The goal of the one-day summit was to get promoters thinking beyond the existing business environment to create a blueprint for attaining future growth by assisting them in overcoming day-to-day operational issues. According to the latest data released by the International Monetary Fund (IMF), India is predicted to surpass Japan and Germany as the third-largest economy in the world by 2027, with a GDP of $5.15 trillion. This also considers the expansion of the MSME sector, which is the backbone of the nation’s economy.

Atul Gupta, Chairman GST Committee, Federation of Indian Industry explained how GST works for MSMEs. He also explained how the different types of classification of supplies under the GST law work. Different types of classification could be taxable and exempt supplies, inter- and intra-state supplies, zero rated supplies, etc.

It is the facilitation and arbitration process time that pushes MSMEzs to move toward courts, said Sanjeev Kumar Sharma, Senior Partner with Saraf and Partners.

Litigation is a big cost on the books and carries a lot of non-tangible costs to the enterprise, said Sumant Batra, Founder of Insolvency Law Academy. Mediation can work for MSMEs to control costs, it is a cost-effective measure.

The time being consumed in recovery and second is the prohibitive cost in the bucket. Litigation cost is a very unproductive cost and is a very substantial cost, said Sanjeev Kumar Sharma, Senior Partner with Saraf and Partners.

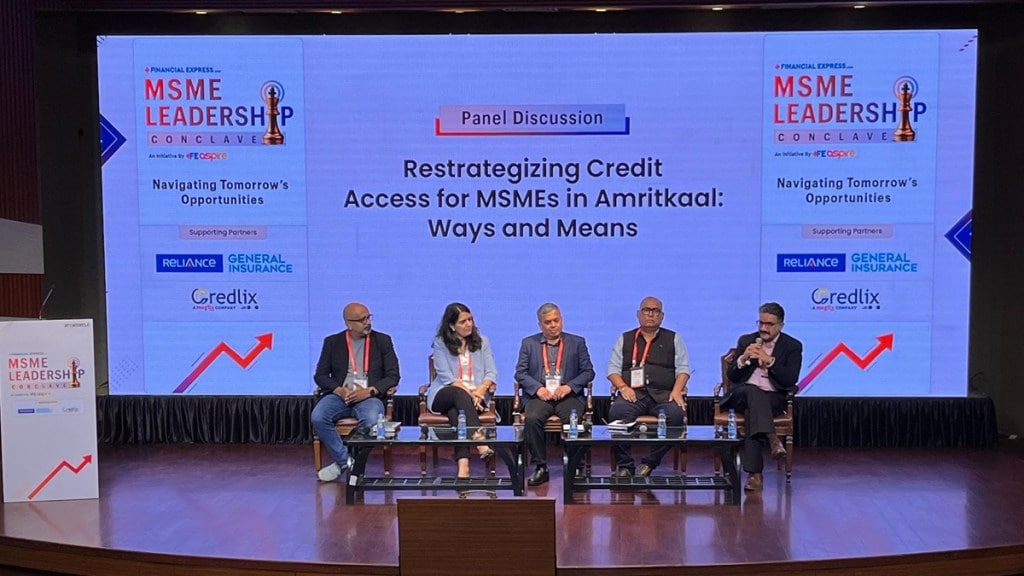

The export finance book has gone up as the bank is bullish on Exports, said Vivek Gupta, President and Head of Wholesale Banking Products at Axis Bank.

Exports through e-commerce will be taking the MSMEs to new heights. Exports complete on ly when the goods enter that country and to meet that standards needs to be met. For that to happen, MSMEs needs to be educated like what are the norms, how to access that required norms, etc., said Satinder Bhatia, Professor of Finance, Dean, and Director (Additional Charge) at Indian Institute of Foreign Trade.

At the ground level MSMEs are facing a lot of difficulties. In terms of the supply-chain, procurement is one of the challenges not just in domestic market but international as well, which needs to be solved. At a growing phase capital is a big thing for micro businesses, said Manav Mahajan, Director of Credlix.

In the foootwear sector, global trade has gone up while India has contracted, earlier it use to be in top 5 sectors. Also, the competitor Bangladesh has added $800 million in that particular sector, said Ajay Sahai, Director General and CEO of Federation of Indian Export Organizations (FIEO).

While giving a masterclass on Section 43B(H) Ashok Saigal explained that all MSMEs are not covered under the section, which asks corporates to pay delayed payments to micro and small enterprises. He said that medium enterprises are not covered under the aforesaid section because of the term enterprises, due to how the term 'enterprises' is defined under it.

Clause 15 of Section 43B(H) says that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance, explained Ashok Saigal while giving his Masterclass on Section 43B(H).

Supply-chain disruption is a big risk for MSMEs. These risks will eventually convert to financial risk later on. MSMEs should move towards technology that'll make their business smoother and advance to mark themselves to the global level, said Preeti Saharan, Partner with KPMG India.

There's a difference between the generations in how they're picking the business, said Sandeep Agrawal, Co-Founder and Director of TeamLease RegTech. A first-generation entrepreneur felt technology is more of an expenditure of no use, on the other hand, the new generation of business people rely more on technology and feel that as an investment. They take information from technology rather than from a particular guy.

Risk management is of very high uncertainty. Small businesses will not be having a proper structure in place and it can't be expected from them, said Suman Chowdhury Executive Director, Head of Research, and Chief Economist of Acuité Ratings & Research Ltd. From a credit agency's view, to mitigate risk one needs to understand that business and sometimes these businesses are in every niche area.

When it comes to credit rating on MSME CGTMSE's only criteria is of non-investment grade, said Sandeep. CGTMSE deal with the banks and rate them, they're not directly involved with the borrower. The NPAs are in the range of 10-12%, which is a standard level globally. The women-led MSMEs NPAs were less, he said.

CGTMSE is a Tier-2 risk taker as we're just the collateral provider, the first one remains the lenders, said Sandeep Varma, CEO of Credit Guarantee Trust for Micro and Small Enterprise (CGTMSE). CGTMSE has a corpus of a total of 16,500 crore to provide collateral to MSMEs.

Women beneficiaries have quite a good number in MSMEs, said Mercy Epao, Joint Secretary, Ministry of Micro, Small & Medium Enterprises. More than 80% were women beneficiaries in the Khadi Scheme. Technology plays an important role in MSMEs' growth and the ministry provides technology to MSMEs on a big level.