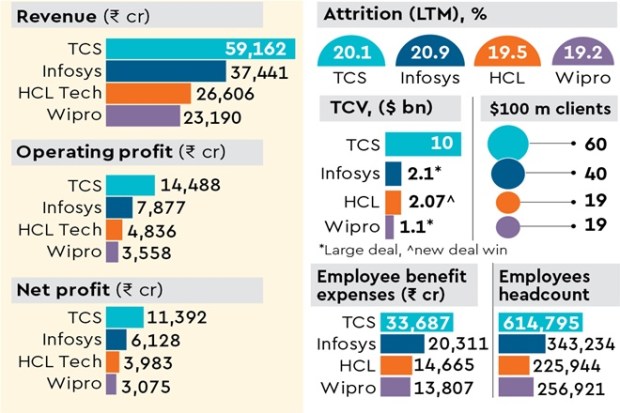

Wipro on Thursday reported a muted 0.70% sequential rise in its net profit to Rs 3,074.5 crore during the January-March, missing the Bloomberg consensus estimate of Rs 3,129 crore.

Revenues during the period were down 0.16% on a sequential basis to Rs 23,190 crore, also below the estimate of Rs 23,460 crore.

The IT company’s board of directors approved buyback of shares worth Rs 12,000 crore, subject to approval of shareholders through postal ballot. The company will buy up to 269,662,921 shares of Rs 2 each (4.91% of total paid-up equity shares) from shareholders by way of a tender offer at a price of Rs 445 per share.

Also read: States’ capex on track, up 12% in April-Feb: Centre

With its Q4 numbers, Wipro joined peers TCS, Infosys, and HCL Technologies, which had also posted either a decline in revenues on a sequential basis or at best growth in single digit.

In terms of profit, positive sequential growth was reported only by TCS and Wipro.

“TCS and Infosys’ earnings prints had two common factors — of course, Infosys was a shocker compared to TCS — deterioration in demand from North America with discretionary programmes that were paused or cancelled, and an inability to flex margin levers as near-term costs are sticky at the beginning of the slowdown,” according to Kotak Institutional Equities report.

In comparison, analysts said the earnings of HCL Tech provided some comfort as the company’s performance was not as bad as feared. In constant currency terms, revenue fell 1.2% sequentially, lower than consensus expectations of a 1.5% fall.

During the quarter, however, these firms were able to stabilise their attrition rates, with HCL Tech and Wipro bringing it below 20%. TCS and Infosys saw their attrition falling to marginally above 20%.

All four IT companies have started FY24 with a good number of $100 million-plus clients, with TCS leading the chart, followed by Infosys. HCL Tech and Wipro are at the third spot.

With regard to outlook for the first quarter of FY24, Wipro expects revenue from IT services business including the India state-run enterprise (ISRE) segment to be in the range of $2,753 million to $2,811 million, which translates to a sequential guidance of negative 3.0% to negative 1.0% in constant currency terms.

The firm said the Rs 1 interim dividend declared by the board on January 13 shall be considered as the final dividend for FY23.

Also read: FM Sitharaman asks CBDT to focus on compliance, widening taxpayer base

Thierry Delaporte, CEO and MD, said, “We closed FY23 with the strongest ever bookings recorded in a year. We delivered two consecutive quarters of total bookings of over $4.1 billion. Our large deal order booking grew by 155% year-over-year for the quarter”.

Jatin Dalal, chief financial officer, said, “We continue to maintain our focus on operational improvements and productivity enhancements which led to our IT services margin exit at 16.3% in Q4 despite macro headwinds. We generated strong operating cash flows at 121% of our net income for the quarter.”