Axis My India reveals a change in media engagement, with an increase in families consuming media forms like TV, Internet, and radio. In the evolving digital era, marked by the widespread use of smartphones and affordable internet, there is a shift towards streaming platforms. 25% of respondents are moving away from traditional cable or satellite subscriptions, embracing the flexibility of digital streaming services. However, traditional media retains its relevance, with 40% of respondents still prefer cable subscriptions, illustrating the coexistence of traditional and digital media formats. The survey further delves into diverse content preferences across different platforms and age groups, highlighting varied interests in serials, movies, sports, and both long and short-form videos.

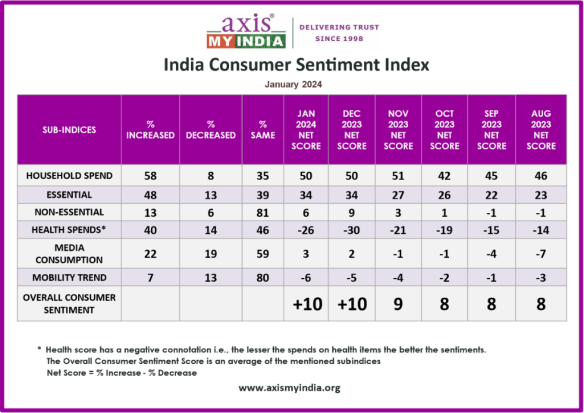

The sentiment analysis delves into five relevant sub-indices – overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment and tourism trends.

As per the survey, overall household spending has increased for 58% of families while consumption remains the same for 35% of families. The net score is +50 which is the same as last month. Additionally, spending on essentials like personal care and household items has increased for 48% of families. Consumption remains the same for 39% of families. The net score is at +34 this month. Meanwhile, the spending on non-essential and discretionary products like AC, cars, and refrigerators has increased for 13% of families. Consumption remains the same for 81% of families. The net score, which was +9 last month, is at +6 this month.

Moreover, expenses towards health-related items such as vitamins, tests, and healthy food have surged for 40% of families. Consumption remains the same for 46% of families. The health score which has a negative connotation i.e., the lesser the spends on health items the better the sentiments, has a net score value of -26 this month. Furthermore, consumption of media (TV, Internet, Radio, etc.) has increased for 22% of families which is a decrease of one percent from last month. The net score, which was +2 last month, is at +3 this month.

“It is clear we’re at the dawn of a new era in how content is consumed. The rise of smartphones and accessible internet has ushered in a shift towards streaming platforms, with a significant portion of audiences embracing this new mode of engagement. Yet, importantly, traditional cable remains a steadfast choice for many, suggesting a diverse and multifaceted media landscape. This blend of new and old, from serials to movies, and sports to varied video formats, reveals a rich tapestry of consumer preferences that transcend age groups and traditional norms. Looking ahead, these insights point to a future where media consumption is not about choosing between digital and traditional, but rather about how these mediums can coexist and complement each other,” Pradeep Gupta, chairman and MD, Axis My India, said.

The December net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +10.3, an increase of +0.3 from the last month. The survey highlighted that serials on TV are favoured by 19% of the respondents. Moreover, movies are watched on TV by 20% of respondents, with another 20% of the respondents enjoying them on both TV and video streaming platforms/OTT. Sports content is equally popular on both mediums, with 22% of respondents tuning into both TV and video streaming platforms/OTT while long-form videos or content on video streaming platforms are the choice for 16% of respondents. Short-form videos or content on video streaming platforms attract 22% of respondents.

19% of respondents aged 36-50, and 51-60 engage in watching, while a slightly higher 21% of the respondents of those above 60 years tune into TV serials while 21% of the respondents of 18-25 age group are viewers, closely followed by 20% in both the 26-35 and 36-50 age brackets. The 51-60 age group is not far behind, with 19% indulging in movies on TV. As for sports viewing on TV, 18% of the respondents of 18-25 age group are keen watchers, while the interest slightly increases to 19% among the 26-35 age group, and notably, 21% of respondents above 60 years also actively tune in to watch sports.

As for video streaming platform/OTT viewership, data reveals 16% of respondents aged 51-56 show a preference for video streaming platforms/OTT in the comedy genre. Moreover, for long-form videos/content, there is an interest among multiple age groups: 17% of respondents aged 18-25, 36-50, and above 60 years lean towards video streaming platforms/OTT. Similarly, 16% of those aged 36-50 also prefer these platforms for such content while short-form videos/content have the highest preference and is seen in the 36-50 age group with 24% favouring video streaming platforms/OTT. Close behind are respondents above 60 years at 23%, followed by 22% each in the 18-25 and 26-35 age brackets, and 20% in the 51-60 age group.