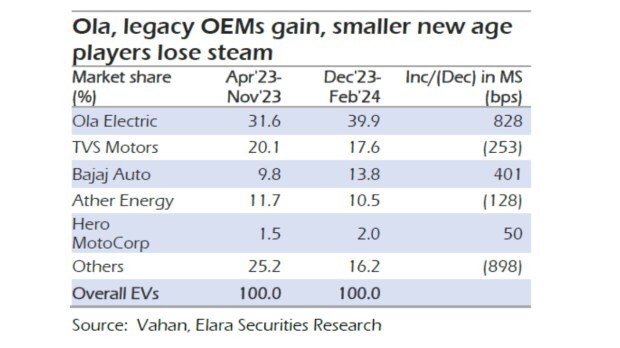

Ola Electric’s electric two-wheeler market share has seen growth from 31.6 percent in the April to November 2023 period, to around 40 percent in the December to February 2024 period says a report by Elara Securities India.

It further highlights that the price cuts in some models may have catalysed the rise of electric two-wheelers. Ola Electric had undertaken price cuts of around Rs 25,000 for some models since Dec 2023, which it says may have aided this sharp increase. In addition, Ola Electric also sold at least 12,000 e-scooters to ANI Technologies and its subsidiaries between April 2022 and December 2023, a bulk of it is said to have happened in recent months.

On the other hand, the gain in market share has also due to market share loss by weaker players. Bajaj Auto, Hero MotoCorp continued to increase their growth, while Ather Energy and TVS Motor Co lost a marginal share.

The report finds that the electric two-wheeler market is seeing consolidation in the hands of a few as weaker players lose share rapidly. New-age, small players are losing steam with respect to funding in the light of FAME-II subsidy reduction. Legacy OEMs such as Bajaj Auto and TVS Motor Co have not yet ramped up their distribution network for EV supplies and hence, market shares are still subdued. Going forward with ramp-up of their supplies and distribution network, expect combined market shares of legacy OEMs and Ather to increase from current levels.

Affordable products to further drive growth

The report expects that going forward, TVS Motor Co, Ather Energy and Hero MotoCorp will launch cheaper priced models.

In an interesting observation, Ola Electric’s price reduction was higher by almost 12-23 percent versus other players. This upto an extent would have helped it gain wider acceptance and growth.

Competitors such as TVS Motor Co, Ather Energy and Hero MotoCorp are also expected to launch cheaper-priced models as battery price reductions have also been supportive.

Going forward, the company expects further consolidation of market share in favour of incumbents such as TVS Motor Co, Bajaj Auto, Ather Energy, Hero MotoCorp and Ola Electric on the back of three key factors

- Stronger balance sheets & funding

- Rapid expansion in dealership touchpoints

- Stronger command on supply chain, driven by brand equity.

Challenges and price cuts

Last year, the Ministry of Heavy Industries reduced the subsidy on electric two-wheelers thus making some of the products a bit expensive and increase in upfront costs impacting affordability and hence demand, and thus, operations of new-age, smaller players.

High battery costs and constraints of imported components sourcing led to widening of losses at gross margin level and inability to secure funding of working capital.

EV manufacturers are prioritising cost optimisation, streamlining operations, and exploring partnerships to attain economies of scale.

On the other hand, when it comes to affordability, Ola has been leader in introducing affordable EV scooters and has taken aggressive price cuts.

Among major players (Ola, Ather, Bajaj, TVS and Hero MotoCorp), Ola has the cheapest available variant, Ola S1X+ priced at Rs 84,999. It has also launched an even cheaper variant of OLA S1X (2KWh) at Rs 79,999 but the delivery timelines are yet not disclosed. Tracking the pricing scenario in the past few months, Ola was the first to take a steep price cut of Rs 20,000 (around 18%) on the S1 X+ in December 2023. The price cut by Ola led to a quick response by Ather when it slashed prices of its cheapest variant, the Ather 450S by around Rs 20,000 (around 15%) in January 2024.

Last month, Ola slashed prices of its variants by another 6-12%. The pricing scenario continues to be aggressive, especially between Ola Electric and Ather Energy.