At the beginning of a journey, it is about setting up, getting the right resources, funds, and people, creating revenue streams, and acquiring users. It’s been a similar story in thecase of the online gaming industry in India. However, the boat seems to have hit a rock with the government implementing a 28% goods and services tax (GST) on the industry. As a result, some of the online gaming start-ups seem to have taken to layoffs blaming unsuitable business conditions. But are these layoffs necessary in reality or is this a way for these companies to take advantage of the situation? Industry experts opine that the industry will face operational issues in the short term but layoffs may not be the answer to the long-term business problem. “It is true that the change in the GST framework will pose short-term challenges for online gaming companies as a high increase of 200-250%, will have disruptive effects on business models and will force these companies to innovate. Having said that, taxation should not really come in the way of business continuity. Businesses need to be resilient and agile to be able to adapt and grow as per the new norms,” John Joseph, ex-chairman – Central Board of Indirect Taxes and Customs (CBIC), told BrandWagon Online.

Understanding how it all works

Based on the recent layoffs, it is now believed that online gaming companies are making a ruckus of the taxation system on numerous accounts including double taxation, multiple taxation, high tax rate, and valuation, among others. For a better understanding, let’s break down the process.

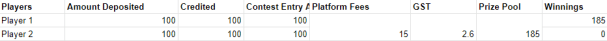

Old GST at 18%

- Player 1 recharges his/her wallet with Rs 100.

- Player 2 recharges his/her wallet with Rs 100.

- Total contest entry amount = Rs 200.

- The platform fee levied on the total contest entry amount is 15%.

- Post the dedication of the 15% platform fee, the amount left that is the prize pool is Rs 170.

- The government earned 18% GST on Rs 30, thereby amounting to Rs 5.4

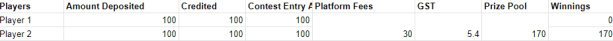

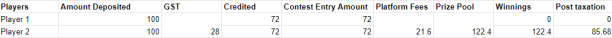

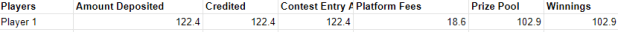

Under the new GST regime at 28%

- Player 1 recharges his/her wallet with Rs 100.

- 28% GST deducted on the face value which amounts to Rs 72 being credited as contest entry amount.

- Player 2 recharges his/her wallet with Rs 100.

- 28% GST deducted on the face value which amounts to Rs 72 being credited as contest entry amount.

- The total content entry amount left is Rs 144.

- 15% platform which is Rs 21.4 is being levied which leaves the total amount at Rs 122.4 as the prize pool.

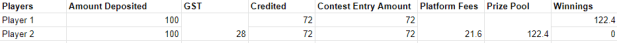

- Now if the player post winning decides to play another round there is no GST which will be deducted from Rs 122.4.

- However, the platform will charge a 15% fee which is Rs 18.33.

- This causes the prize pool to reduce to Rs 103.9.

- Now there will be no additional GST which will be implemented if the player continues to play.

- However, for every new gameplay an online gaming company can charge a 15% platform fee.

According to industry estimates, the platform fee ranges between 10-15%. Experts opine that in order to make game-play more viable one of the steps which can be undertaken is to reduce the platform fee, which perhaps will make playing a lucrative proposition among gamers. “28% GST on the contest entry fees will mean that the entire gaming ecosystem has to recalibrate the prize pool and platform fees equation. With the depletion of the prize pool, maths on win probability and ROI on contest entry fees will change and may have an adverse impact on volume and value of transactions,” Prashanth Rao, partner, consulting, Deloitte India, explained.

While players can play an infinite number of gameplays post recharging their wallet if at any point in time, at the time of withdrawal which could also be at the end of the financial year, he or she would have to pay a 30% TDS (tax deduction at source), under the norms of Income Tax (Direct Tax). However if a game is cancelled a player is not charged with any extra tax, and the same amount is credited to the wallet. Critics opine that sector participants must respect the GST council’s policy decision, and also wait for clarity on the tax collection method. “Collecting the whole tax at the first point of ‘Buy-in’ eliminates the need to tax each player on recurrent games, allowing for a simple tax ecosystem. From a macroeconomic standpoint, industry demand for taxing casinos, racehorses, and internet gaming at a lower rate of 18%, applicable to general products such as rental services, consulting services, and higher education, may not be justified,” Rajat Mohan, partner, AMRG Associates – an accounting firm, added.

Managing cost for profitability

While it takes anywhere from five to eight years for a business to turn profitable, during this phase a lot of areas are factored in – starting from acquiring a good volume of users who will spend enough money to play games. And this is done through various marketing strategies, building new products, among others. According to the FICCI-EY 2023 report, new players, marketing efforts, specialised platforms and brand ambassadors, among other factors grew the segment by 34% in 2022 to reach Rs 13,500 crore in 2022. There are over 400 million online gamers in India, of which around 90-100 million play frequently. Real-money gaming comprised 77% of segment revenues, the report stated.

To be sure, the acquisition of customers comes at a hefty cost. BrandWagon Online took a look at MPL’s last filings to understand how the company’s cost soared. Marketing and promotional expenses rose 39.47% to Rs 530.8 crore in FY22 from Rs 380.45 in FY21, as per regulatory filings accessed by business intelligence platform Tofler. The total expenses borne by the online gaming company increased 54% to Rs 1059.6 crore in FY22 from Rs 687.3 crore As a result, MPL’s revenue from operations grew 37.46% to Rs 600.68 crore in FY22 from Rs 436.96 crore in FY21 (standalone). The net loss widened 247.2% to Rs 449.48 crore in FY22 from Rs 129.45 crore in FY21.

According to the FICCI-EY2023 report, greater awareness was created through marketing and the use of brand ambassadors such as MS Dhoni by WinZO, Shah Rukh Khan for Ace23, Hrithik Roshan for Games 24×7 and Virat Kohli for MPL.

Similarly, Fantasy sports and online casual gaming platform Play Games 24×7’s total expenses rose six percent to Rs 1497 crore in FY22 from 1411 crore in FY21. Interestingly, the company’s employee benefit cost shot up 84% to Rs 372 crore in FY22 from Rs 202 crore in FY21. The company posted a net loss of Rs 282.4 crore in FY22 from a net profit of Rs 110.02 crore during the same period in the corresponding year. While revenue from operations dropped 24.38% to Rs 1169.27 crore in FY22 from Rs 1546.27 crore in FY21 (consolidated). This is despite the company reducing its advertising cost by 10% to Rs 877 crore in FY22 from Rs 977 crore during the same period.

Industry experts call the layoffs nothing but a smoke-screen. “So far with the inflow of investment and sky-rocketing valuation, the focus has been on the acquisition of customers, which is one of the reasons behind such high bleed. The current GST has forced online gaming companies to optimise cost so that in the long run these become viable businesses,” said a senior analyst who did not want to be named.

While it may not be a smooth ride anymore for the online gaming industry in the short term, the new GST regime also will make these companies create a stronger business model with multiple revenue streams, like any other business with a sharper focus on user retention through data analytics, enhancing trust besides creating separate, focussed communities for each game to increase engagement levels.