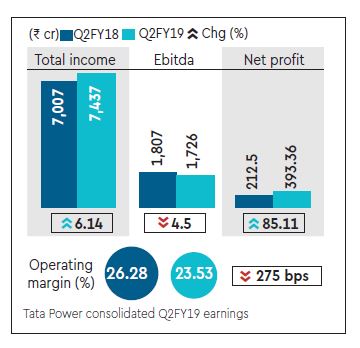

Tata Power’s consolidated operating profit for the quarter ended September 30, 2018 fell 4.5% year-on-year to Rs 1,725 crore while margins dropped 275 basis points, as the company continued to face headwinds on account of higher fuel cost and power purchase costs.

Power purchase costs rose 13.05% Y-o-Y to Rs 1,706 crore, while fuel costs rose 4.90% to Rs 2,653 crore. “The quarterly results were adversely impacted due to pricing pressures and higher fuel cost,” the company said in a statement.

Finance cost for the period rose 4.65% Y-o-Y to Rs 1,034 crore, while depreciation and amortisation was up 5.35% on year to Rs 610 crore.

However, the net profit for the period rose 85% Y-o-Y to 393 crore, led by strong performance of renewable business, whose profits grew 19% to Rs 159 crore, and better performance of other regulatory businesses, the company said in a statement.

During the quarter, the company had an exceptional income of Rs 1,897 crore from sale of investments in associate companies, Tata Communications and Panatone Finvest, which were classified as assets held for sale in the previous year.

On a consolidated basis, Tata Power’s revenue for the period stood at Rs 7,234 crore, compared with Rs 6,610 crore, led by capacity addition in renewables and increase in shipping tonnage, the company said.

Contribution from the power segment revenue rose 7.8% Y-o-Y to Rs 6,864.96 crore. Project management and property development businesses fell 30% Y-o-Y to Rs 402.53 crore.

Although the company did not disclose any information on Coastal Gujarat Power (CGPL), the subsidiary that operates Mundra Ultra Mega Power Project (UMPP), analysts are of the opinion that the decision of the committee to increase tariff and 100% pass through to consumers would be beneficial for the company and would allow the company overcome financial distress at the Mundra power plant.

The Supreme Court on Monday allowed Tata Power, Adani Power and Essar Power to make proposed amendments to their power purchase agreements with procurers for higher compensatory tariffs. The Central Electricity Regulatory Commission will decide on the proposed amendments in eight weeks.

Praveer Sinha, CEO and managing director of Tata Power, said, “Our growth agenda now is more focused on renewables, rooftop solar solutions and using the resurgent power platform to acquire value adding assets. In the coming years, we have identified key growth areas which include renewable generation, transmission, and distribution along with new value-added businesses including rooftop solar, smart metering, home automation, micro grids in rural areas and setting up of EV charging units.”

The company did not disclose the total plant load factor (PLF) and the total generation from plants. Analysts, however, believe there is an improvement in PLF and utilisation levels at Maithon Power in Jharkhand, and the renewable business.

Standalone revenue for the period rose 9% on year to Rs 1,922 crore due to favourable tariff order. Standalone net profit rose to Rs 265 crore for the period from Rs 52 crore due to higher wind PLF, lower finance cost, lower taxes and favourable tariff order impact, the company said.