Indian banks may have weathered the pandemic with high capital buffers and improved quality of assets, but going forward, they face a highly uncertain outlook, the Reserve Bank of India (RBI) said in its Trend and Progress of Banking in India 2021-22 report on Tuesday.

The main concerns are global headwinds brewing on account of continuing geopolitical tensions, tighter monetary and liquidity conditions and potential adverse spillover effects on profitability and asset quality.

“With global growth set to deteriorate in 2022 and with rising prospects of a recession in 2023, credit growth could pro-cyclically decelerate across major economies which, in turn, could shrink bank profitability,” the report said.

The RBI’s other concerns are the wider adoption of technology in the financial system amid a new wave of innovations and climate change risks posing new challenges for financial stability that would require risk-mitigating regulatory and supervisory actions.

The apex bank’s commentary comes on the back of a 10-year high credit growth in FY22 and a double-digit growth in the consolidated balance sheet of scheduled commercial banks after a gap of 7 years. However, household financial saving rates declined to a 5-year low in FY22, which was also reflected in subdued deposit growth

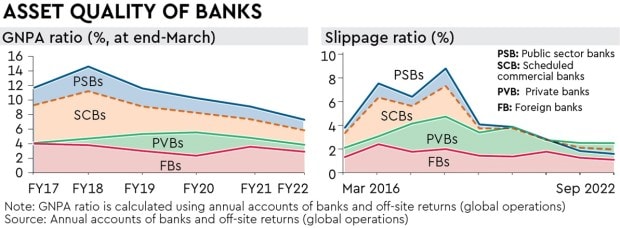

“Enhanced credit monitoring processes, coupled with portfolio diversification, helped arrest slippages and strengthened their balance sheets. Accordingly, the profitability of banks, improved to levels last observed in FY15,” the central bank said.

On the corporate side, working capital and term loans, which were decelerating since 2019, showed steady growth during FY22. Around 75% of incremental credit during the year was in the form of term loans. The higher credit growth was accompanied by lower slippages and a strengthening of the capital buffers of the banks.

The ratio of standard assets, which were restructured, improved to 110 bps (basis points) from 30 bps in FY22. The improvement in the standard restructured asset ratio was likely on account of the new resolution framework aimed at retail and MSME loans during the pandemic period, the RBI said.

“Going forward, it is imperative that banks ensure due diligence and robust credit appraisal to limit credit risk…If downside risks materialise, asset quality could be affected,” the RBI report added.

On the resolution of stressed assets, banks have multiple channels such as Sarfesi, insolvency and sale to asset reconstruction companies (ARC). Post the pandemic, the incidences of referring the cases to debt recovery and IBC increased significantly. The admission of cases under the IBC increased by 65% in FY22 while cases referred under Sarfesi increased by 335% during the year. However, the amount under IBC rose to a whopping `1.99 trillion from `1.35 trillion in FY21 – a jump of 47%.

With the success of Unified Payments Interface (UPI) and mass adoption of digital banking services, various concerns such as engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, exorbitant interest rates, and unethical recovery practices have emerged, the RBI said, adding that the lenders need to develop appropriate business strategies, strengthen their governance framework and implement cybersecurity measures to mitigate these concerns.