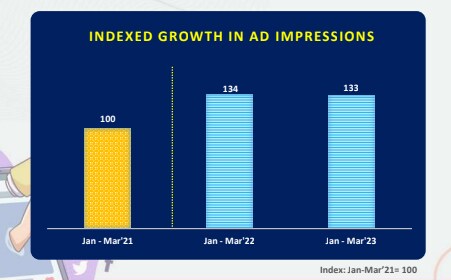

The TAM AdEx report on digital advertising for January- March 2023 quarter reveals that digital medium witnessed an increase in ad impressions by 33% in the period as compared to the same period in 2021. However, it witnessed a minor drop of one percent when compared to the same quarter in 2022.

Services was the leading sector with a 45% share of ad impressions during January-March 2023. Moreover, the top two sectors accounted for 54% share of ad impressions on digital. Personal accessories and textiles/clothing were the two new entrants in the top 10 list of sectors.

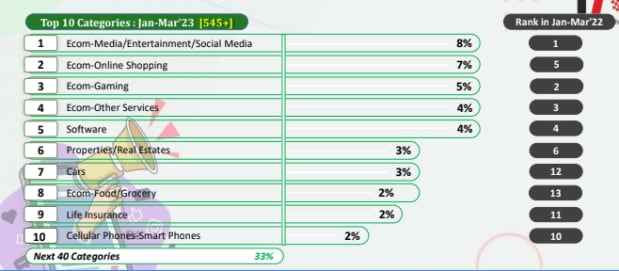

The report further highlighted on the leading advertising categories in the January-March 2023 quarter. According to the report, the top 10 categories added 41% share of digital ad impressions with Ecom-Media/Entertainment/Social Media leading the category with an eight percent share of ad impressions, retaining its top position. Cars, Ecom-food/grocery and life insurance were the new entrants this year.

The AdEx report also reported that more than 40,000 exclusive advertisers present in digital and more than 1200 common advertisers between TV and digital. Snapchat was the leading exclusive advertiser among digital and TV medium while Reckitt Benckiser was the leading common advertiser.

Additionally, more than 240 categories registered positive growth. Ecom-Online shopping lead the top 10 growing categories in January-March 2023 as compared to the same period last year, based on the difference in ad impressions. Hosiery category witnessed a growth of 12 times while aerated soft drinks and airlines grew 6.1 times and 5.7 times respectively.

Highlighting about the leading web publisher and app, the report stated that YouTube with 19% impression leads as both a web publisher and an app in terms of ad impressions in January-March 2023 quarter. While among Apps, again YouTube lead the list with 17% share followed by Cricbuzz with seven percent. Furthermore, during January-March 2023, YouTube alone had 36% of ad impressions.

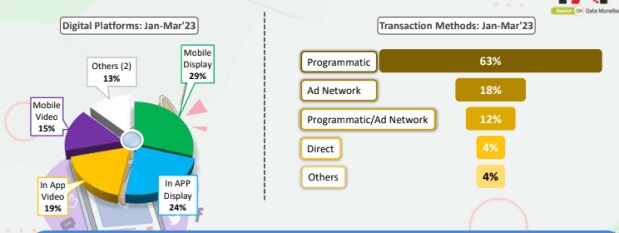

Moving further, the report delved on the leading digital platforms and transaction methods for digital advertising. It stated that mobile display was the leading digital platform with 29% share of ad impressions during Jan-Mar’23 followed by In APP display with 27% ad share. Interestingly, programmatic ascended to the top with a 63% share of ad impressions with direct occupying only four percent of the ad impressions during January-March 2023 as compared to the same period last year. Since the volume has gone up significantly, this can speculatively affect the price of ad inventory, as a result, especially at a time when marketers are looking to spend less money but want higher yield.

According to Siddharth Dabhade, managing director, MiQ, “The data highlighted in the TAM report demonstrates the increasing effectiveness and adoption of programmatic advertising in India. While it is possible that an increase in ad inventory demand could result in a decrease in prices, we have not observed a significant reduction or increase in prices as digital advertising platforms employ sophisticated algorithms and bidding mechanisms to optimize ad placements and ensure fair market value for ad inventory.”

However, with the festive season approaching, industry opines that the prices of ad inventories will witness a rise. “The larger platforms would continue to charge higher rates whereas the smaller platforms would have to charge moderately. While revenues are going to go down, but with the festive period approaching, marketers will pull through,” Harsha Joshi, independent media consultant stated.