By Sreejith Balasubramanian

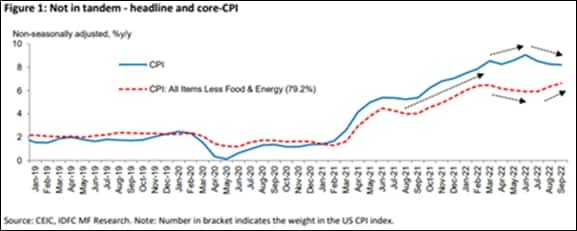

Given the current global financial market volatility, data can fuel the frenzy. September US headline CPI printed 8.2% y/y, down from 8.3% in August but accelerated sequentially. Core CPI picked up in year-on-year and month-on-month terms. However, both headline and core were slightly above consensus forecasts.

Keeping the frenzy aside, we look at the underlying trends in US CPI, how its drivers have changed more recently, what other measures of inflation imply, the evolution of inflation expectations, and finally the risks ahead.

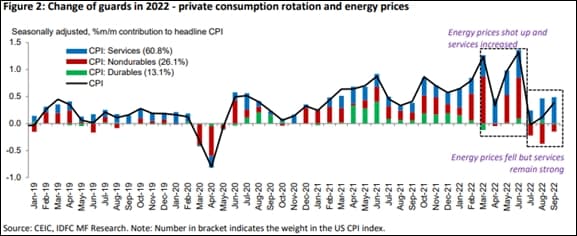

Back in 2021, used vehicle prices had spiked significantly as new vehicle manufacturing faced severe supply shortages. Economic reopening after government restrictions imposed during the pandemic was relaxed and fear among people subsided, as vaccination rates increased, which also contributed to the rise in inflation.

Also Read: Why did US stock market rally after hot inflation numbers?

However, a crucial aspect during this period was the strong consumer demand, particularly for goods, driven by multiple rounds of generous fiscal stimulus. Headline and Core-CPI (headline ex-food and energy) mostly moved in the same direction. This narrative has changed.

Also Read: What is Dollar Index and how it impacts the stock market – Explained

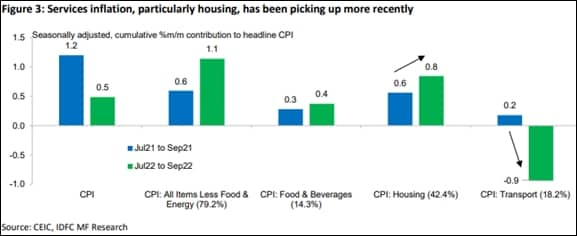

Two key themes for US inflation in 2022 have been the gradual rotation in consumption from goods, mainly durables, to services as the economic reopening got broader and stronger, and the energy price trajectory after the onset of the Russia-Ukraine war in February this year. More recently, headline CPI has moved down after hitting 9.1% y/y in June, driven by the drop in energy prices, but Core-CPI has continued to move up.

Comparing the latest quarter’s contribution vs. the same period of last year for some of the main components shows how transport prices (vehicles, motor fuel, etc.) are now less of a driver than housing (of which a major component is rent).

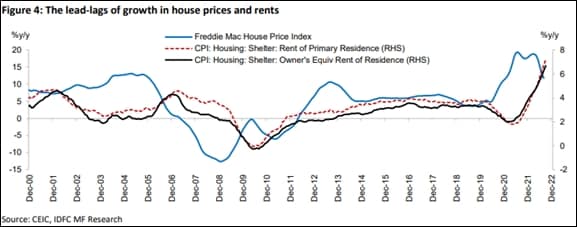

Noteworthy here is the fact that rental inflation is typically sticky and lags house price changes. Its sequential momentum has picked up quite strongly of late and, as the Fed Governor too noted recently, could stay high for some time. Despite the recent drop in house prices, very high mortgage rates involved in buying a house, employment and income uncertainty deterring purchases, etc. means rents could continue to face upward pressure for a while. This and the high weightage in the CPI basket (31.6%) could thus make rents a major driver of inflation readings ahead.

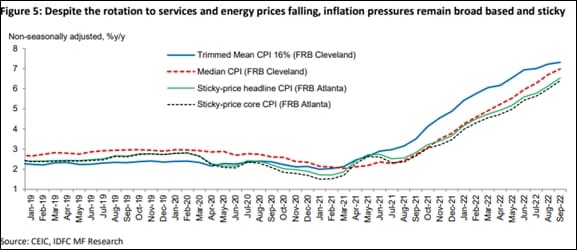

We now turn to various measures of inflation provided by the regional Federal Reserve Banks (FRBs) to understand how broad-based and sticky the current CPI readings are. Cleveland Fed’s Trimmed Mean CPI 16% (weighted average across component inflation rates after excluding items whose expenditure weights fall in the top 8% and bottom 8% of price change distribution) and Median CPI (inflation rate of the component in the 50th percentile of price changes) continues to move up indicating inflation drivers are broad-based. Atlanta Fed’s Sticky-Price CPI (a weighted basket of items that change price relatively slowly) is also rising.

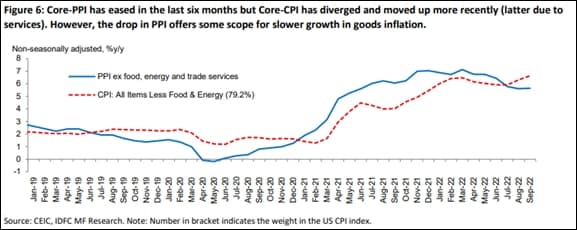

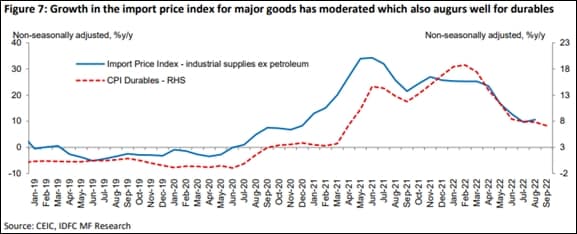

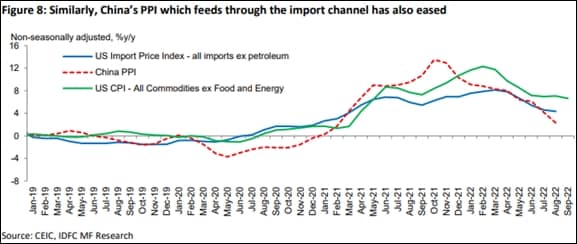

It is also important to look at alternative measures of inflation such as the Producer Price Index (PPI) and the Import Price Index (IPI) to gauge the correlations with CPI and thus what lies ahead.

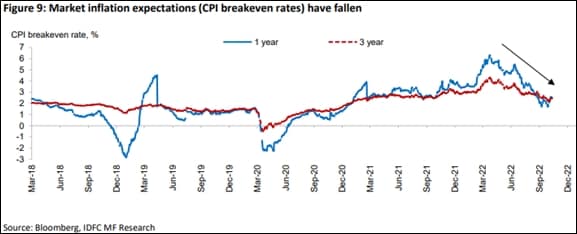

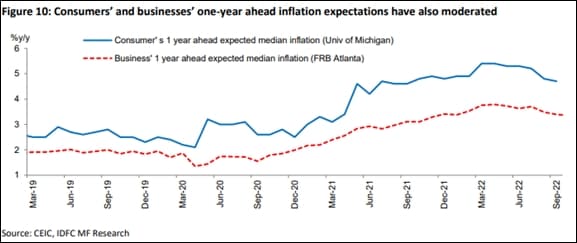

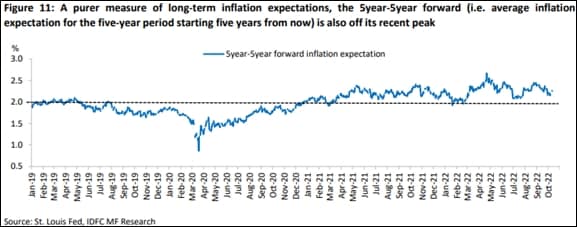

A major fundamental driver of inflation, and something the Fed looks at very closely, is inflation expectations. Deciphered through surveys and market-based measures, they influence future inflation trajectories. Long-term expectations remaining anchored is very crucial for the effective and credible conduct of monetary policy.

More recently, inflation expectations have moderated, likely reflecting several factors but also definitely the Fed’s guidance that it would raise interest rates higher than previously expected and maintain a restrictive policy for some time even at the cost of a sustained period of below-trend growth and softer labour market.

Thus, we see the drivers of US inflation have changed in 2022, with services picking up as rents have moved up strongly. It continues to be quite broad-based and sticky. However, softer growth in US PPI, US IPI and China PPI suggests there is scope for US CPI growth to moderate, albeit with a lag and different magnitude. Further, various measures of inflation expectations have fallen more recently.

In this context, we see downside risks for inflation could stem from slower growth (both domestic and elsewhere as Europe and China are also likely to slow meaningfully), decongestion of supply and in fact, lower freight costs of late, the effect of lower wealth on consumption expenditure (impact of tighter financial conditions on house prices, equity values and also due to falling personal savings), and a deteriorating outlook for employment and wage growth which are already reflecting in consumer confidence surveys.

Upside risks could be higher and sticky rents, slower-than-expected correction in wage growth, geopolitical risks (particularly for energy prices), any manifestation of global financial market pressures, and the Fed’s response. Until then, one needs to adopt a nuanced analytical approach to gauge US inflation readings. The eye of the beholder also matters.

(Author is Economist – Fund Management, IDFC AMC)