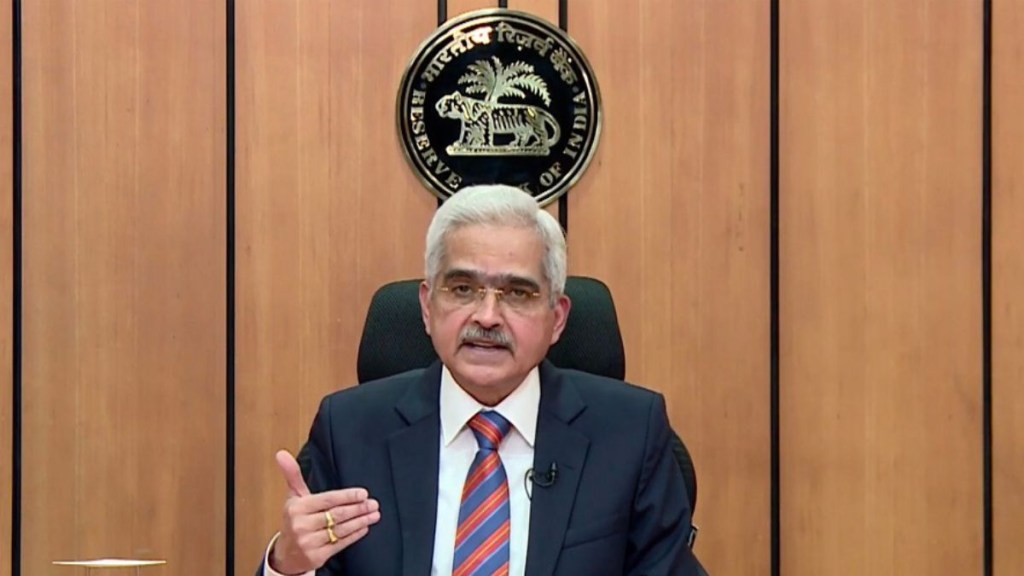

Reserve Bank of India (RBI) governor Shaktikanta Das recently said that the draft Bill for the setting up of the National Financial Information Registry (NFIR) announced in the 2023-24 Union Budget would be ready soon. NFIR is aimed at expediting loan sanctions and credit flows by providing lenders a “360 degree” perspective on potential borrowers, Das told reporters after the customary post-Budget address to the central board of the RBI.

While experts agree that significant strides have been made to grant micro, small and medium enterprises (MSMEs) access to credit, but more remains to be done.

However, on the introduction of the NFIR for MSMEs, fintech founders agree that it has the potential to improve MSME access to credit if it effectively addresses the challenge of ready information availability and connects with the Account Aggregator framework, enabling end-to-end digital MSME financing.

“The creation of a registry to facilitate credit flow to MSMEs will strengthen cash flow-based lending from collateral-backed sources, increasing credit flow and facilitating economic inclusion,” said Arun Poojari, Co-founder and CEO of Cashinvoice, a digital marketplace that unlocks supply chain finance for small businesses.

The impact of the registry on MSMEs will be determined by the fine print. “Banks and Non Banking Financial Companies (NBFCs) can now review GST and data from the Ministry of Corporate Affairs to access credit bureau data on delays and defaults. Creating a registry, in particular, will be an important step if it is accessible to buyers and sellers, i.e. commercial entities. (Of course, consent would be required). The agency should also provide a validation service to weed out any false claims,” said Arvind TCA, Co-founder of Artfine, a supply chain finance platform that has helped more than 800 SMEs and has arranged and advised Rs 1,000 crore as part of its financing portfolio.

The RBI introduced the Account Aggregator System to make financial data more accessible. It aids in the collection and consolidation of all disparate financial data, making credit access easier for both individuals and businesses. According to the government’s Chief Economic Advisor, Dr V Anantha Nageswaran, lending potential to MSMEs could reach around $3 trillion by FY23.

On further action steps required to accelerate the growth of credit in the MSME segment, Poojari said that Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) only offers term loan products. “Extending coverage to include supply chain financing solutions such as inventory funding, bill discounting, and factoring can assist MSMEs in obtaining timely working capital.”

Arvind stated that, “Only one transaction under the Insurance Regulatory and Development Authority of India (IRDAI) has occurred, according to data, in the past year, underscoring the lack of intention. Credit insurance has made it possible for vendors, SMEs, and MSMEs to cover risks and take expansion plans into consideration. In addition to managing non-payment risks that have an impact on the trade finance portfolios of SMEs and MSMEs, it gives banks, suppliers, and NBFCs access to new markets.”

Speaking on government initiatives,, Poojari said that several government initiatives, such as the Goods and Service Tax Network (GSTN) and e-invoicing, have aided in the digitization of trade data, allowing companies such as Cashinvoice to validate business transactions from legitimate sources. “Furthermore, the AA framework’s potential and granting FinTechs access to credit data, has enabled us to provide financiers with nuanced scorecards that allow them to extend credit to businesses with little or no prior credit history.”

“For seamless invoice processing and discounting, we have integrated with RXIL’s (Receivables Exchange of India Ltd) TReDS (Trade Receivables Discounting System) platform. As a TReDS participant, the availability of insurance-backed deals on the platform assists us in expanding our MSME coverage,” added Arvind.