Following a scintillating and scorching run for the sector at large, earnings growth is likely to slow. Key points: (i) Higher raw material costs to impact profitability; (ii) Subdued domestic demand to impact ferrous volumes; (iii) Robust LME prices to aid non-ferrous companies. Going ahead, we expect earnings to bounce back led by: (i) signs of revival in domestic demand; and ii) underlying commodity prices bottoming out. Hence, H2FY22 is likely to be much better, leading to consensus earnings upgrades for most companies. We remain positive on the sector with Tata Steel, Vedanta and JSPL — ‘BUY’ on all— as our key picks.

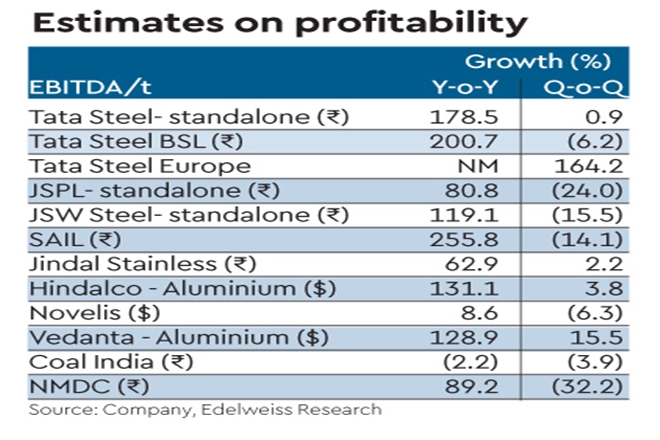

Earnings momentum meets cost headwinds: After a glorious run since Q3FY21, we see the earnings momentum stalling due to: (i) higher coking coal (up $25-30/t q-o-q) and consumables prices; (ii) subdued domestic demand leading to more dependence on exports, impacting realisation; and (iii) flat to lower steel prices (particularly for longs). That said, we expect non-ferrous companies to benefit from higher LME Al price—up 10% q-o-q. In case of mining companies, we expect performance to remain relatively dull owing to lower volumes. Among mid-caps, we expect record Ebitda for Jindal Stainless (JSL).

Focus companies: Unlike the previous three quarters, we expect companies’ performance to vary. We expect the following companies to stand out: (i) Tata Steel’s Ebitda at record Rs 198 bn; (ii) SAIL’s Ebitda likely at Rs 72 bn; (iii) JSL to record Ebitda of Rs 6.2 bn. However, we expect NMDC’s Ebitda to dip 36% q-o-q.

Outlook: A healthy pause

Despite an apparent slowdown in earnings momentum, we stay positive as:

(i) domestic steel demand is showing signs of recovery; (ii) prices in secondary market (ferrous) are up; and (iii) non-ferrous prices continue to stay robust (current LME Al price is up 10% q-o-q compared to Q2FY22 average). However, we need to watch out for coking coal prices as it could lead to cost escalation of 8,000–10,000/t on average for ferrous players in Q3FY22.

On the macro front, we expect production cuts due to decarbonisation drive and power shortages in China, resulting in structurally higher prices sustaining. Furthermore, production cuts are likely to offset the prevailing demand doldrums to a large extent. We maintain positive stance on the sector with Tata Steel, JSPL, Vedanta and Jindal Stainless as preferred picks.