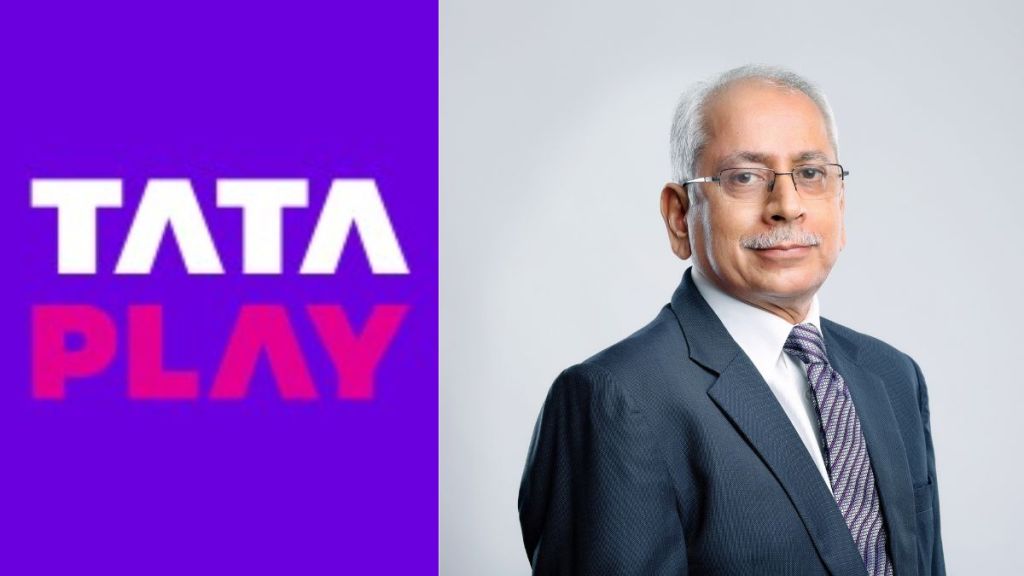

After testing its services with its 20 million-strong direct-to-home (DTH) subscriber base, OTT content aggregator Tata Play Binge is eyeing a bigger opportunity, opening up the platform for all connected TV and smartphone users. In this interview, Harit Nagpal, MD & CEO of Tata Play, talks to Christina Moniz about the company’s content aggregation and distribution strategy in a market where television remains the go-to platform for home entertainment. Excerpts:

What prompted your recent move to make Tata Play Binge available to non-DTH subscribers?

We have been in TV for a long time and what we did was create a unified technology platform to host hundreds of TV channels, and we made content discovery easy while doing that. We made it easier for viewers to select the channel they want by genre and language in a matter of seconds. We recognised that there would be a need for an OTT content aggregator eventually, and that was why we launched Binge about three years ago. Since it was a new, internet-based platform, we expected that it may have bugs and would need extensive testing to perfect it. So we initially took it only to our customer base and then last year to smartphone users to put the offering in more hands and iron out glitches. Now that we have a bug-free platform, we are offering it to everyone. We’ve removed two major hindrances for consumers with Binge — the challenge of managing many app subscriptions and the inconvenience of search.

How big a concern is profitability considering that you’re offering Binge at a fairly affordable price?

There is of course no compromise on profitability. We are not in the business of free OTT. We have priced Binge at Rs 249 a month for 22 apps with four devices connected, and Rs 349 a month for 27 apps, also with connectivity for four devices. The pricing benchmark in the Indian market is Rs 250-300. You must understand that each app has been spending money on acquiring and reacquiring customers, and often not earning much in the process. We are well-acquainted with the subscriber acquisition, retention and reacquisition game because we have been doing it for a long time. If an app is spending a certain sum to acquire a customer, we too are spending a similar amount, except that as an aggregator, we are spreading that figure over 27 apps, which leaves money for both, the app and Tata Play. Because we have been in TV for so long, our strength lies not so much in content creation but rather in content distribution, aggregation and discovery.

Currently, our Binge subscriber base is close to one million, and we want to grow further. Our biggest challenge is consumer inertia. Consumers are not inclined to change their content consumption habits in a hurry. We will be running our new campaign to promote the Binge offering extensively and hope to break the inertia with promos and trials. It will take time, and we need to see more brands launch similar offerings to drive this change, because competition always helps grow the market.

With industry pundits predicting that OTT and connected TV are the future, what is your outlook for the DTH business at Tata Play?

Half the country still has to buy their first TV. To expect them to afford monthly broadband and OTT subscriptions is a bit much. The cycle is very simple in the customer’s journey — they buy their first TV, subscribe to free-to-air channels, move to pay TV and later they will add a paid OTT subscription. India is still very much on TV and the numbers have not shrunk. The best example of that was the IPL. Even though it was available free of cost on OTT, consumers still watched it on pay TV. Paid OTT is consumed alongside pay TV in India, unlike in the West where TV content is much more expensive. OTT is the cheaper alternative in those markets. Paid OTT content is still expensive in India, especially when you add broadband cost to it. My estimate is that paid OTT consumers (who purchase around eight apps) would not be higher than 2% of the pay TV universe.

You currently offer 27 apps on Binge, are you in discussions with more OTT players?

Yes, we’re constantly in talks with different platforms. In a few weeks, we will add Apple TV and we’re in commercial negotiations with at least 10 more, including Prime Video and Netflix. There is plenty of scope to grow the number of apps, considering the country has over 70 OTT players. In fact, we reached the 27 mark from just four apps around three years ago. Since we already have several national players like Disney+ Hotstar and SonyLIV on board, the focus is on regional apps that usually are not able to go to the mass market. Many of these have dubbed content in Hindi and English, or have subtitles, which makes it accessible to a wider audience. Having watched many of Satyajit Ray’s movies with subtitles while growing up, I believe that good cinema and content will always do well irrespective of the language.