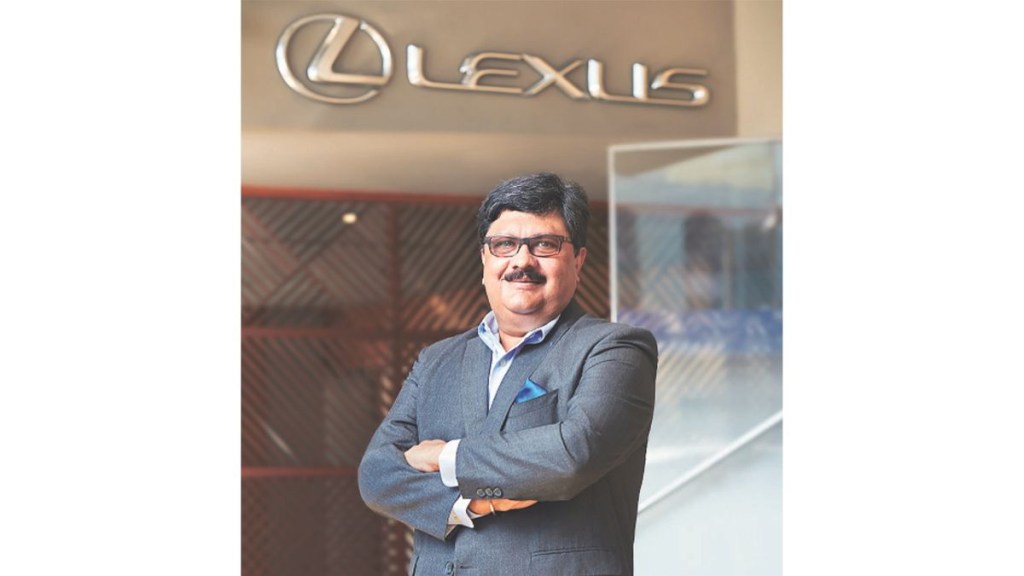

Lexus, the luxury car brand of Toyota that debuted in India in 2017, posted a 76% increase in sales in 2022, albeit on a small base. Naveen Soni, president of Lexus India, tells Christina Moniz how the India arm is trying to break into the top 3 APAC markets by 2024-25. Edited excerpts:

Lexus is a late entrant to India’s luxury car market. How challenging has it been to make inroads in a market that has BMW and Porsche?

Lexus entered the Indian market in 2017, and would have completed six years in the country in March this year, but two of those years were lost to the pandemic. I would say we’re a four-year-old brand and in that sense, are still in the early stages of our journey in India market. We have been growing our presence rapidly across the country since our launch, and now have 23 touch points in 16 cities. Lexus covers around 70-75% of the total luxury car market in terms of sales and around 85% for service.

Having said that, we have been growing at four times of where we were two years ago. The overall car industry, including the mass market, grew by 22% last year. Luxury grew by 52%. But Lexus grew by 76% in the last calendar year in retail terms, which means we were growing faster than the market and we expect this trend to continue this year as well.

Market share is not a major KPI for us — the biggest parameter we evaluate ourselves on is customer satisfaction. We outpaced the industry last year, albeit on a smaller base, but even with an increased base now, we expect to double sales this year. That also means that we will definitely gain a better market share.

How important is India to Lexus’ global scheme of things?

India was the fourth country (after the US, Canada and Japan) to produce Lexus vehicles locally, which we started in 2020 with ES, our luxury sedan. Going by the growth India has been demonstrating, we believe that the market is likely to become among the top three in the APAC region for Lexus by 2024-25.

For the luxury car segment, certain factors come into play such as the number of millionaires in the market and India is poised to see that number grow rapidly. The other key factor is per capita GDP, which in India is currently around $2,500 but is expected to grow six-fold. When that happens, more consumers will enter the market.

Events and experiences have been important to the brand’s marketing efforts. How much of your marketing budget is spent on experiential initiatives?

We do not want to be seen as another luxury carmaker but rather as a luxury lifestyle provider. Our endeavour is to offer bespoke, luxury experiences for our guests. Our events address our guests’ passion or trigger points across areas such as food, sports, travel and health. While most luxury brands invest a lot in seeking and identifying potential customers, we believe that new customers will come from word-of-mouth from the existing ones. That is why we spend 40% of our marketing budget on our existing guests. Through our online programme, Lexus Life, guests can choose experiences based on their passion points. Our customers are given what we call a ‘taiken’ card, which means experience in Japanese. Using this, they can book and secure customised experiences.

Have these efforts paid off in terms of driving sales?

Referral sales, or sales from word-of-mouth, account for 18% of our total sales. We want to take that up to one-third of our total sales in the next few years.

Which cities and consumer segments are you tapping to drive growth for Lexus?

The top seven cities in the country such as Delhi, Chandigarh, Mumbai and Bangalore account for around 45-50% of the market. The market becomes really fragmented beyond that. We’re expanding our footprint to smaller markets like Coimbatore, Pune and Ahmedabad. The growth rate in emerging, smaller markets is quicker, thanks to consumer aspirations and rising awareness.

Another interesting trend is that younger consumers are getting into this market, including those with entry-level jobs in multinational firms. These are young customers, sometimes even in their 30’s, who have houses of their own and high dispensable incomes. The average age of our customers has reduced from 50-55 years a few years ago to around 40-45 years today, indicating that customer aspirations are increasing. The luxury car market starts at Rs 40 lakh in India, and our vehicles operate at a mid-price point with a starting price of Rs 65-70 lakh. It is easier for our guests to purchase entry-level models and then subsequently upgrade and spend more on their next car purchase.