It began as a family remedy for post-COVID hairfall, prepared in a kitchen in Surat. But when an 84-year-old grandfather unexpectedly began regrowing hair after years of baldness, what started as a household experiment turned into the foundation of a company.

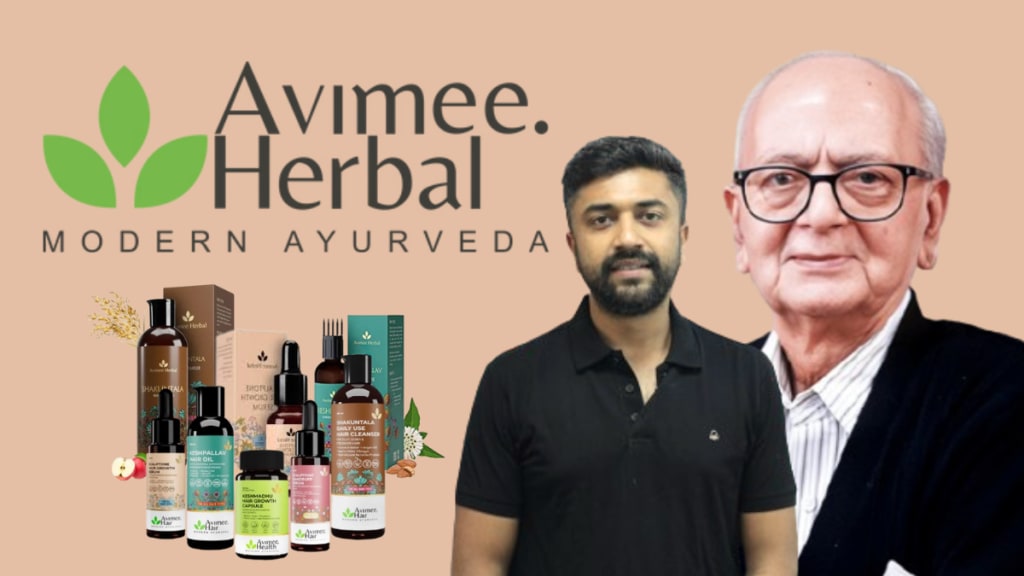

“In January 2021, Nanaji, who had been bald for nearly two decades due to genetic conditions, suddenly started growing hair at the age of 84,” recalled Siddharth Agarwal, co-founder of Avimee Herbal, in conversation with financialexpress.com. “At first I thought it was dandruff, but on closer look, we realised it was new hair. That was the turning point.” Three years later, Avimee ships over 15,000 units a day across India and operates from a 1 lakh sq. ft. facility in Surat. Its story, though, is as much about entrepreneurial serendipity as it is about supply chains and margins.

Branding out of love

The business began with Agarwal’s mother, Vinita, who experienced severe hairfall after recovering from COVID-19. Disappointed with remedies in the market, she turned to her father, RK Choudhary, fondly called “Nanaji”, who had spent over two decades researching ayurveda and homoeopathy on his own.

Nanaji created an oil using select herbs. The concoction was pungent enough for the house to smell “like a dump yard”, as Agarwal jokingly recalled, but the results proved effective. Vinita saw visible improvements, neighbours who tried it shared similar feedback, and soon the family decided to launch a brand. Nanaji named it Avimee, after his three daughters: Anita, Vinita, and Meenakshi. The initial sales came through Instagram, just a bottle or two a day.

When Instagram broke

Things changed after the family hired a social media manager and then, dissatisfied, took over content creation themselves. Agarwal’s wife, an influencer, posted a reel that unexpectedly went viral with more than 20 lakh views.

“From one or two orders a day, we jumped to 100–200,” Agarwal said.

Then came the tipping point. Humans of Bombay, without informing the family, posted Avimee’s story within days of each other. The result: 25,000 orders in two weeks. “We were nowhere close to being prepared,” Agarwal admitted. “It took us three months to fulfill them.” The delay triggered a flood of customer complaints, accusations of fraud, and even a cybercrime complaint in Kannur. Police arrived at their home. “One of them was bald. He came to take Nanaji away, but after hearing the story, he asked for the oil for himself,” Agarwal recounted. According to Agarwal, the company’s Instagram page was briefly taken down amid the chaos, but was reinstated once reviews began pouring in from satisfied customers.

Scaling up, building trust

From those turbulent months, the brand scaled deliberately. A 7,000 sq. ft. rented unit became their first factory; today, they operate from a 1 lakh sq. ft. facility. Avimee manufactures all products and even active ingredients in-house to maintain control over quality and efficacy.

“This is where we are different,” Agarwal said.“This is where we are different,” Agarwal said. “Most brands don’t make their products, and manufacturers cut corners. Take Redensyl, for example — it costs around Rs 70,000 to Rs 90,000 a kilo, and works effectively only at 5% concentration. But there’s no way for a consumer to test how much is actually being used in a finished product. Many brands will use just 1% and still claim benefits.” By contrast, Avimee began producing Redensyl in-house, at less than Rs 1,000 a kilo, by upcycling their base materials, Agarwal noted. “Because we make it ourselves, we can put the right quantity in and still stay affordable,” he said.

Financial Express looked into the tax audit reports shared by the company. The company’s turnover jumped from Rs 3.9 crore in FY22 to Rs 28.7 crore in FY23, and further to Rs 48.3 crore in FY24. That translates to a growth of nearly 635% between FY22 and FY23, followed by another 68% jump in FY24. Profitability has kept pace: net profit rose from Rs 1.57 crore in FY22 to Rs 12.1 crore in FY23, and Rs 14.1 crore in FY24.

The brand now sells five to six lakh bottles a month, which comes up to shipping around 15,000 units a day, with plans to expand capacity to 20 lakh by March 2026. About 38–40% of sales come from repeat customers, though Agarwal noted the percentage has dipped as new customers surge.

Credibility and competition

For consumers, pricing remains a sticking point: Avimee’s oils and serums sell for Rs 500–1,000, higher than many FMCG rivals. Agarwal insists transparency bridges that gap. “We’re not selling products, we’re selling trust. We show our factory, we share real before-and-after reviews, and customers often hear directly from us,” he said. That philosophy also shaped their marketing. “Earlier, influencers had credibility. Now people know many endorsements are scripted. We don’t pay influencers to claim results. We ask them to tell our story,” Agarwal explained.

The brand’s credibility also received a boost from its appearance on Shark Tank India. “In India, people associate anything on TV with trust. Shark Tank shortened our journey — what might have taken us three years, we reached in one,” he said.

Financially, Avimee remains bootstrapped and profitable, with EBITDA margins of around 15%, while allocating about a third of expenses to marketing. Agarwal considers hair transplants — not rival brands, as their real competition, noting that their treatments cost a fraction of surgical alternatives.

As far as the online reviews are concerned, Avimee’s products, particularly its hair oils, have garnered largely positive feedback, though with some caveats. Many users say the Keshpallav and Amla oils helped reduce hair fall, improve growth, and enhance texture within weeks of consistent use, with the natural, chemical-free formulation often highlighted as a key draw. However, a section of customers has pointed to changes in formulations, variations across batches, and the need for continued use to sustain benefits. Pricing and delivery delays during high-demand periods have also been flagged. That said, experiences with personal care products tend to be highly individual, and such reviews remain inherently subjective.

A business rooted in belief

Most of Avimee’s customers come from tier-1 cities across north, west, and south India, though tier-2 demand is growing. Serums now outsell oils, reflecting younger consumers’ preferences. Yet, despite scale and shifting market dynamics, Agarwal circles back to the same ethos. “Our funnel begins with hope,” he said. “Customers come to us after losing faith in other remedies. What we try to give them is the belief that their hair can grow back.” And for proof, he points back to the family kitchen and a moment in January 2021, when his 84-year-old grandfather surprised everyone by sprouting new hair.