Apart from new regulations issued by the ministry of home affairs (MHA) and the Reserve Bank of India (RBI), the refusal of large public sector banks (PSBs) to shell out higher interchange for ATM transactions has made the business unviable, people from the industry said.

Interchange is the fee paid for an ATM transaction by the card-issuing bank to the bank owning the ATM, known as the acquirer. The interchange is further distributed between the bank and the cash-handling company maintaining the ATM. In India, this fee has been capped at Rs 15 per transaction for the last few years and the cash management industry has been lobbying hard with RBI and the National Payments Corporation of India (NPCI) to raise it to Rs 18 at least.

The chief hurdle for them has been some of the large PSBs which are predominantly card-issuing banks with a relatively smaller ATM network.

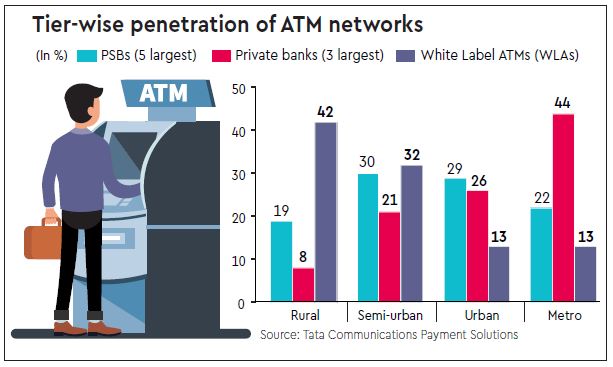

Private banks have a larger presence, but it is largely confined to urban centres. The penetration of ATMs belonging to the three largest private banks in metros stands at 44%, in stark contrast to their 8% reach in rural areas, as per a report by Tata Communications Payment Solutions.

Five of the large PSBs have a limited reach in both sets of geographies — 22% in metros and 19% in rural areas. The far-flung areas are serviced largely by white label ATMs (WLAs).

“The large PSBs have been blocking our attempts to get the interchange raised. They are neither in a position to expand their own ATM networks nor are they willing to shell out more for using other people’s machines,” the head of a firm engaged in deploying WLAs said.

According to industry body Confederation of ATM Industry (Catmi), half of India’s ATMs are likely to be shut down by the end of FY19, with rural areas taking the worst hit. The cash management business is set to see a squeeze in operating margins with the new regulations pertaining to security and transportation of cash kicking in in March 2019 and no accompanying rise in revenues.

“There has been a request from the industry that something like a working committee be formed to find an amicable solution to prevent such an outage, with RBI, NPCI, Indian Banks’ Association (IBA), the MHA and Catmi on board,” said Navroze Dastur, managing director (MD), NCR India. “Otherwise, things will go back to the demonetisation days, with ATMs turning non-operational.”

Dastur said there is a precedent of such a working group having been formed by the RBI during demonetisation. That group comprised management service providers (MSPs), banks and other stakeholders to keep the cash network operational. Catmi expects the industry will need an additional outlay of about Rs 3,500 crore for complying with the new guidelines.