“Organisms that are better adapted to their environment are best suited to survive and successfully reproduce.” Charles Robert Darwin’s theory on ‘Natural Selection’ couldn’t have been more accurate. The phrase, survival of the fittest, defines not only the mechanism of natural selection or the biological concept of ‘fitness’ but also describes the current scenario of the online real money gaming industry. “The immediate impact was felt with a few online gaming companies shutting shops, as some chose to lay off staffers and close down regional centres. For instance, MPL and Hike-owned Rush Gaming Universe, a Web3 gaming platform, laid off as many 350 (MPL) and 55 staffers,” said a senior analyst, on the condition of anonymity.

It has been approximately nine months since the 50th Goods and Services Tax (GST) Council meeting where 28% GST was levied. The impact can already be felt in many ways which includes a steep decline in investments, and a reduction in revenue and margins of online gaming companies, among others. Meanwhile, it was widely reported across several media outlets in February, this year, that there has been a jump in GST revenues from online gaming companies post-October 1. From monthly revenue of Rs 225 crore, the aggregate tax paid by the sector now stands at about Rs 1,200 crore.

The Impact so far!

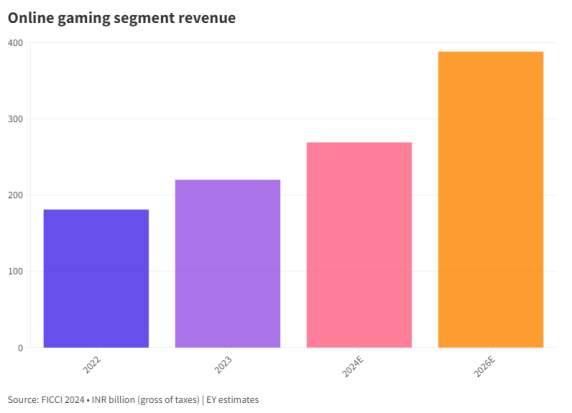

Once touted as the fourth largest segment of the Indian media and entertainment sector in 2023, displacing filmed entertainment, there is a fear now that in the forthcoming years, the rate of growth may slowdown, especially in the case of real-money gaming segment. As per the recent FICCI-EY report about 90 million gamers reportedly paid for online games

in 2023. Transaction-based game revenues increased by 21% to Rs 1,82,00 crore. The report further suggested that post the change in GST rules introduced from October 1, 2023, large online gaming companies absorbed the impact, and by cushioning the player, ensured growth rates were not significantly disturbed, though margins were. “In the case of smaller online gaming companies margins have shrunken to as much as 70-80%, while in the case of larger firms the reduction is between 40-50%,” said a senior executive of an online gaming company on the condition of anonymity.

The situation explained: Under the new tax regime, typically users are expected to pay 28% GST at the time of making a deposit their wallet. For instance, if a gamer deposits Rs 1,000, in her wallet then tax paid by the user should be Rs 280 and she should be left with Rs 720 in the wallet. However, some of the operators currently provide gamers with the credit by subsuming the GST amount, due to which users don’t feel any pinch in their pocket, so there is no impact on the playing behaviour.

Between FY18 and FY22, an aggregate of Rs 4,500 crore was generated by the Fantasy Sports industry as revenue to the exchequer. Of these, an approximate Rs 2,800 crore was contributed as GST, as per the FIFS and Deloitte report on Fantasy Sports. Given the intent of fantasy users is sports engagement, most retain the winnings on the platform and utilise them to enter more contests. As a result, it is estimated that the ratio of deposits to CEA is approximately 1:3 for the industry, that is every Re 1 of deposit generates Rs 3 of CEA.

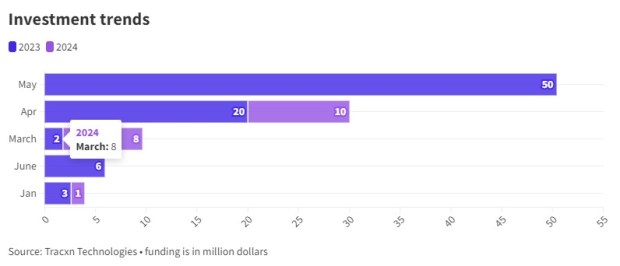

Meanwhile, investments have lowered significantly, when compared to last year. The online gaming industry raised funds worth $19.1 million between January-June this year, thereby reporting a decline of 76.3%, when compared with the same period, during the previous year, when it raised funds worth $80.7 million, reveals data from Tracxn, a data platform. “The online ecosystem was built with the entry of Flipkart which was similar to the model of Amazon. As a result, everyone including investors were familiar with that business model, which continued to attract investor funds. In the case of the online gaming industry with no clarity on regulation, and business models which are new, the current situation has made it difficult for investors to continue to fund, as they typically look at existing post the business matures at scale. With many tech careers invested in this new sector, we need to have absolute clarity now for further funding on a large scale,” Sreedhar Prasad, start-up advisor and former partner at KPMG, said.

Where is the growth?

Google’s decision to permit listing of skill-based real money games on its app store has widened the reach for many other games that charge participation fees, as per the FICCI-EY report. As per the report the segment is expected to grow at a CAGR of 21% to reach Rs 38,800 crore by 2026. The report further stated that the fastest growing segment would be in-app purchases at a CAGR of 27%, followed by fantasy sport (23%) and then rummy and poker (19%). Lastly, the share of RMG will be 83% of the total revenue. It is predicted that consolidation can be expected, as smaller, less profitable companies struggle to manage the implications of GST. Add to this, a much larger adverse impact is the growth of offshore betting platforms. “There is a big fear which looms among the home-grown gaming companies, is that if they pass on the GST to consumers, then users may choose to play on offshore betting platforms. These offshore players do not pay any kind of taxes yet have managed to accrue a substantial user base. This will cripple the industry further and will put users at risk,” said a senior analyst, who did not want to be named.

Offshore sports betting market receives an estimated Rs. 8,20,000 crore ($100 billion) per annum in deposits from India and has been clocking growth of 20% per annum in the last three years post the pandemic, as per a recent report by Think Change Forum (TCF), an independent think tank, ‘State of the Betting and Gambling Industry in India’. According to the report, at a baseline estimated deposits of Rs 8,20,000 crore ($100 billion), being received from India, at the current GST rate of 28%, India is losing a GST collection of Rs. 2,29,600 crore, per annum. In addition is TDS on player earnings which are estimated to be 90% of post GST deposits. This works out to another Rs 1,59,408 crores in taxes, making the total tax loss stand at Rs 3,89,008 crore.

The report further observed that under the new GST regime, despite best enforcement efforts, the illegal offshore betting industry will continue to grow at 20% at the least, leading to a tax loss figure of Rs 6,72,205 crore by 2026.

And it’s not just online gaming companies which continue to suffer, industry experts pointed out that the reduction in growth rate will also hamper job opportunities. As per the FIFS-Deloitte report, fantasy sports created 5,000 jobs in FY22, but as it now struggles to stay afloat, this number can drastically reduce in the future.