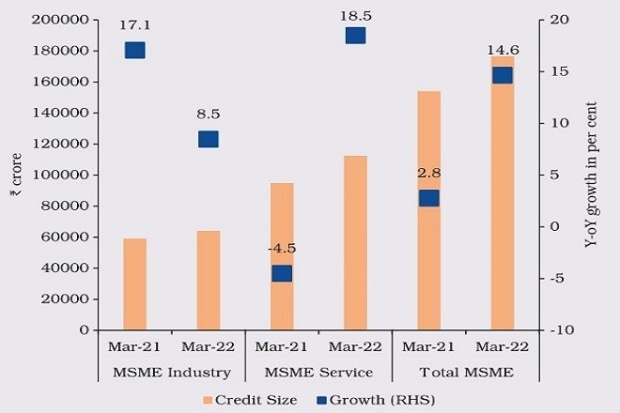

Credit and finance for MSMEs: Amid an overall increase in bank credit to MSMEs in the financial year 2021-22, non-banking finance companies (NBFCs) also had a noticeable growth in the previous fiscal. The credit to MSMEs by NBFCs in FY22 grew by 14.6 per cent with around more than Rs 1.75 lakh crore extended in comparison to 2.8 per cent growth with around Rs 1.55 lakh crore extended in FY21, according to the provisional data from the Reserve Bank of India (RBI), indicating disbursements under schemes such as the Emergency Credit Line Guarantee Scheme (ECLGS).

“NBFCs play a crucial role in bridging the credit needs of MSMEs, primarily those engaged in services. The ECLGS helped MSMEs to access enhanced credit. The co-lending model introduced by the Reserve Bank in November 2020 also improved the flow of credit to the MSME sector,” the central bank noted in its annual Report on Trends and Progress of Banking in India released on December 27, 2022.

NBFC Credit to MSME Sector

Also read: Large NBFCs to diversify into SME, used-vehicle loans in FY24, says Crisil; here’s why

The growth was higher among MSMEs in the services segment. While NBFC credit to industrial units registered 8.5 per cent growth in FY22, NBFC credit to service units saw an 18.5 per cent jump in FY22. The credit extended to services units through NBFCs increased from around Rs 90,000 crore in FY21 to more than Rs 1.10 lakh crore while to industrial MSMEs, the credit grew from nearly Rs 60,000 crore in FY21 to only around Rs 62,000 crore in FY22.

Meanwhile, overall growth in credit outstanding to the MSME sector by scheduled commercial banks in FY22 stood at 12.73 per cent with Rs 20.11 lakh crore across 2.64 crore loan accounts in comparison to Rs 17.83 lakh crore across 4.20 crore loan accounts in FY21.

Through ECLGS, as of November 30, 2022, 1.19 crore loans involving 71 per cent or Rs 3.58 lakh crore of the Rs 5 lakh crore ECLGS limit were sanctioned while 57 per cent or Rs 2.85 lakh crore loans were. Out of the total sanctioned amount, 66 per cent were extended to MSME borrowers while 95.17 per cent of loans sanctioned also belonged to MSMEs, according to government data.

Also read: Large NBFCs to diversify into SME, used-vehicle loans in FY24, says Crisil; here’s why

Importantly, NBFC credit to MSMEs is expected to further grow up as large NBFCs will be looking to diversify into unsecured loans including credit to SMEs and consumer loans, secured SME loans and used vehicle loans next fiscal amid high competition from banks and a rising interest rate environment, according to credit rating agency Crisil.

“Competition from banks will remain intense and the rising interest rate environment will exert pressure on margins and limit competitive ability, especially in the largest traditional segments of home loans and new vehicle finance, said Gurpreet Chhatwal, Managing Director, CRISIL Ratings had said in a Crisil report in November 2022.

Subscribe to Financial Express SME newsletter now: Your weekly dose of news, views, and updates from the world of micro, small, and medium enterprises