By Aditi Nayar

The Monetary Policy Committee’s (MPC’s) final monetary policy meeting for FY2023, that was held earlier today, maintained the policy rates and stance unchanged, as we had expected. However, several interesting things stood out in the MPC’s commentary and outlook.

First, the MPC’s growth outlook was quite subdued. It expects real GDP growth to moderate to 7.8% in FY2023 from the base-effect led surge of 9.2% projected by the NSO. While the MPC took a positive view of the Union Budget FY2023, highlighting that enhanced capex is expected to augment growth, its H2 FY2023 growth projection is quite modest at 4.3-4.5%. This implies that the MPC is expecting growth to remain quite weak beyond the base-effect led surge in H1 FY2023.

Further, these projections are subject to downside risks emanating from global financial market volatility, elevated international commodity prices and continuing global supply-side disruptions. Given such tepid expectations around growth beyond the next 2-3 quarters, the policy normalization process and rate hike cycle is likely to be quite drawn out, unless there is an unusually large surprise on inflation.

Separately, the consumer confidence data released by the Reserve Bank of India (RBI) indicated a mild improvement in the current situation index. While the future expectation index did moderate amidst the onset of the third wave, it remained in the optimism zone. This is in line with our view that the relatively lower severity of the third wave, would prevent a shock to consumer confidence, allowing a faster normalization in economic activity thereafter.

Moreover, the MPC’s projections for inflation were quite benign. It expects CPI inflation to average at 4.5% in FY2023, down from projections of 5.3% in FY2022; this is well below market expectations which are closer to 5%. More importantly, inflation is expected to revert close to the mid-point range of the MPC’s inflation target of 2%-6% by H2 FY2023, implying that there is no imminent need to hike rates (beyond policy normalization in the form of reverse repo hikes) on account of concerns around inflation.

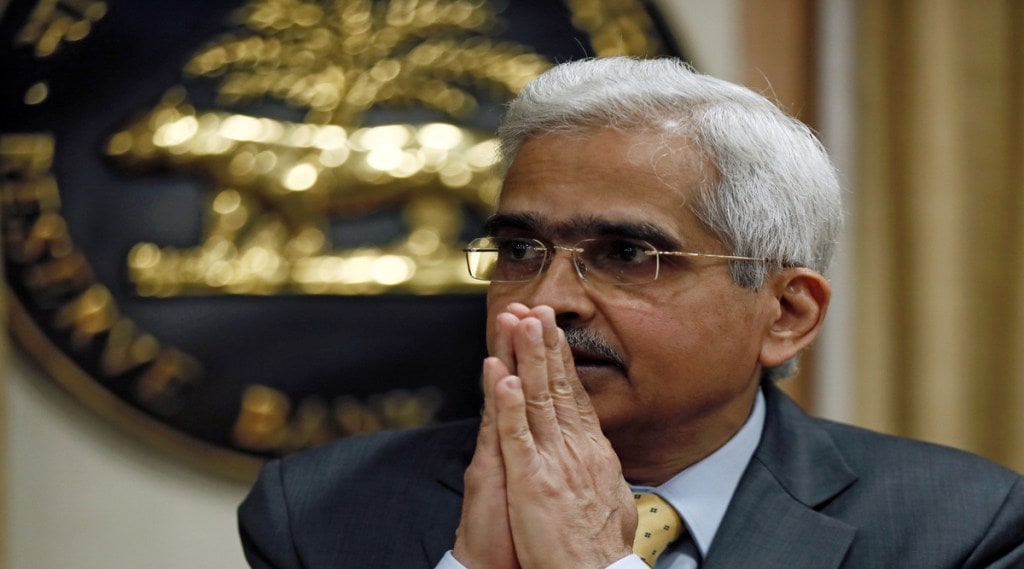

Besides, inflation is also perceived to be largely driven by supply side issues as is perceived in the MPC’s statement that ‘cost-push pressures on core inflation may continue in the near term’ and the RBI Governor’s statement that while ‘core inflation remains elevated, but demand-pull pressures are still muted’.

On a positive note, the RBI seems to have provided some support to the GoI’s borrowing programme, by enhancing the voluntary retention route (VRR) limits for investments by foreign portfolio investors by Rs. 1.0 trillion, which should help to contain yields.

Overall, the policy was extremely dovish, considering that a large segment of market participants had expected reverse repo hikes. Accordingly, a shift to a neutral stance in the April 2022 policy meeting appears to be ruled out, although we do expect policy normalization moves in the meetings thereafter. We have penciled in two 25bps repo rate hikes, in the August and October 2022 meetings, in conjunction our estimates of higher inflation vis-à-vis the RBI’s projections. Nevertheless, we believe that these are likely to be followed by an extended pause to assess the durability and broad basing of growth.

(Aditi Nayar is Chief Economist at ICRA Limited. The views expressed are author’s own.)