By Pritish Raj

As the government and two-wheeler manufacturers remain at loggerheads over the deadline to phase out the conventional internal combustion engine and bring in electric vehicles instead, several entrepreneurs are busy creating a landscape to make the latter a success in their own small ways.

Fully conscious that electric vehicles in the two-wheeler space is not going to be an instant hit with consumers the way the government seems to think, these entrepreneurs are manufacturing at a low-scale and tying up with e-commerce (BigBasket, etc) and QSR firms (Dominos, etc) for their last mile deliveries.

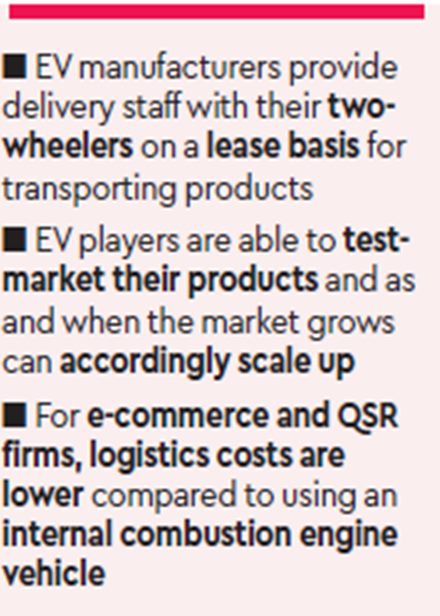

Their model is simple: The e-commerce and QSR firms have delivery staff who deliver products to consumers at their doorstep. These EV manufacturers provide them with their two-wheelers on a lease basis for transporting products. In this way the EV players are able to test-market their products and as and when the market grows can accordingly scale up.

For e-commerce and QSR firms, the logistics costs are lower compared to using an internal combustion engine vehicle.

Saurav Kumar, co-founder and CEO of New Delhi-based Euler Motors said issues such as charging infrastructure and range anxiety will continue to keep the private consumers disinterested for a while. “Most of the delivery services platforms are fairly young and they aim at lowering costs of operation and EVs are clearly one of the options,” Kumar told FE.

The company has already provided over 100 vehicles to companies like BigBasket, EcomExpress, Udaan and BlueDart. Euler Motors is around four year old start-up which manufactures a range of electric vehicles for carrying cargo and passengers.

Pankaj Tiwari, India business head of Avan Motors, said this is a segment which is eagerly looking for options of cost effective modes of commute for their delivery service executives, apart from environmental concerns. “We have the B2B segment as one of the key verticals of growth, which we are strongly pursuing and are in talks with such leading delivery services platforms to offer our electric scooters,” he said. Founded in 2015, Pune-based Avan Motors sells smart e-scooters across 25 touch points across India and plans to reach 200 points by end of 2019.

Executives working with such start-up firms said that the two-wheelers are given on a lease basis, for instance, an electric-scooter is given on a lease of `1,500-2,000 per month. The cost of an e-scooter with a battery capacity of 1 kilowatt is anywhere between `70,000 to `1 lakh. A lesser battery capacity two-wheeler would cost less.

Jeetender Sharma, founder and MD of e-vehicle start-up Okinawa Autotech said its vehicles are being used by PizzaHut and few regional delivery service platforms. “At the end of the day, these companies look for cost reduction and maximising profits for which e-scooters are apt. This model has also given an immediate boost to the sector,” Sharma said. Gurugram-based Okinawa Autotech was established in 2015 and manufactures a range of electric scooters. The manufacturing facility is located in Bhiwadi, Rajasthan.

Amrit Raj Singh, co-founder of e-scooter start-up Gemopai Electric believes until there is enough infrastructure for mass usage, the acceptance of EVs has to come from the B2B segment. “With the B2B players using them for last mile delivery, the use of EVs will percolate down to consumers,” he said. Apart from directly lending vehicles to the companies, these start-ups are also working on an aggregator model wherein they source the vehicles from the electric vehicle makers and deploy them to the delivery service companies on a contract basis. Among others, Swiggy, Grofers and Flipkart have announced they will be using EVs across the country for their delivery services.