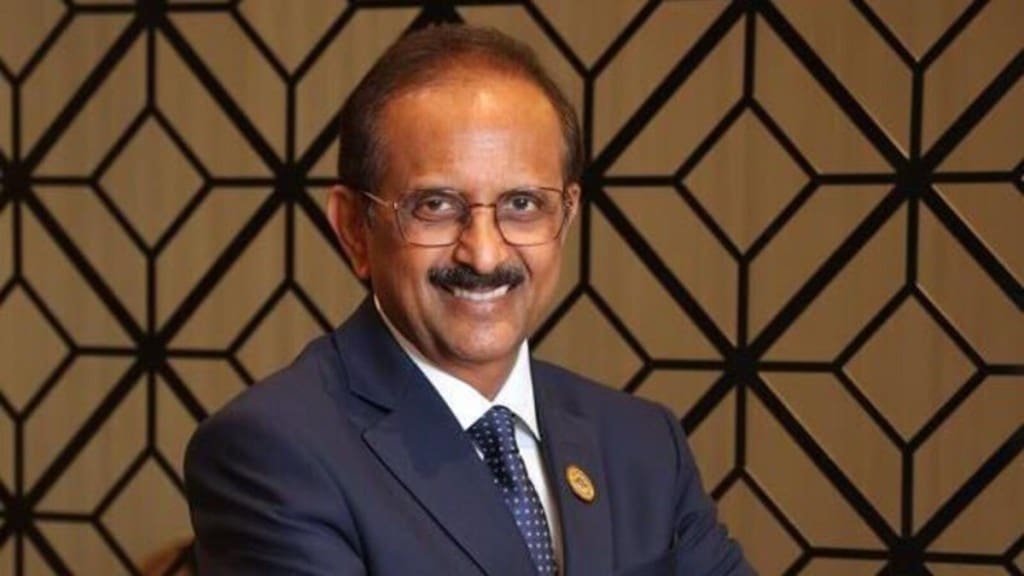

In the past 12-15 months, a host of fiscal and regulatory measures have been taken to give a boost to the economy. In this exclusive interview, State Bank of India (SBI) Chairman CS Setty tells Mahesh Nayak and Joydeep Ghosh they led to a flywheel effect on credit growth. Setty believes FY26 could see one more rate cut. Excerpts:

How has the strong fiscal and regulatory measures to push growth played out for the banking sector, especially SBI?

They created a flywheel effect on credit growth, with the outlook upgraded to 12-14% from 11-12%, driven by resilient domestic demand. Rising consumption encouraged corporates to utilise working capital and even consider capital expenditure, while banks fine-tuned underwriting standards and maintained asset quality through digitalisation and availability of data. Together, these factors created an environment for the next level of growth – corporates with strong balance sheets, banks with robust credit growth, and an economy poised for sustained momentum.

Do you think the GST effect is just a one- or two-quarter phenomenon, or will it last longer?

Right now, we are clearly witnessing growth. But the real visibility will come in Q1 of the next financial year (Q1FY27), typically a quieter quarter that will reveal whether consumption demand sustains beyond seasonal factors like marriages, festivals, and year-end activity. Personally, I believe it will be sustained, though momentum may vary across sectors. The auto industry has performed very well in the last two quarters, but we would like to see secular demand across industries rather than just a few sectors driving growth. Encouragingly, retail segments whether it’s personal loans, home loans, or auto loans we are witnessing healthy growth.

Is the rate cut cycle over, or do you expect more cuts ahead?

FY26 could still see one more rate cut. The thinking is that the terminal rate is around 5%, so there could be a single cut to align with that. Even today, at 5.25%, the repo rate is quite reasonable given the robust growth we are witnessing.

Going forward, how do you reimagine banking from SBI’s perspective?

Reimagining banking at SBI is a long-term journey, aligned with the Viksit Bharat vision for 2047, but in the shorter term, our focus is on 2030. Having already crossed Rs 100 lakh crore in business, and adding nearly Rs 10 lakh crore every year, we could double in size within six to seven years. To manage that scale, we must invest continuously in people, processes, products, and technology.

One of the primary drivers of this transformation is what I call the ‘yonoisation of the bank’, essentially simplification. It’s about creating simple, intuitive journeys for customers and employees alike. Project Saral, I believe this will be a game changer, making both our digital and branch platforms stronger, more productive, and more customer‑oriented.

Going forward, we will position transaction banking and trade finance as central to SBI’s growth strategy.

You have spoken about increasing focus on wealth management. Will this be driven by lateral hires or built in-house?

Our ambition is to build trusted wealth offerings at scale, accessible across geographies and segments. We have defined three categories –high-value clients above Rs one crore, served by market-recruited specialists; mass affluent customers in the Rs 30–50 lakh range, supported by nearly 3,000 internally trained relationship managers; and a wider base served through virtual RMs, ensuring reach and personalisation. While selective lateral hiring will support specialised needs, the backbone remains our internal resources, strengthened by technology.

Today our wealth portfolio stands at Rs 3.50 lakh crore, with an ambition to scale it to Rs 15 lakh crore by 2030, including Rs 4 lakh crore targeted toward investments. Wealth for us encompasses both deposits and investments. To achieve this, we are strengthening resources through internal and external recruitment, with around 3,000 people expected to be engaged in wealth and premier banking services. Recruitment has already begun, with 1,000 staff in place and another 250–300 professionals being hired from the market this year.

With CASA growth slowing and the credit-deposit ratio around 80%, do you see scope for banks to cut deposit rates further?

There is still strong demand and competition for deposits, so aggressive rate cuts seem unlikely. Monetary transmission cannot take place unless deposit rates are also calibrated, but given robust credit growth alongside modest deposit growth, adjustments will likely be limited to specific segments or tenors. In a deposit-driven banking system, healthy mobilisation remains critical to support lending and sustain balance between growth and stability.

There’s been talk about the end of lazy banking days. What’s your view on this?

Banking has never been a lazy job, it has always been demanding, and today it has become even tougher. Banks today are willing to lend, and SMEs are a good example, supported by robust data and improved underwriting, mainstream banks are far more confident about lending to this segment. At the same time competition for deposits is rising as households and corporates diversify into other asset classes, making mobilisation critical.

Where do you see the tipping point for MSME growth?

MSMEs, though vast in number, still account for a relatively small share of industry credit compared to large corporates. Our priority is ensuring no deserving MSME is denied credit, whether directly through banks or indirectly via NBFCs and MFIs. MSME credit must be viewed as part of the broader flow of savings into productive sectors. Over the next decade many medium enterprises will evolve into large corporates, while thousands of small firms will scale into medium ones. We want to drive transformation through scale, technology, market linkages, and sustainable growth. While large corporates will retain significant credit share, MSMEs remain the vital pipeline of future large enterprises.

How important is bank consolidation for SBI?

Bank consolidation has certainly benefited public sector banks in achieving scale, but whether further consolidation will happen depends entirely on the government of India. From SBI’s perspective, I believe we have more than adequate potential to grow organically. Our focus remains on leveraging our existing scale, franchise strength, and organic growth opportunities. The path forward is clear: we can continue to expand and compete globally through our own growth trajectory.

The regulator plans to open up acquisition financing for banks. What are your initial thoughts?

The opening up of acquisition financing is both an opportunity and a strong vote of confidence in Indian banks. For almost two and a half decades, acquisition financing was restricted, perhaps because the view was that banks should focus on MSMEs and domestic companies, but today balance sheets are strong and capital is not crowded out.

SBI already has experience in outbound acquisition financing through foreign offices, giving us the ability to support such transactions. However, we will remain disciplined, focusing on fundamentals like capital structure, integration, and underwriting, even if that means passing on deals. At the same time, we will leverage SBI Capital Markets and collaborate with foreign banks where needed.

Do you see SBI taking the lead in raising more capital through bonds?

We will explore all sources of funding, but SBI has two clear advantages. First, with a deposit base of Rs 55 lakh crore, even modest growth of 10% adds Rs 5.5 lakh crore annually, ensuring robust mobilisation without compromise. Second, our credit-deposit ratio of 71–72% means we need not aggressively raise market funds. With current capital strength, we can support credit growth up to Rs 12 lakh crore, far exceeding the Rs 4–5 lakh crore required at 12–14% growth. While other banks may rely on bonds when deposits lag loans, SBI’s position is comfortable. That said we will tap the market this year to the extent of Rs 10,000–12,000 crore mainly for capital structure management.

You had earlier mentioned that the personal loan space has a long runway, with only about 28% tapped. What has been the progress?

Today we are the largest provider of unsecured personal loans, with a portfolio of nearly Rs 3.5 lakh crore. The runway remains significant, driven by strong acquisition of corporate salary package customers. In this financial year alone, we added nearly 4.2 lakh new salary accounts. So, we are creating new runways as well. Even if 30% borrow through express credit, it creates fresh growth potential.