As gold prices remain firm, Titan expects 50% of Tanishq sales to come from old gold exchange programmes this festive season.

On Tuesday, the price of gold touched a record Rs 1,20,900 per 10 g, driven by robust global market conditions. Year-to-date, gold prices are up over 50%, hurting local demand. Titan, the country’s largest jewellery retailer, reported an 18% rise in domestic sales in the September quarter, according to its business update released on Tuesday, slower than the 25% it saw during the same period last year. Jewellery sales grew 19% year-on-year in Q2, driven in part by Tanishq’s old gold exchange offers, which began during Navratri. These offers will be on till the end of Diwali.

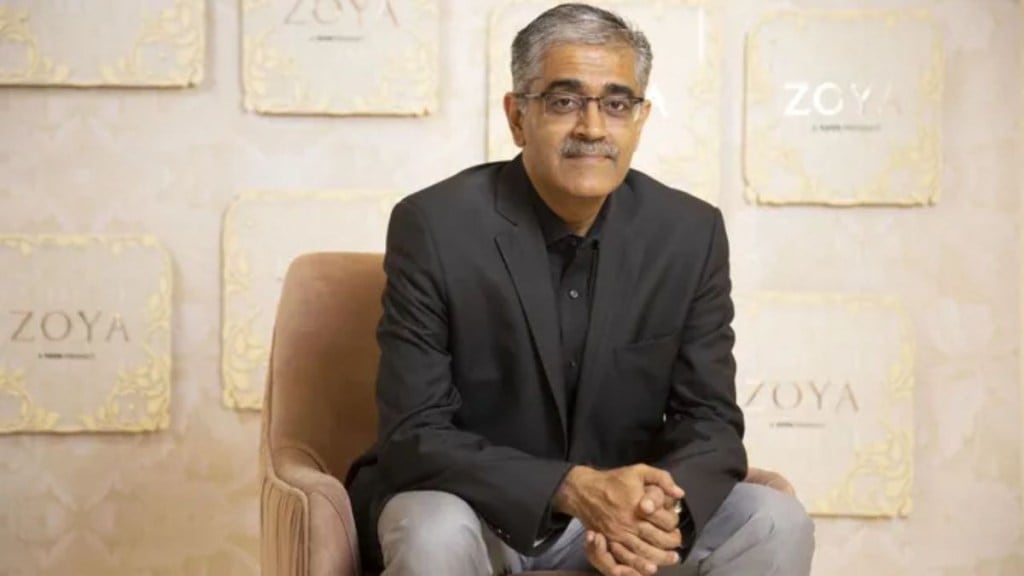

What did Ajoy Chawla say?

“Typically, old gold exchange has constituted 35-36% of Tanishq sales. During this festive season, however, we have strengthened this initiative, offering zero deduction on exchange across all caratages. Since the launch during Navratri, sales contribution from old gold exchange has inched up to about 38-40% of Tanishq sales. We see this number touching about 50% of sales by the end of Diwali,” Ajoy Chawla, CEO, jewellery division at Titan, told FE in a one-on-one interaction.

Titan is the second organised player to give it Q2 update after Kalyan Jewellers, which on Monday reported its slowest sales growth (at 30%) in four quarters in Q2, as high gold prices tempered demand. Chawla said there was stress in the sub-Rs 1 lakh jewelry segment, as price-conscious consumers have reduced buying in recent months, while well-heeled consumers continue to upgrade.

From where does Titan drive its most revenue

This has reflected in Titan’s September quarter sales, with buyer count seeing “a marginal y-o-y decline” in Q2, even as ticket prices improved as premium consumers bought expensive collections, its business update said. Titan derives 90% of its revenue from its jewellery division, which is led by Tanishq among other jewellery brands such as Mia, Zoya and Caratlane. Studded jewellery, which has diamonds and precious stones in it, grew in the mid-teens, outpacing growth in plain gold jewellery, the company said.

Titan is also pushing light-weight jewellery (such as 14-carat and 9-carat) in its studded portfolio, and is seeing early signs of consumers accepting 18-carat jewellery in gold versus the standard of 22-carat gold jewellery. While 24-carat is considered pure gold, it is impractical for most jewellery as it is soft, implying it can bend and lose its shape with everyday wear.

Investment-grade gold coins, meanwhile, continued its strong run for the quarter, Titan said, as consumers chose to invest in the bullion as a store of value. However, since coins yield lower profit margins than jewellery, the shift has constrained overall margin growth in recent quarters.

The company’s watches business, the second-largest by revenue, clocked sales growth of 12%. The analogue segment grew by 17% in Q2, while the eyecare business grew 9% versus last year in Q2.

The international business grew 86% y-o-y, led by Tanishq more than doubling its business in the US, the company said.

A total of 55 stores (net) were added during the quarter, expanding Titan’s combined retail network presence to 3,377 stores, it said. Jewellery operations added 34 stores in India in July-September, of which six were in Tanishq, 18 in Mia and 10 in CaratLane.