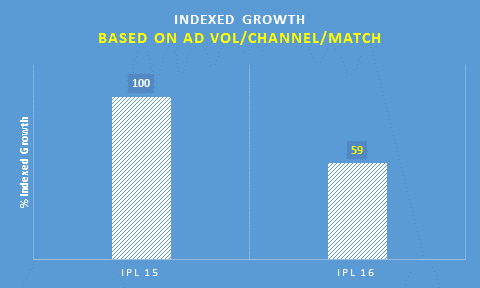

This year’s Indian Premier League perhaps has been able to live upto the phrase, ‘There is more than meet the eyes’. With a total of 74 matches being played in this 16th season of the IPL, this year’s T20 tournament has 14 extra matches when compared with previous years of 60 matches. This means that there is a longer period for advertisers to utilise the platform. Hence, industry experts believe that advertising on the IPL will gain momentum in the coming weeks. “In total advertising volume has dropped by 20-30% this year, that is largely due to the fact that the market sentiments are a little subdued with several categories like start ups taking a pause. Hence, advertisers are cautious,” Jehil Thakkar, partner, media and entertainment sector leader, Deloitte India, told BrandWagon Online.

The Advertising Scenario

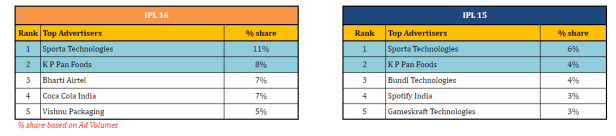

Interestingly, as per the latest ad-spends report by TAM Sports an unit of TAM Media Research, during first seven matches, food and beverages (F&B) topped the five categories’ list with three advertisers when compared to E-commerce sector which gabbed most of the advertising during last year’s IPL. Sports Technologies and KP Pan are the two companies which are common during this year’s T20 tournament. 11 new categories and 45 new brands advertised during the first seven matches of IPL16 compared to the same number of matches in IPL15.

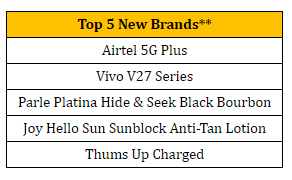

Among the 45 new brands, Airtel 5G Plus topped the list followed by Vivo V27 Series. Furthermore, among the new categories, majority of the E-commerce categories haven’t advertised so far in IPL 16th when compared to IPL15th season.“It is very pre-mature to say that this IPL season has failed to get advertisers ad spends.

In fact, with a few e-commerce companies dropping out of this IPL season, it has paved the way for more traditional categories to come back. What is attractive for these traditional brands is the longevity of IPL. It allows categories with seasonality to advertise with short four-to-five-week campaigns and that too in specific market feeds. As the long summer season picks up in many northern markets, white goods and fizzy drinks categories will join to advertise too,” L V Krishnan, CEO, TAM Media Research, said.

This year the IPL started before March 31, 2023, that is before the closure of last financial year. This is also a time when brands typically refrain from spending too much money on advertising. Hence, yet another reason for what is being called, a ‘muted response’, so far.

ICC World Cup 2023

Towards the latter half of the year, India will host The ICC (International Cricket Council) ODI World Cup 2023 between October-November. This is also the festive season in the country and advertisers typically reserve a good chunk of the spend for the time. “Also, with the ODI World Cup scheduled this year, marketers are being judicious about their budget allocation across events and categories,” Thakkar explained.

To be sure the IPL is an expensive playground for advertisers which require them to typically spend anywhere between Rs 200-300 crore to create the right kind of buzz. “Not all brand have large ad budgets to spend in the whole of IPL. Hence, they will use short burst campaigns on IPL to build Reach & select the right weeks to advertise. While some brands may advertise in the initial phase, a few may select to advertise towards the end of the T20 tourney,” Krishnan explained.

Television versus Digital

This year is also different in terms of the broadcast rights being split between Viacom18 and Walt Disney Company India. Last June, Walt Dinsey Company India – Star had retained the IPL TV rights for Rs 23,575 crore – which amounts to Rs 57.5 crore per match for a period of five years, while Viacom18 bagged the digital rights for the Indian subcontinent for Rs 20,500 crore, thereby amounting to Rs 50 crore per match. So why is the game different this year? According to industry experts, one of the star differences this year is that linear TV comes with limited inventory while digital has unlimited inventory.

When compared to last year, as per TAM Sports, the IPL on TV is being telecast on 25 channels as opposed to 20 channels last year. On the other hand, on digital users have free access to the IPL on Jio Cinema besides Voot – its over-the-top (OTT) platform. According to industry estimates, the spot for Associate Sponsor currently costs anywhere in the range between Rs 70-100 crore. Interestingly, unlike last few years, the broadcast company has also created customised packages for advertisers. These packages ranges from Rs 3-4 crore and go upto as high as Rs 20-30 crore. Besides currently it is believed to be selling a ten second ad spot in the range of Rs 14-15 lakh. This however, is expected to increase to the earlier rates of Rs 18-20 lakh per tend second as the tourney approaches finale.

As for Jio Cinema, the platform unlike Hotstar – its previous streaming platform has opened the IPL for free viewing to users. According to a senior media analyst, on the condition of anonymity, Jio is playing a long term gaming which is based on experience. “This year, the platform have asked advertisers to experience its richness and services and once can expect the rates to go up next year,” the analyst noted.

As per industry estimates, a sponsorship slot on Jio Cinema currently costs Rs 15 crore and above, while the company too has created customised packages for advertisers including regional. On digital Jio Cinema’s asking rate of a CPM (cost per thousand impressions) is in the range of Rs 400-450, but as per industry estimates, the realised CMP is in the range of Rs 250-300. What’s more, a lot of Reliance owned brands can also be seen advertising currently during the IPL on Jio Cinema. “The market is tight, hence currently one can see limited advertising. Moreover, digital offers lot more inventory at a lower price to advertisers, making it a top pick,” Jai Lala, CEO, Zenith – The ROI Agency, said.