The Reserve Bank of India (RBI) expects daily Unified Payments Interface (UPI) transactions to reach the milestone of a billion in the next few months, from 500 million transactions per day at present, said governor Shaktikanta Das.

At a panel discussion during Group of Thirty’s Annual International Banking Seminar in Washington, DC on Saturday, Das said the RBI will not rush to announce a nationwide rollout of the central bank of digital currency (CBDC), as it aims to conduct thorough trials and be fully confident about its design, robustness and security before considering broader implementation.

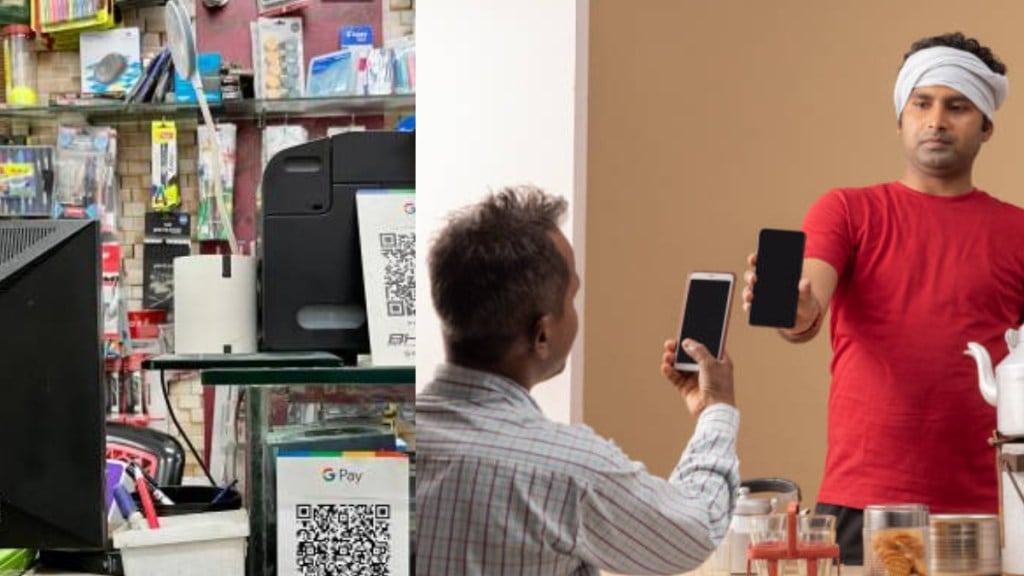

“UPI has brought in high efficiency into the payments system. Today, the number of transactions that takes place in UPI per day is about 500 million,” said Das. “We are trying to step it up further and the idea is to reach a billion transactions, may be in the next few months.”

The average daily transaction count crossed 500 million in September, up from 483 million in August, according to the National Payments Corporation of India data. In September 2024, UPI processed 15.04 billion transactions, valued at Rs 20.64 lakh crore.

The RBI is taking steps to link UPI with payment systems of more countries. “UPI has actually got a lot of potential for cross-border payments. We have also taken the initiative of linking the UPI of India with the fast payment systems of other countries,” Das said.

UPI is now available in seven countries – France, the UAE, Singapore, Bhutan, Sri Lanka, Mauritius and Nepal.

On e-rupee, the governor said the RBI will take a measured approach to a nationwide rollout of the CBDC. The most significant potential of the CBDC lies in cross-border payments. By eliminating multiple intermediaries, CBDC can facilitate low-cost, fast and instant cross-border money transfers.

The RBI launched the pilot phase of its first CBDC for wholesale transactions of government securities on November 1, 2022, followed by the pilot for retail transactions a month later, on December 1.