“If you can’t disrupt the existing market, create a new one” Peter Thiel, chairperson of Palantir Technologies, once said. He could not have been more correct. Interestingly, Rebel Foods, a multi-brand cloud kitchen restaurant chain claims to be working on the same lines. With an array of food brands under its umbrella, the company claims to focus on bettering efficiency going forward. “In FY25, we aim to continue improving operational efficiencies, leveraging technology, and maintaining our growth trajectory to enhance our financial performance further,” Nishant Kedia, chief marketing officer and SVP, Rebel Foods, told BrandWagon Online.

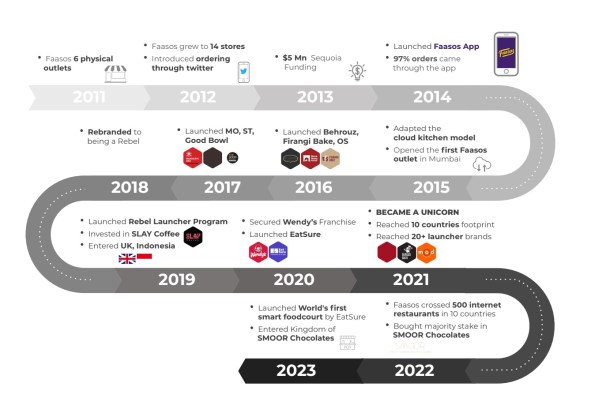

The company’s revenue from operations rose 19.12% to Rs 940.08 crore in FY23 from Rs 789.16 crore in FY22, according to regulatory filings accessed by the business intelligence platform Tofler. The company’s losses widened 29.3% to Rs 670.20 crore in FY23 from Rs 518.02 crore in FY22. The company which delivers food based on a cloud kitchen restaurant model claims to have more than 45 brands including owned and partnered. These include Faasos, Behrouz Biryani, Oven Story Pizza, Lunch Box, The Good Bowl, Sweet Tooth, and Firangi Bake.

Additionally, the company claims to have partnered with Naturals, Wendy’s, Anand Sweets, Mad Over Donuts, Narula’s, Daryaganj, Chaipoint, Big Wong, and MOPP, among others. The company has also invested in food brands including Slay, SMOOR Chocolates, Biryani Blues, and Zomoz. Moreover, it runs the franchise for Wendy’s offline and online stores.

As per the market research firm Statista, the gross merchandise value of cloud kitchens in India is estimated to reach $2.3 billion in 2025. The GMV of the cloud kitchen market saw a steep increase from about $180 million in 2018.

Rise like a Phoenix!

The pandemic needless to say adversely affected all sorts of businesses, especially restaurants. find a silver lining to recover from these setbacks. However, experts believe that cloud kitchens benefitted at the time. “We recorded a significant growth, achieving 100% year-on-year growth between 2018-2019 and 2019-2020. This growth was driven by expanding our kitchen network and strengthening our existing brands. However, the pandemic prompted a period of reinvention for all companies and sectors. During this time, we reduced our losses significantly and began our recovery in the subsequent year,” Kedia said.

At the time of the pandemic, the company claims to have explored multiple new business models and focused on strengthening the brand. Kedia further emphasised that the company is undergoing a shift that strategic shift which is a first-of-kind in the past three to four years. “ Our bottom line has seen substantial improvement in FY24,” he claimed.

Many brands in hand, across the land!

The company claims to cater to the diverse needs of customers for different occasions and moods. For instance, it recently launched ‘Nawabi Handi Dum Biryani’ with brand ambassador Saif Ali Khan for Eid 2024. Additionally, on occasions like Navratri, it claims to have offered specialised menus across multiple categories, catering to diverse tastes. Kedia asserted that each brand requires different marketing strategies for distinct consumer missions across verticals throughout the year. “During Eid and Ramadan, biryani posted a surge in demand, and similarly, we have seen a shift in consumer behaviour during rainy seasons translate into increased sales of burgers and pizzas, he said.

As for its customer acquisition strategy and effective marketing channels, the company stated to have used its diverse audience preferences across brands like Behrouz, Faasos, and Wendy’s, each appealing to distinct demographics ranging from middle-aged urbanites to digitally savvy millennials. The company claims to have earmarked peak order timing as per cuisine to market the same to consumers. For example, during the evening it claims to have recorded a high demand for pizzas and at night consumers prefer desserts. “We’ve leveraged technology to streamline operations, automate processes, and improve real-time inventory visibility to minimise waste and optimise costs. These interventions have helped absorb fixed costs and improve our bottom line,” he added. The company further claims to utilise customer data fetched through apps and websites to send personalised offerings and recommendations

Shining Star!

The company further claimed that in its kitty which has more than 45 brands across 70 cities and over 350 cloud kitchens, in terms of revenue share per kitchen outlet Behrouz Biryani, Oven Story, and Faasos are the top three brands of the company. As these three brands drive a significant portion of Rebel Foods’ business, and the company claims to be focusing on strengthening its position. “Our market share is still relatively small compared to larger categories like the Rs 5000 crore burger segment or the Rs 7000 crore pizza category, especially when considering the online segment alone. There is also substantial offline and unorganised market business to consider,” he added.

In addition to its top three brands, the company claims to have seen significant growth in other brands including The Good Bowl, Lunchbox, and Wendy’s over the past few years. These brands have surpassed company growth rates and gained market share due to their relevance, especially in the post-Covid landscape where office food requirements have evolved, it claimed. “There is a lot of scope to up the scale and quality within existing categories like biryani, pizza, burgers, and wraps. There are flavours people haven’t tasted. So we are trying to fill those gaps through all of our brands,” he added.

As for its plan to expand its business, the company claims this year its priority is to strengthen its presence in existing markets as opposed to adding new markets. “Currently we are focusing on doubling the business in India. We are currently present in 70 cities with over 350 cloud kitchens and intend to further strengthen our presence. We are also present in the UAE (specifically Dubai), Saudi Arabia, and the UK. These are the markets where we plan to intensify our efforts before considering entering completely new markets this year,” he said.

And like any company in the business, it claims that its strategy differs from market to market.“For instance, in India, we operate a full-stack model where we control the entire supply chain—from food preparation in our kitchens to delivery through both third-party aggregators and our channels. In Dubai, our approach may differ slightly, and in the UK, we primarily adopt a franchise-led model alongside our kitchen operations,” he noted.