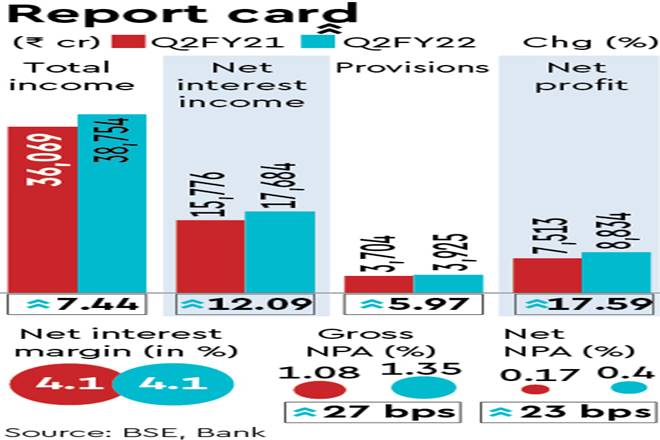

HDFC Bank on Saturday reported a 17.6% year-on-year (y-o-y) growth in net profit for the quarter ended September to Rs 8,834.31 crore on the back of a 21% y-o-y rise in other income to Rs 7,401 crore, with net interest income (NII) growing 12% y-o-y.

The bank’s provisions rose 6% y-o-y to Rs 3,924.7 crore, of which loan loss provisions were Rs 2,286.4 crore. In a statement, HDFC Bank said the total provisions for the current quarter include approximately Rs 1,200 crore in contingent provisions. The bank’s gross non-performing asset (NPA) ratio in Q2 fell 12 basis points (bps) sequentially to 1.35% and the net NPA ratio fell eight bps to 0.4% as on September 30.

HDFC Bank held floating provisions of Rs 1,451 crore and contingent provisions of Rs 7,756 crore as on September 30, 2021. Total provisions — comprising specific, floating, contingent and general provisions — were 163% of gross NPAs as on September 30, 2021.

The core net interest margin (NIM) in Q2 stood unchanged on a sequential basis at 4.1%.

Total advances as on September 30, 2021 were Rs 11.99 lakh crore, up 15.5% over September 30, 2020. Retail loans grew 13%, commercial and rural banking loans grew 27.6% and other wholesale loans grew 6%. Overseas advances constituted 3.5% of total advances.

Total deposits as of September 30 were Rs 14.06 lakh crore, up 14.4% over September 30, 2020. Current account savings account (CASA) deposits grew 28.7%, with SA deposits at Rs 4.52 lakh crore and CA deposits at Rs 2.06 lakh crore. Time deposits stood at Rs 7.48 lakh crore, an increase of 4.2% over the corresponding quarter of the previous year. The CASA ratio was 46.8%, as against 41.6% a year ago.

The lender’s total capital adequacy ratio (CAR) as per Basel III guidelines was at 20% as on September 30, up from 19.1% as on September 30, 2020 and as against a regulatory requirement of 11.075%. Tier-1 CAR was at 18.7% as of September 30, compared to 17.7% as of September 30, 2020. The common equity tier-1 (CET-1) ratio was at 17.4% as of September 30. Risk-weighted assets were at Rs 11.9 lakh crore, as against Rs 10.37 lakh crore as on September 30, 2020.

The bank’s NBFC subsidiary HDB Financial Services posted a net profit of Rs 191.7 crore in Q2FY22, as against a loss of Rs 85 crore in Q2FY21. The company’s provisions and contingencies for the quarter were at Rs 634 crore, down 32% y-o-y. The total loan book was Rs 60,008 crore as on September 30, up 0.44% from Rs 59,744 crore as on September 30, 2020. As on September 30, the gross NPA ratio based on the approach used for non-bank lenders was 6.1%, over 200 bps lower than in the previous quarter.