At Rs 37.8 bn, Q1 PAT rose 61% y-o-y – higher volumes (+12%), realisations (+10%, hike in Jan18), evacuation facility charges (effective Dec’17) offset in part by higher costs (wage negotiations concluded in Oct’17). PAT was however below estimates — sharp drop in e-auction volumes, lower FSA realisations than expected (both likely due to higher sales to power).

Volumes: strong; mix shift

Q4 despatches rose 12% y-o-y with FSA despatch growth at ~22%. While higher y-o-y, FSA prices fell ~2% vs. Q4 (adj for incentive) —grade mix, higher volumes to power and inventory liquidation (39mt vs. 56mt as of Mar18). Volumes to the power sector grew ~15%; inventory at power plants is now at ~10 days (flat y-o-y) but still lower than CEA’s guidelines of >15 days—demand support. CIL’s FY19 production target is 610mt; Citi despatch estimates 616mt (+6% y-o-y).

E-auction: prices up; volumes down

At ~19mt, e-auction volumes fell 29% y-o-y and accounted for ~13% of despatches (18% in Q4, 20% last year). E-auction prices rose ~14% q-o-q (to Rs 2,400/t) – limited supplies to the non-power sector. According to CIL, e-auction volumes should likely pick up as production growth is strong; and elevated prices are sustaining. On our calculations, e-auction prices are at ~15% discount to import parity (~20% in Q4).

Wages up 19% y-o-y Q1 wage costs at Rs 96 bn were higher vs. last year – nonexecutive wage revision, higher executive wage revision provision, higher gratuity, Rs 3 bn linked to prior period pension. Natural attrition should benefit going forward — 44% of employees are in the 50-60 age bracket.

Implications

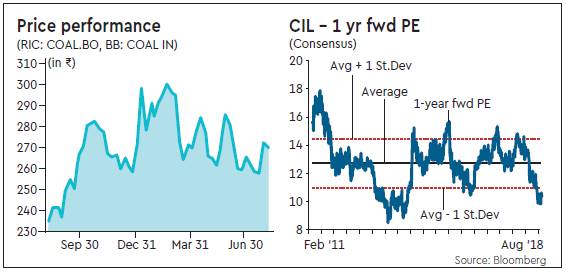

CIL trades at 10x 1-yr fwd PE (consensus) – at 1.4SD below mean, offers ~7% dividend yield. Buy on: (i) E-auction price support; (ii) realisation upside from linkage auctions: fourth tranche (30mt) has commenced; auctions to sponge iron have concluded (~7mt) at avg premium of ~39%; (iii) strong volumes, YTD despatch growth of ~11%; 4) limited cost pressures.