By Dr Srimathy Kesan & Yagna Sai

Deep technology, or “deep tech,” denotes sophisticated technologies founded on significant scientific advancements, possessing the capacity to revolutionize conventional industries and instigate the emergence of novel markets. It encompasses groundbreaking innovations that transform what was once deemed science fiction into tangible reality.

Deep tech startups are enterprises that leverage tangible engineering innovations or scientific breakthroughs to develop new offerings. Operating across various sectors including but not limited to agriculture, life sciences, chemistry, aerospace, and green energy, these startups spearhead advancements in fields such as Artificial Intelligence, advanced materials, blockchain, biotechnology, robotics, drones, photonics, and quantum computing. Notably, these cutting-edge technologies are progressively transitioning from early-stage research to practical market applications.

Reflecting on the transformative impact of previous waves of platform technologies such as the internet, mobile technologies, PCs, and silicon chips, one can grasp the potential magnitude of advancements that deep tech may bring to diverse industries. Deep tech has the capacity to address or alleviate pressing global issues such as climate change, diseases, food security for a burgeoning global population, and the challenges posed by aging demographics.

In India, a dynamic group of leading deep tech startups is spearheading innovation across various sectors. InMobi utilizes AI to revolutionize mobile advertising, while Fractal Analytics empowers enterprises with ML-driven data insights. Niki.ai simplifies daily tasks with its AI-powered voice assistant, and SigTuple transforms healthcare diagnostics with AI precision. Meanwhile, Vedantu redefines education through personalized AI-driven learning experiences, Pixxel, a Bengaluru-based space startup using AI-powered analytics platform to study satellite images. Together, these startups epitomize India’s technological advancement and its potential to reshape industries and daily life. These are merely a few examples of the groundbreaking deep tech startups that are flourishing in India. Their pioneering efforts are not only reshaping industries but also positioning India as a global hub for cutting-edge innovation.

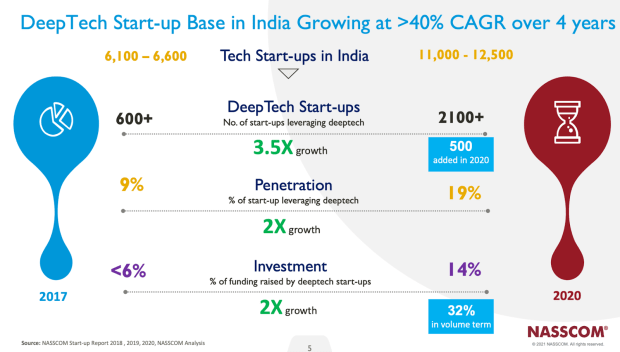

India has seen a significant increase in the number of startups leveraging deep technology such as artificial intelligence, machine learning, blockchain, robotics, and biotechnology. According to various reports and estimates, India is home to 10,000+ deep tech startups according to DPIIT, and a significant portion of these are involved in deep technology. The number has been steadily growing over the years, fueled by factors like increased access to technology, supportive government policies, growing investor interest, and a vibrant entrepreneurial culture.

Deep tech startups frequently require substantial long-term investments and extensive research efforts. Achieving commercial success may also entail a prolonged timeline, given the disruptive nature of these technologies, which often necessitate considerable time for genuine market adoption to occur.

Deep Tech Startups: Fueling Innovation in India

Amidst the vibrant startup landscape of India, a fresh cohort of enterprises is rising, equipped with state-of-the-art technologies and a fervent aspiration to revolutionize various sectors. These entities constitute deep tech startups, harnessing the potential of artificial intelligence (AI), machine learning (ML), blockchain, and quantum computing to confront intricate hurdles and unleash unprecedented opportunities.

Funding on the Rise

According to NASSCOM, deep-tech start-ups in India raised USD 2.7 billion in venture funding in 2021, in which Bengaluru accounts for 25-30% of India’s deep-tech start-ups, followed by Delhi-NCR (15-20%) and Mumbai (10-12%). Phenomenal interest in generative AI after the release of ChatGPT and other chatbots based on large language models (LLMs) – have led to significant interest by investors in deep tech.

In the last decade India’s deep tech ecosystem has grown 53% and is at par with that in developed markets like the US, China, Israel, and Europe. This substantial influx of funding underscores the increasing confidence among investors in the transformative capabilities of deep tech solutions. Notably, deep tech startups now command an impressive 12% share of total startup funding in India, emphasizing their pivotal role in shaping the nation’s technological landscape.

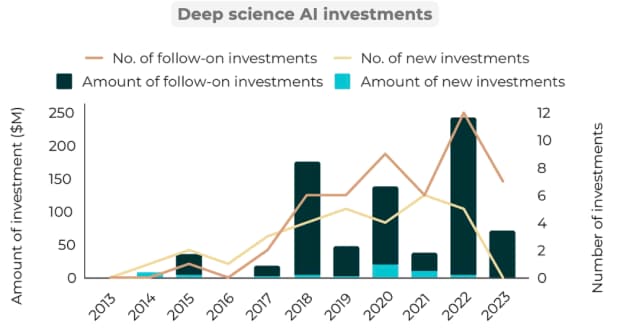

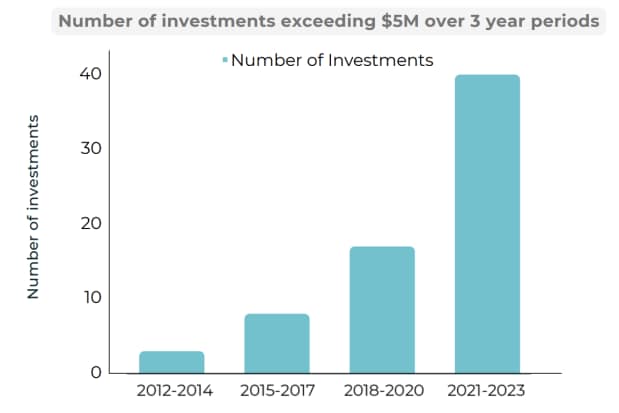

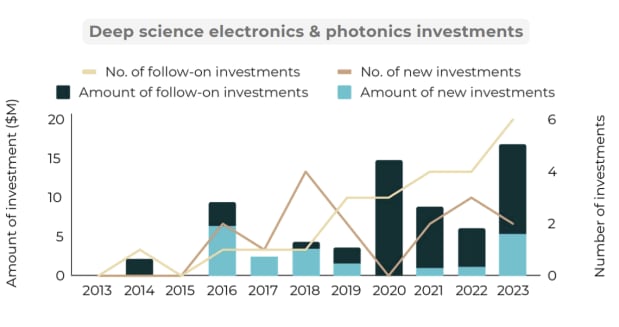

Total deep science tech investments have doubled or better in every tracked three year period, and crossed $1 billion in the 2021-2023 period according to the latest report by VC firm Ankur Capital. While the number of investments have been growing linearly, the number of investment rounds over $5M has been growing exponentially. This number, too, has followed the rule of three: it has doubled in every 3-year period.

Deeptech is also a term for businesses using advanced science and technology to find solutions for complicated problems across over a dozen sectors and spread across sub sectors such as space technology, electric vehicles, semiconductors, and cleantech.

Deep science in electronics is driven by AI, telecom and space:

In the last five years, deep science in electronics has been driven by applications in space tech and telecom, with an increased focus on AI and chip design in more recent years.

Indian space startups have attracted over ₹1,000 crores of private investment, Union Minister Jitendra Singh expressed confidence that India has the potential to achieve a 100 billion USD space economy by 2040. The earnings from European satellites exceed 290 million euros, while revenue from American satellites surpasses 170 million USD. These international collaborations underscore India’s credibility in the global space community.

India experienced the establishment of 54 new space startups, bringing the cumulative count of emerging enterprises in the sector to 204. Within the same year, Indian space startups garnered a funding total of $123.9 million, contributing to an aggregate sectoral funding of $380.25 million, as reported by the Indian Space Association (ISPA).

Furthermore, foreign analysts speculate that India has the potential to evolve into a $100 billion space economy by 2040, as indicated in recent research such as the ADL (Arthur D. Little) Report as well. Nearly half were launched in 2021 alone, when private investments nearly tripled. Peak XV Partners, formerly Sequoia India and Southeast Asia, in June led, opened a new tab a $10 million investment in Digantara, which maps space debris. Launch-vehicle maker Skyroot Aerospace raised $51 million, opening a new tab in September in a funding round led by Singapore’s GIC, a deal it boasted was the sector’s largest ever.

In 2023, A significant endorsement of this potential came when Alphabet, Google’s parent company, invested $36 million in Pixxel, a Bengaluru-based space startup. This marked a watershed moment, being the first major investment in the Indian space sector post the privatization policy implemented in April.

Challenges concerning the future of Deep Tech in India in current scenario:

Limited participation from domestic corporates & strategic investors. In countries such as the US, startups in tech-led sectors such as pharma, energy and semiconductors are supported by partnerships and strategic investments by large corporations. This sort of collaboration is limited in India. Industry-startup engagement is slow to pick up.

Investors Understanding about the Tech:

There is a severe knowledge gap and information asymmetry between investors and investees. The knowledge gap stems from difficulties that deep tech startups face in pitching their firms to investors as they over focus, they often elaborate on the complex scientific and technical features of their ventures rather than the end applications and business potential. This issue is particularly relevant with founders from Tier II/III cities.

High Risk and Long-term Return on Investment:

Deep tech initiatives often demand substantial upfront investment in research and development and may require years or even decades to materialize in the market and yield revenue. Consequently, they may appear less appealing to traditional investors who gravitate towards ventures with lower risks and shorter timeframes.

Insufficient Research Funding in India:

Inadequate research funding in India persists despite a target of 2% GDP allocation. While absolute spending on R&D has risen, the proportion relative to GDP has declined, currently standing at 0.65%, well below the global average of 1.8%. This financial shortfall hampers India’s competitiveness with scientifically advanced nations, signaling a concerning trend in diminishing support for crucial research activities.

Scarcity of Specialized Talent:

Lack of activities and comprehensive university programs focusing on deep tech widens the talent gap. Deep tech endeavors necessitate highly skilled and seasoned professionals such as researchers, engineers, and entrepreneurs, who are in short supply and high demand. The acquisition and retention of such talent pose significant challenges and expenses for deep tech startups, particularly in burgeoning markets.

Lack of Market Readiness:

Deep tech undertakings might encounter regulatory, ethical, social, or environmental hurdles that impede their adoption and scalability. Moreover, they may need to enlighten and persuade potential customers and stakeholders regarding the value and feasibility of their solutions, a task that can be intricate and unfamiliar. Deep Tech startups often face challenges in validating their products. The doubts regarding their functionality and operational effectiveness impact their future revenue generating abilities. Similarly, the information asymmetry emanates from reluctance of deep tech startups to reveal their IP (patents, trade secrets etc.) as there could be a substantial cost to revealing information to their competitors It is proposed to establish an institutional arrangement for adequate mentorship to guide the founders and build internal capacity in securing funding.

So, How the Government is supporting the Deep Tech Startups Ecosystem:

The government has been actively promoting research and innovation in transformative technology areas, such as mobility, battery storage, and quantum technology. Initiatives like the National Mission on Transformative Mobility and Battery Storage and the National Quantum Mission are examples of these efforts.

In 2023, a policy framework aimed at fostering an enabling environment for companies operating in deep tech sectors was finalized. Known as the National Deep Tech Startup Policy (NDTSP), it is currently awaiting government approval. This policy is a collaborative effort between the Department for Promotion of Industry and Internal Trade and the Office of the Principal Scientific Adviser.

Recent government initiatives suggest a shift towards fostering partnerships with the private sector to bolster R&D investment. Recognizing the limitations of public funding alone, efforts are underway to enhance collaboration among industry, research institutions, and educational bodies. Ensure Optimum Utilization of Funds: The Rs 1 lakh crore corpus is intended to provide seed funding for startups and private sector ventures engaged in research and development.

The Draft National Deep Tech Startup Policy (NDTSP) aims to support deep tech startups, stimulate innovation, and promote economic growth. The policy focuses on research and innovation, intellectual property, and ethical innovation. India’s deep tech ecosystem is poised for exponential growth, with increasing investment, untapped opportunities, and world-class talent.

In summary, deep tech holds immense promise for India’s future, driving economic progress, societal development, and global competitiveness. The government’s initiatives and private investments will play a crucial role in shaping this dynamic sector.

About the author:

Dr Srimathy Kesan is Founder, and CEO Space Kidz India.

Yagna Sai works at Space Kidz.

Disclaimer: Views expressed are personal and do not reflect the official position or policy of Financial Express Online. Reproducing this content without permission is prohibited.