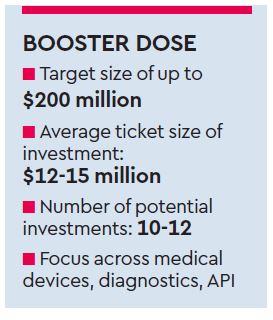

Tata Capital has launched its second healthcare fund — Tata Capital Healthcare Fund II — and hopes to raise up to $200 million from both domestic and overseas investors.

Visalakshi Chandramouli, partner at Tata Capital Healthcare Fund, told FE the theme of the fund is India lifesciences and healthcare, focussed across both domestic consumption and competency.

Chandramouli added that it would have a growth capital investment focus and the average ticket size would be about $12-15 million. “We are looking to do about 10-12 investments,” she said. The corpus will be invested in segments like medical devices, diagnostics, domestic pharmaceuticals and API segment.

Chandramouli is confident the fund has the potential to make a gross internal rate of return (IRR) of at least 20-25%. The first healthcare fund by the firm — Tata Capital Healthcare Fund-I — was launched in 2010 and saw its final close in 2012 with assets under management (AUM) of $70 million. It invested in nine companies, of which it has already made four profitable exits and is eyeing the fifth and sixth exits in the next six months.

The average ticket size for the first fund stood at $8 million.

“We have returned significantly more than the capital to investors. And we still have another five investments which we are hoping to close in the next few years or so,” she said.

Chandramouli indicated that so far the first fund has been tracking a 33% gross IRR, on the realised investment.

The first fund’s investment strategy focussed on two key themes: domestic consumption and the competency. Under the domestic consumption theme, the fund looked at companies which generated significant cash flows from the domestic market.

The competency theme focussed on key advantages that a company has in terms of its manufacturing or its technology. “Competency theme is more like a bottom-up approach towards investing and has a company specific advantage related to a manufacturing advantage, a customer advantage or any kind of technology or an edge they have. It’s basically an India centric healthcare and lifesciences mandate that they run,” Chandramouli explained.