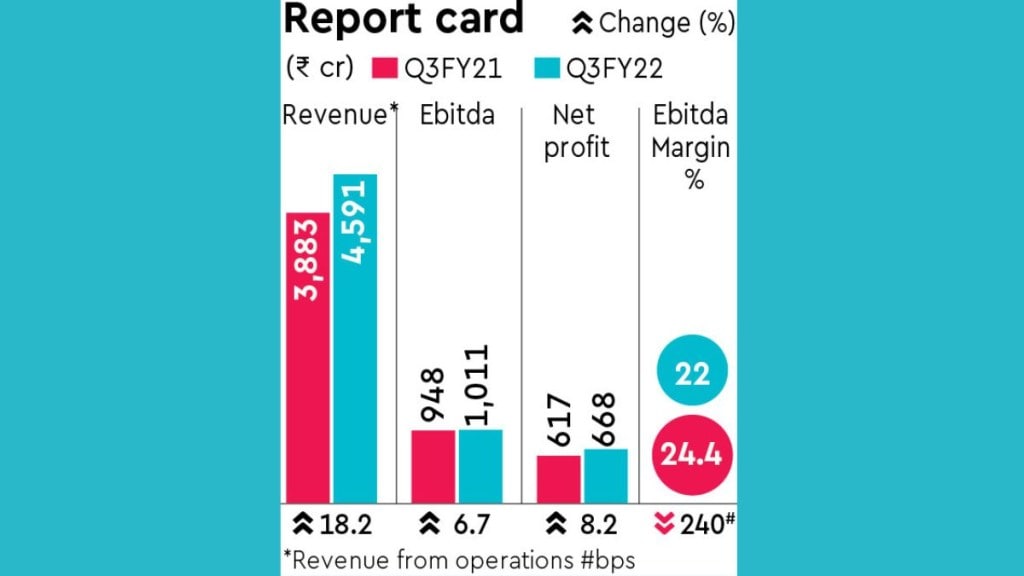

FMCG major Nestle India reported an 8.2% year-on-year increase its net profit to `668 crore for the quarter ended September 30, 2022, which was slightly above Bloomberg consensus estimates of `651 crore, amidst a growth in volumes and pricing mix.

The company’s revenue from operations surged 18.2% y-o-y to `4,691 crore, led by Maggi noodles, Milkmaid and Nescafe classic, beating analyst estimates of `4,377 crore. The sales growth for the noodles-to-chocolate manufacturer has been its highest seen in the last five years, for a quarter. This was contributed by mix of price and volume growth. While domestic sales grew by 18.3%, export sales were up by 15.7%, driven by expansion in newer markets specifically in Maggi noodles and the confectionary segment.

Higher advertisement spends and distribution expansion aided in growth, while out of home channels saw strong growth on the relatively lower sales in base quarter, according to analysts. Also, e-commerce channel continue to grow and is now contributing 7.2% of the total sales.

Suresh Narayanan, chairman and managing director, Nestlé India said, “We have witnessed the highest sales growth during a quarter in the last five years. This achievement has been on continued strong volume and mix evolution with broad based double-digit growth across all categories.”

Pointing towards a broad based contribution to the performance, Narayanan said that growth has been strong in the large metros and mega cities and continued to be robust across smaller town classes including rural markets.

Ebitda (earnings before interest, taxes, depreciation, and amortisation) for the company increased 6.7% y-o-y to `1,011 crore. Ebitda margin for the quarter, however, remained under pressure as like other FMCG companies, high cost inventories for raw material continues to impact margins, which fell 240 basis points to 22%.

The company highlighted in a statement that there are early signs of stability in prices of a few commodities such as edible oils and packaging materials. However, fresh milk, fuels, grains and green coffee costs are expected to remain firm with continued increase in demand and volatility.

According to analysts, the sharp correction in edible oils and crude related packaging costs would be reflected from December quarter onwards. “Nestlé India is experiencing robust growth across segments driven by ad-spends distribution expansion specifically in rural regions. Foray in newer categories, expansion of e-commerce channels and increasing manufacturing capacities is also helping in increasing volumes. We believe higher volumes and margin expansion would boost profitability for the company in next two years,” said analysts at I-direct.

Nestle India also announced the launch of its first ever direct-to-consumer (D2C) platform called MyNestle platform. The platform will offer curated product bundles, personalised gifting, subscriptions and discounts. “Not just this, consumers can also try gourmet recipes on the site and get free nutrition counselling,” Narayanan added.In an update on the Purina Petcare acquisition, the company said, “In terms of the business transfer agreement, the business has been acquired by the company after the end of the quarter, with effect from October 1, 2022. An amount of `142.13 crore was paid to Purina Petcare India after the reporting date as a consideration for the acquisition of the Pet Food Business.”

Nestle India’s board of directors have declared second interim dividend for 2022 of `120 per equity share amounting to `1,157 crore, which will be paid on and from November 16, 2022. This is in addition to the first interim dividend of `25 per equity share paid on May 6, 2022.

Also Read: Representation of women in top 100 firms improves