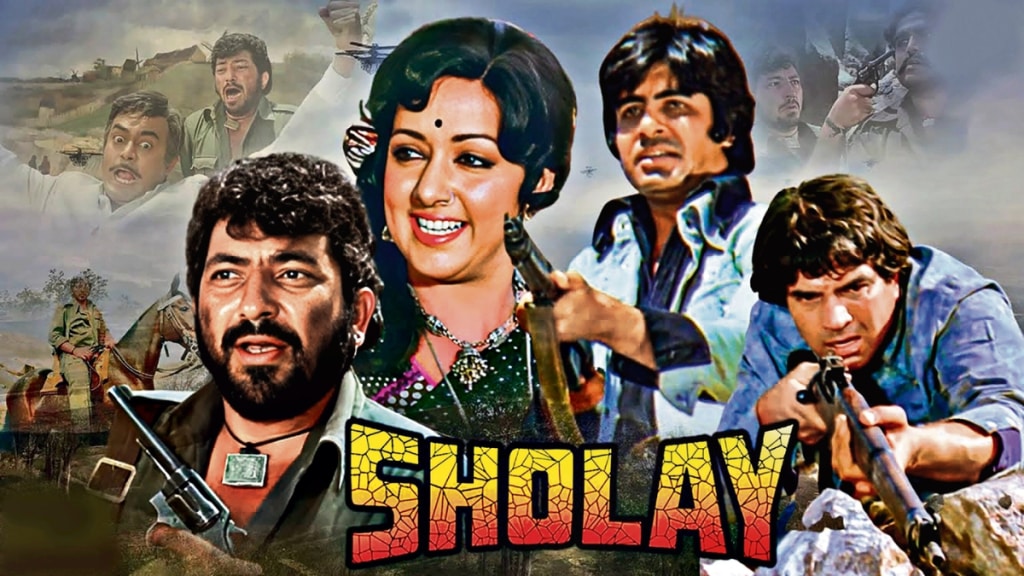

“Sholay, on its re-release weekend, added Rs 1.7 crore,” Devang Sampat, Managing Director, Cinépolis India, told financialexpress.com.

Days after one of Bollywood’s greatest, Dharmendra, passed away, India’s cult classic Sholay hit Indian theatres. A newly restored 4K version with a long-lost original uncut ending that was censored during its 1975 release returned to charm the Indian audiences years after ruling the Indian cinema. With a great buzz emerging on social media, Sampat pointed out that the re-release added about Rs 1.7 crore and drew over 15,000 footfalls across 30 cities, with average occupancy around 40%.

With the re-releases in the picture, Bollywood seems to have discovered a second-hand revenue project. These are increasingly emerging as an efficient key source of revenue for Bollywood. Contrary to previous experiments of sequels with new star Bollywood has turned to re-releasing the original cult. Earlier, where a film’s economics were settled most likely within the first few weeks of its release, Box office revenue, followed by the broadcast rights, would just be the end of it.

Unlike new films, where budgets include rising star fees, marketing spends and an uncertain audience turnout, re-releases work on a thinner cost structure, accounting for the print restoration and limited marketing. The heavy lifting categories, such as production, music, brad recall already exist.

Re-releases: smaller numbers, sharper margins

Re-releases operate on a fundamentally different economic model. While their box-office collection ceiling is lower, typically Rs 20–50 crore, the absence of production costs and the reliance on targeted, low-cost marketing radically improve profitability.

Sanam Teri Kasam, which had collected just Rs 9 crore during its 2016 theatrical run, grossed Rs 42–50 crore on re-release in February 2025. Tumbbad, released in 2018, added Rs 30–37.5 crore across its 2024–25 re-runs, surpassing its original lifetime collections within days.

“These are exceptions, but they show what’s possible. For most titles, re-release earnings remain a fraction of the original run. The difference is the cost structure—distribution and marketing are the only real expenses—so even modest collections can be commercially attractive.” Sampat added.

Originals still deliver scale, but risk has intensified

However, that does not mean originals are totally out of flavour. If numbers are to be seen, 2025 was a year of theatrical releases indeed. year indeed. A handful of big hits absorbed a major share of the revenue. Chhaava emerged as the biggest Hindi grosser at around Rs 600 crore, while Saiyaara got about Rs 570 crore on a reported budget of just Rs 45 crore. The latest entrant to the party is Dhurandhar with a 14-day domestic collection of Rs 460.25 crore.

Furthermore, Hindi films collectively earned Rs 4,496.98 crore in 2025, spread across 228 releases, an average of just Rs 19.7 crore per film. Several big-budget projects struggled to justify their scale. Sky Force, mounted on a Rs 160-crore budget, collected roughly Rs 150 crore.

The risk profile for originals remains high. Production costs, star fees and marketing spends, often Rs 50–100 crore or more, must be recovered before films break even. Even so-called “Rs 100-crore” films frequently fail to generate meaningful producer returns once costs are netted out.

Pricing and a younger audience

A key lever behind re-release economics is pricing. Tickets for re-runs are typically priced 30–35% lower than new films, around Rs 170–180 compared with roughly Rs 260 for fresh releases, Sampat added.

“The lower price point encourages trial, particularly among younger audiences who are watching these films theatrically for the first time,” Sampat said.

Audience data suggests re-releases are not drawing only nostalgia-driven viewers. The core demographic skews 20–35 years old, reflecting a mix of repeat viewers and first-time theatrical audiences.

From filler to fixture

Exhibitors say re-releases have moved well beyond being opportunistic gap-fillers. At PVR INOX, they now form a planned part of annual programming.

“Re-releases have become an integral pillar of our programming strategy,” Niharika Bijli, lead strategist, PVR INOX Ltd, told financialexpress.com. Over the past year and a half, she said, re-releases have delivered incremental box-office returns, particularly during weeks when new releases are sparse.

In 2025 alone, PVR INOX re-released around 200 films across languages, many curated into themed festivals. While last week’s occupancy for new releases crossed 60%, re-releases contributed to a 4% growth in overall revenue, the company said.

Promotion costs remain limited, relying on PR, digital outreach, in-cinema branding and word of mouth rather than large advertising blitzes. Ticket prices typically range between Rs 150 and Rs 200, significantly below those of new films.

A thinner pipeline changes the math

According to Deloitte India, the post-pandemic tilt toward OTT platforms, coupled with a slowdown in the number of big-budget Hindi releases, has weakened the traditional theatrical pipeline.

“In the pre-COVID era, a robust and consistent release pipeline ensured regular theatre visitation. Post the pandemic, the number of large, big-budget Bollywood releases has declined significantly,” Chandrashekar Mantha, partner and media and entertainment sector leader at Deloitte India, told financialexpress.com. “This, along with changing audience behaviour, has resulted in a 30–40% drop in footfalls across cinemas.”

Against this backdrop, Mantha said, re-releases have provided incremental momentum, helping theatres sustain occupancy and revenue during periods of limited fresh content.

Originals still matter—but the bar is higher

Re-releases are unlikely to replace originals as the backbone of theatrical economics. New films still account for nearly all box-office revenues and remain essential to sustaining cinema infrastructure. But one thing that stands out is that mediocre originals with bloated budgets are increasingly losing out to proven classics.

The numbers suggest the choice is no longer between originals and reruns. It is all about films that clear the higher quality threshold that audiences have shown they are willing to pay for.