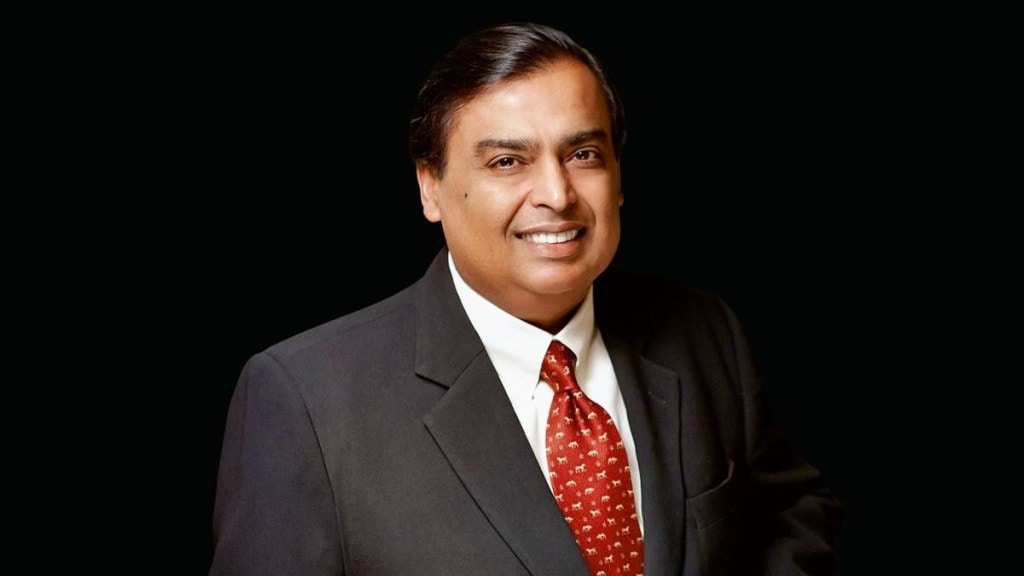

Mukesh Ambani, Asia’s richest man, boasts an astonishing net worth of Rs 9,81,471 crore. While you may not be the Chairman of Reliance Industries, understanding your own financial worth is essential and certainly achievable. With the help of the Securities and Exchange Board of India (SEBI), calculating your net worth is straightforward. This article will guide you through the process, helping you assess your financial standing.

Understanding Net Worth

Net worth is simply the difference between your total assets and total liabilities.

- Assets are everything you own, including cash, investments, properties, and valuable possessions.

- Liabilities are your debts, such as loans and credit card balances.

Calculating your net worth gives you a clear picture of your financial health and allows you to plan for your future more effectively.

Types of Assets

- Liquid Assets: These can be quickly converted to cash, such as savings accounts and mutual funds.

- Partially Liquid Assets: Assets like Employees’ Provident Fund (EPF) that can be accessed under certain conditions.

- Illiquid Assets: These include real estate and collectibles, which may take time to sell at market value.

Exclusions

Note that the home you live in is considered a consumable and should not be included in your investment asset calculation.

Step-by-Step Guide to Calculate Your Net Worth Using the SEBI Portal

Step 1: Access the SEBI Net Worth Calculator

- Open your web browser and visit the SEBI official website. Look for their financial tools or calculators section.

- Locate the Net Worth Calculator (https://investor.sebi.gov.in/calculators/Networth_Calculator.html)

Step 2: Enter Your Assets

- Liquid Assets: In the left panel, list all your liquid assets like cash in hand, savings accounts, and stocks. Adjust the type of liquidity for each asset where applicable.

- Partially Liquid Assets: Add your EPF and any other partially liquid assets.

- Illiquid Assets: Include real estate and other valuable assets you may own, but remember to exclude your primary residence from this calculation.

Step 3: Enter Your Liabilities

- On the right panel, input all your total liabilities. This includes:

- Home loans

- Car loans

- Credit card dues

- Any other debts you may have

Step 4: Calculate Your Net Worth

- Once all information has been entered, click on the Calculate button.

- The calculator will display your net worth, asset-to-debt ratio, and the amount of accessible wealth.

Step 5: Analyze Your Results

- Review your net worth to understand your financial standing.

- Compare your results against your financial goals and consider areas for improvement.

Calculating your net worth is a valuable exercise that provides insight into your financial health. While you may not be at Mukesh Ambani’s level, having a clear understanding of your finances is crucial for future planning. With SEBI’s user-friendly net worth calculator, you can easily assess your financial standing and take steps toward achieving your goals. So, how do you stack up? It’s time to find out!