IT companies are increasingly shifting their focus to tier 2 and smaller cities to cut real estate cost, stabilise attrition and give employees a better work-life balance.

Experts believe that employees working closer to homes will help companies bring down attrition, as there are not much employment opportunities to change jobs, besides providing a better quality of life.

Last week, New Jersey-headquartered IT services company Cognizant announced that it will rationalise workspaces across the world, especially in large cities of India, by redistributing some real estate to smaller cities.

Cognizant said it is optimising corporate functions, consolidating and realigning office space to reflect the post-pandemic hybrid work environment. It is giving up office spaces (eliminate 80,000 seats and 11 million sq ft in large cities of India) and expects to reduce its annual real estate costs by about $100 million by 2025 versus 2022.

Also read: Bidding on GeM Portal: How to apply for govt tenders; check detailed online step-by-step process

IT giant Infosys has also been seeing its office spaces grow in smaller cities in the last few years. Its biggest office space in terms of sq ft is in Mysore that measures up to 12 million sq ft. In the last five years, the Bengaluru-based company consolidated its office spaces in other smaller cities like Thiruvananthapuram, Nagpur, Indore, Hubli, Mohali apart from having big campuses in Bhubaneswar and Jaipur.

Harshvendra Soin, global chief people officer and head – marketing, Tech Mahindra, said, “We are hiring talent from new areas, setting up physical centres in tier-2 and tier-3 cities. These cities include Coimbatore, Trivandrum, Vizag, Nagpur, Bhubaneswar, Chandigarh, Kolkata, Indore and Vijayawada, and help us to diversify our talent pool.”

Tech Mahindra’s NXT.Towns initiative focuses on expanding to tier 2 & 3 cities across India with appropriate skill clusters according to talent availability. The company stated in its FY22 annual report that “besides expanding our talent access footprint, this also gives our associates a chance to transfer and work closer to home”.

Speaking about the real estate cost benefits that tech companies derive in smaller cities, Col Sanjeev Nair (Retd), CEO, Technopark, Trivandrum, said, “The rentals here are at a very discounted rate, 35% lower in comparison to major IT hubs in the country. This along with flexible lease terms provides a positive incentive for IT/ITeS companies to consider Technopark as a suitable digital hub.” The rate at Technopark, Trivandrum, is Rs 70 per sq ft per month for plug and play, and Rs 38 per sq ft per month for warm shell (companies have to do their own furnishing).

Also raed: Bank of Baroda launches Electronic Bank Guarantee on its digital platform

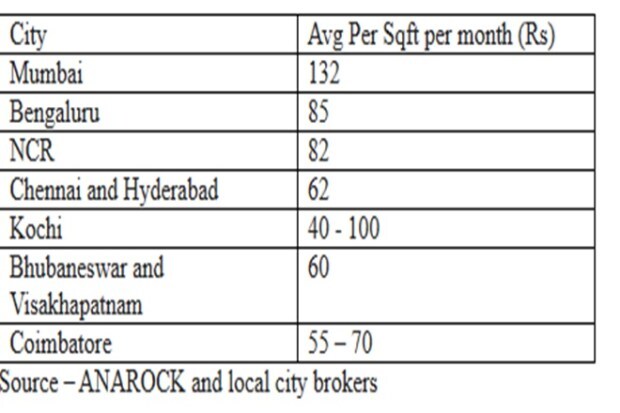

While the rates in Kochi range between Rs 40-100 per sq ft per month depending upon the locations, the average rate for Bhubaneswar and Visakhapatnam is Rs 60 per sq ft per month. Coimbatore’s average rental rate for office space is Rs 55-70 per sq ft per month, said local real estate brokers.

Due to their sheer size, IT companies have huge bargaining power to negotiate a better rate with office space owners, said real estate brokers.

As per an ANAROCK Research, the average office rental cost per sq ft per month in Bengaluru and Mumbai are Rs 85 and Rs 132, respectively. The same rate for NCR is Rs 82, and for Chennai and Hyderabad Rs 62.

LTTS, another IT company that specialises in engineering services, is also making a huge stride into smaller cities. Abhishek Sinha, COO and member of the board at L&T Technology Services, said, “Tier II urban landscape is defining the next frontiers of growth. We are present in Vadodara and Mysuru, and our centres there have an excellent ecosystem of engineering colleges and youth, representing an exciting potential for future expansion.”

Sinha added that today more than a third of LTTS’ employees in India operate from Tier II cities.

LTIMindtree, which also has offices in tier 2 cities, told FE: “Our decision to set up offices in tier 2 cities like Bhubaneswar, Coimbatore, etc, is an integral part of our ‘Future of Work’ talent strategy. Currently, about 15-20% of the company’s workforce are based in tier 2 cities.”

Alexander Varghese, COO, UST, a digital transformation solutions company, said, UST was founded in 1999 in California, the US, and Thiruvananthapuram, India, at the same time. Today, apart from Thiruvananthapuram, the company has offices in Kochi, Hosur, Ahmedabad, Coimbatore and metros in India.

Varghese added, the factors like diverse talent pool, local government’s support and reduced cost of living for employees have helped us to scale up in smaller cities.

Not just large IT firms, even smaller peers are opening their centres in smaller cities. Birlasoft operationalised a new delivery centre in Coimbatore with a seating capacity of 250 during the March quarter of FY23. It billed Coimbatore as an emerging lower-cost tech talent hub. Another midcap IT firm Happiest Minds opened its centres in Coimbatore and Madurai this year, apart from one centre in Bhubaneswar last year.