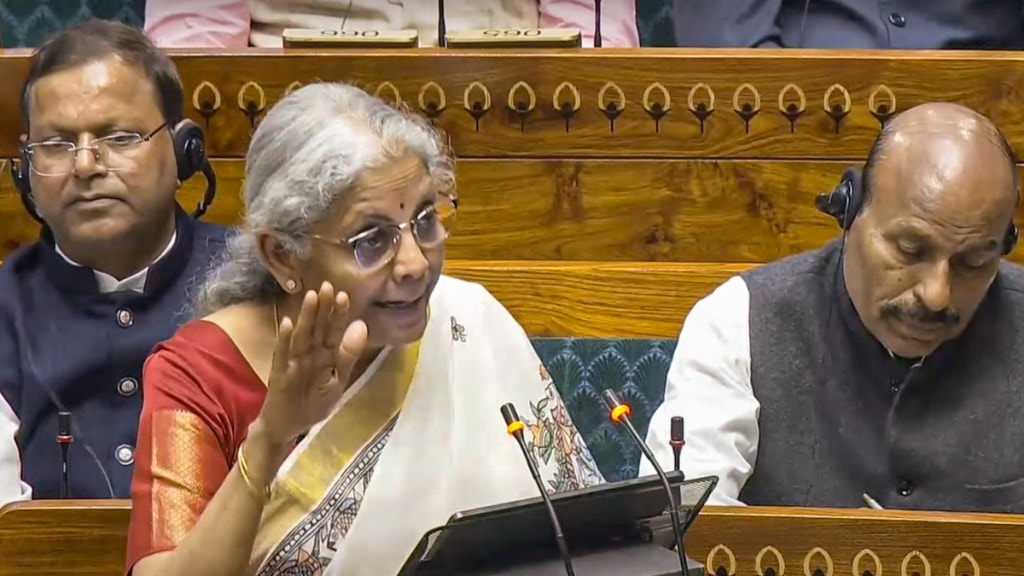

Budget 2025 Highlights, Announcements Highlights: India’s middle-class is finally rejoicing! In a major announcement, Finance Minister Nirmala Sitharaman in her Budget 2025 speech said that there will be no income tax till income up to Rs 12 lakh under the new regime. From increasing the FDI limit in insurance sector to modifications in cess and surcharge, the FM made some really significant announcements in this Budget. She also announced a rationalisation of the TDS (Tax Deduction at Source) regime aimed at easing compliance burdens. Presenting the 2025-26 Budget, she highlighted tax proposals focused on income tax reforms for the middle class, simplifying TDS processes, and reducing compliance challenges. The government will also introduce a new Income Tax bill next week, designed to be concise, clear, and half the size of the current version. Additionally, the limit for TCS on remittances under the RBI’s Liberalised Remittance Scheme will be raised from Rs 7 lakh to Rs 10 lakh. The Budget also includes exemptions for 35 additional goods used in EV battery manufacturing and 28 goods for mobile phone battery production.

Income Tax Slabs Under New Regime

- For income between Rs 4 to 8 lakh – 5%

- For income between Rs 8 to 12 lakh – 10%

- For income between Rs 12 – 16 lakh – 15%

- For income between Rs 16 – 20 lakh – 20%

- For income betweenRs 20 – 24 lakh – 25%

- Rs 24 lakh plus – 30% income tax slab

Budget 2025 Highlights Live: Delhi gets Rs 100 crore more; AAP calls it a ‘major disappointment’

The Delhi government has allocated Rs 100 crore more in the Union Budget 2025-26 compared to the previous fiscal, with total transfers rising to Rs 1,348 crore from Rs 1,248.01 crore in 2024-25.

The allocation includes Rs 968.01 crore as grants-in-aid under the revenue head and Rs 380 crore as loans and advances under the capital head, an increase from Rs 280 crore in the last budget.

Despite the rise in funds, the Aam Aadmi Party (AAP), which is seeking to retain power in the February 5 Assembly elections, termed the BJP-led Central government’s Budget a "major disappointment."

Budget 2025 Highlights Live: BJP CMs hail Budget as ‘Milestone’ for Viksit Bharat

Chief ministers of BJP-ruled states, including Uttar Pradesh, Haryana, Uttarakhand, and Rajasthan, have praised the Union Budget 2025 as a major step toward building a "self-reliant" and "developed" India. They hailed the announcements as crucial for economic growth and national progress.

However, opposition leaders had a mixed response. Himachal Pradesh Chief Minister criticized the Budget for not addressing key concerns such as unemployment, poverty, and inflation. Meanwhile, the National Conference, the ruling party in Jammu and Kashmir, termed the Budget announcements by Finance Minister Nirmala Sitharaman as "balanced."

Uttar Pradesh Chief Minister Yogi Adityanath, in a series of posts on X, welcomed the move to make income up to Rs 12 lakh tax-free, stating that it would significantly improve the lifestyle of the middle class.

PTI

Budget 2025 Highlights Live: Precious Metal Jewellery & Parts to Become Cheaper

Imported jewellery and parts made from precious metals are set to become more affordable as the government has proposed reducing the basic customs duty in the Budget 2025. The customs duty will be lowered from 25 per cent to 20 per cent for the fiscal year 2025-26.

As per the Budget document, the reduction applies to jewellery and parts under Harmonised System (HS) codes 7113 and 7114, including goldsmiths’ and silversmiths’ ware.

Additionally, the government has proposed a cut in the import duty on platinum findings, from 25 per cent to 5 per cent, but with the introduction of a 1.4 per cent Agriculture Infrastructure and Development Cess on platinum findings.

PTI

Budget 2025 Highlights Live: 5 key takeaways from Union Budget 2025

Income Tax cuts

Responding to growing discontent among the middle class over high taxation, the Finance Minister surprised many by announcing a major income tax relief. The tax rebate level has been raised to an annual income of Rs 12 lakh, up from Rs 7 lakh. Additionally, the highest tax rate of 30% will now apply only to those earning above Rs 24 lakh per annum.

These changes will leave taxpayers with more disposable income, which the government hopes will spur spending, drive economic growth and encourage businesses to invest in new capacities, ultimately leading to job creation and increased incomes.

Fiscal discipline maintained despite revenue foregone

A common concern with tax cuts is the potential increase in government borrowing. However, despite the Rs 1 lakh crore in foregone revenue, the fiscal deficit is projected to decline further to 4.4% of GDP in 2025-26. This disciplined approach prevents excessive borrowing, curbing inflation risks while ensuring economic stability.

Capital expenditure growth stalls

In previous budgets, the Modi government prioritized high capital expenditure to develop infrastructure projects like roads, ports, and bridges. However, this year’s Budget signals a shift, with capital expenditure growth slowing significantly. The government missed its target for the current fiscal year by nearly Rs 1 lakh crore, and next year’s budgeted capex increase is a modest Rs 10,000 crore. Nevertheless, the allocation remains high by historical standards.

Renewed focus on employment generation

Addressing criticism over the lack of employment-focused policies, this Budget emphasises job creation, particularly in labor-intensive industries like textiles and leather. Unlike previous Production Linked Incentive (PLI) schemes, which primarily benefited capital-heavy industries, these measures aim to boost employment and provide livelihood opportunities to a wider section of the population.

Push for regulatory reforms to improve business climate

The Finance Minister announced the formation of a high-level committee to evaluate regulatory reforms and introduce an Investment Friendliness Index. These measures aim to simplify bureaucratic hurdles and make it easier for businesses to operate in India. While a welcome move, experts note that these reforms come more than a decade after the Modi government first took office.

Budget 2025 Highlights Live: DEA on National Savings Scheme

The Secretary of the Department of Economic Affairs stated that the full asset monetization plan will be released soon. He also highlighted that the debt-to-GDP ratio is on a downward trajectory. Additionally, he mentioned that if there are higher inflows into the National Savings Scheme (NSS), market borrowing will decrease accordingly.

Budget 2025 Highlights Live: FM on SGBs and MGNREGA

Finance Minister on the future of the Sovereign Gold Bond scheme said that they are concluding it. Regarding MGNREGA, the Minister emphasised that it is a demand-driven program. He said the allocation will increase if there is a need. The revised estimate reflects this based on the demand."

Budget 2025 Highlights Live: Transition from old to new regime

Finance Secretary during the press conference said that 75% of taxpayers have already transitioned to the new Income Tax regime, and we anticipate that all taxpayers will eventually make the switch.

Budget 2025 Highlights Live: DEA Secretary on full asset monetisation

The Secretary of the Department of Economic Affairs (DEA) stated that the full asset monetization plan will be released shortly. He also mentioned that the debt-to-GDP ratio is on a downward trajectory. Additionally, he highlighted that if there are increased inflows into the National Savings Scheme (NSS), market borrowing would be reduced accordingly.

Budget 2025 Highlights Live: What FM Nirmala Sitharaman said at the press conference?

- Income is always calculated without capital gains

- Govt has responded to the voices of people

- I-T simplification work is completed

- This budget has many things to talk about

- We aim to become the food basket for the world

- There is continued emphasis on MSMEs

- Energy security has got special attention in this budget

- No reduction in public spending on capital expenditure

- Our fiscal prudence is aligned with our glide path announced

- Tax cuts will benefit every tax payer

- For someone who earns Rs 8 lakh, there will be Rs 1 lakh more to spend.

- We will continue with disinvestment

Budget 2025 Highlights Live: FM Sitharaman on capex

The Finance Minister addressed capex, stating that there is a clear demand for it, but the growth will proceed at a sustainable pace to ensure ongoing development. While some ministries may require additional capex, others may see their spending stabilize. She also emphasized that capex has not been sacrificed in favor of revenue expenditure or consumption-related spending.

Budget 2025 Highlights Live: FM on tax simplification

The Finance Minister stated that tax simplification will focus on making the language simpler and reducing the numerous exemptions. There will be no backtracking on the privatisation of banks. Meanwhile, the Revenue Secretary mentioned that an additional one crore people will benefit from the ₹12 lakh income tax rebate.

Budget 2025 Highlights Live: FM on Tax rebate

Finance Minister highlights that individuals earning up to ₹12 lakh annually will have nearly ₹2 lakh more at their disposal. Tax rates have been reduced across the board, with a revision of tax slabs. The FM emphasized that the government has placed significant amounts of money into the hands of those who truly deserve it, providing relief to taxpayers.

Any reason why rebate has been hiked from 7 to 12 lakhs? Finance Secretary Tuhin Kanta Pandey said that the changes in the slab are done to benefit every tax payer at every level. He said that those who are earning up to Rs 12 lakh will get more benefit. He added that the step to give income tax rebate was to come back to the economy in terms of consumption, savings and investment. The FM said that the rebate is not just for those earning Rs 12 lakh per annum, but the rates are being brought down for every salaried person.

Budget 2025 Highlights Live: The new Income Tax Bill will first go to a standing committee, informs FM

On being asked when the Income Tax Bill will come, Sitharaman said, "As a bill it will go to standing committee the it will come back to us, if any more amendments come, we will review and take it forward."

Budget 2025 Highlights Live: No reduction in public spending in capex

Sitharaman in her statement said that there's no reduction in public spending in Capex'. She said that the government has put continued emphasis on multiplier effect of capex.

Budget 2025 Highlights Live: Budget simplifies tariffs, says FM

The Budget focuses on reducing and simplifying tariffs, addressing the needs of the people. It reflects a government that listens and acts accordingly. Additionally, the process of simplifying income tax has already been completed, with the bill expected to be introduced next week.

Budget 2025 Highlights Live: Interest of health and education has been prioritised, says FM

Interest of health and education has been prioritised, says Nirmala Sitharaman at the press conference. She further added that measures like day care cancer centers needed action and implementation. She also said that this budget has given us several things from which you can understand how this economy is being planned to take forward towards Viksit Bharat.

Budget 2025 Highlights Live: Sitharaman's press conference begins

Finance Minister Nirmala Sitharaman is about to begin the press conference post the Union Budget 2025 speech. Stay with us as we bring to you direct developments form the presser.

Budget 2025 Highlights Live: JP Nadda applauds Budget for focus its inclusivity and focus on development

Union Minister and BJP National President JP Nadda praised the Union Budget 2025, calling it a well-balanced, inclusive, and development-oriented plan that advances India’s path toward becoming a developed nation. He extended his congratulations to Prime Minister Narendra Modi and Finance Minister Nirmala Sitharaman for presenting a budget that prioritizes the growth of all sectors. Nadda highlighted the increased tax exemption of up to Rs 12 lakh, which benefits middle-class families, and emphasized the budget's focus on youth skill development, agricultural investment, and creating employment opportunities, particularly in rural areas.

Budget 2025 Highlights Live: Eknath Shinde welcomes Union Budget 2025

Maharashtra Deputy Chief Minister Eknath Shinde expressed strong support for the Union Budget 2025, particularly the complete income tax exemption up to Rs 12 lakh, emphasizing its potential to drive economic growth. He noted that when people utilize these savings for spending or investment, it will stimulate the market. Shinde highlighted that the budget is a crucial step toward Prime Minister Narendra Modi's vision of transforming India into an economic superpower. He also praised the increased loan capacity for MSMEs, which he believes will foster growth in small industries, boost employment, and strengthen the national economy.

Former NITI Aayog CEO Amitabh Kant praised the Union Budget 2025 for offering a significant tax relief of Rs 1 lakh crore to the middle class, marking a historic move. He highlighted that this will stimulate consumption, production, investment, and long-term economic growth. Kant commended the fiscally responsible approach taken to ensure macroeconomic stability while focusing on key areas such as nuclear energy and insurance, which he believes will provide substantial benefits for the country in the future.

Budget 2025 Highlights Live: Yogi Adityanath apploauds Union Budget 2025-26

Uttar Pradesh Chief Minister Yogi Adityanath praised the Union Budget 2025, stating that it aligns with Prime Minister Modi’s vision for a 'Viksit Bharat.' He highlighted the budget’s focus on the middle class, cancer centers for hospitals across the country, and the establishment of an AI Center of Excellence in Uttar Pradesh, which he believes will boost global recognition for the state’s youth. Adityanath also welcomed the expansion of the Pradhan Mantri Jan Dhan Yojana and the increase in Kisan Credit Card limits, emphasizing that Uttar Pradesh would benefit significantly from these initiatives.

Reacting to the Union Budget 2025-26, Congress' Rahul Gandhi said that it is a band-aid for bullet wounds. He said, "Amid global uncertainty, solving our economic crisis demanded a paradigm shift. But this government is bankrupt of ideas."

Budget 2025 Highlights Live: RJD MP Manoj Kumar Jha says Makhana Board in Bihar is not a new thing

RJD MP Manoj Kumar Jha questioned the creation of the Makhana Board announced in the Union Budget 2025, suggesting it was not a new initiative. He challenged the government to verify if such a board already existed, labeling the announcement as re-packaging old plans with a fresh label.

Budget 2025 Highlights Live: Kiran Mazumdar-Shaw calls Union Budget stable and reassuring, emphasises need for IT Bill

Kiran Mazumdar-Shaw, founder and executive chairperson of Biocon, praised the Union Budget for its focus on key sectors like the poor, youth, farmers, and women, alongside proposed reforms in six critical areas. She described the budget as stable and reassuring, with a deliberate approach not to disrupt existing systems. Notable measures, such as the customs duty exemption on certain cancer and life-saving drugs, were highlighted as commendable. However, she emphasized the importance of considering the budget alongside the upcoming IT Bill for a more comprehensive understanding.

Budget 2025 Highlights Live: ITC’s Sivakumar applauds agricultural focus in Union Budget 2025

S Sivakumar, Chairman of the CII National Council on Agriculture and Group Head of Agri & IT Businesses at ITC, welcomed the Union Budget 2025 for prioritizing agriculture as a key driver of growth. He highlighted the integrated approach under the PM Dhanvantri Krishi Yojana, aimed at boosting agricultural growth in key districts. He also praised the proposed scheme to develop vegetable and fruit value chains, which he believes will support the expansion of high-value perishables and enhance nutritional security. Sivakumar further noted that the increase in credit limits under KCC would reduce farmers' reliance on costly borrowings and strengthen credit flow. He also expressed support for the inclusion of FPOs and cooperatives in agricultural schemes, viewing it as a positive step.

Budget 2025 Highlights Live: Uptick in budget allocated to Ministry of Road Transport and Highways

The Union Budget 2025 has allocated Rs 2,873.33 crore to the Ministry of Road Transport and Highways for the fiscal year 2025-26, marking a 2.41% increase over last year's allocation of Rs 2,805.18 crore. Additionally, Finance Minister Nirmala Sitharaman announced an increased funding of Rs 1,878.03 crore for the National Highways Authority of India (NHAI), up from Rs 1,693.71 crore in the previous year. At the start of the current fiscal year, NHAI's total debt was Rs 3.35 lakh crore, which had reduced to approximately Rs 2.76 lakh crore by the end of the third quarter of FY25.

Budget 2025 Highlights Live: Moody's Ratings skeptic about Budget pushing economic growth

Moody's Ratings expressed skepticism about the impact of the Indian government's tax relief measures for middle-class consumers on economic growth, following the announcement of the federal budget. Christian de Guzman, senior vice president and lead sovereign analyst for India at Moody's, questioned whether the tax cuts would effectively stimulate growth. He highlighted uncertainty over whether consumers would actually spend the additional income freed up by these tax reductions.

Budget 2025 Highlights Live: DMK criticises Union Budget 2025-26

Sitharaman after On Saturday, Tamil Nadu's ruling DMK party criticized the Union Budget, accusing it of being strategically crafted to gain political favor in states like Bihar, which is preparing for elections. DMK spokesperson TKS Elangovan argued that the income tax exemption introduced in the budget does not effectively encourage savings. He also claimed that the Budget seemed to prioritize certain states, citing that last year’s budget saw generous allocations for Bihar and Andhra Pradesh while states like Tamil Nadu were overlooked.

Budget 2025 Highlights Live: 'Budget has revolutionised rural economy,' says PM Modi

PM Modi while addressing the nation also said that the Budget announcements will revolutionise the rural economy and India's agriculture sector.