By Rohit Taneja

In 1920, Arthur Pigou developed the concept of externalities, which suggested that every transaction between two parties has consequences for people not part of the transaction. The greater the magnitude of these consequences, the greater the market failure. If a transaction has more significant positive externalities, markets would underinvest in the space and vice versa. This concept is still apt to explain India’s Know Your Customer (KYC) problems a century later.

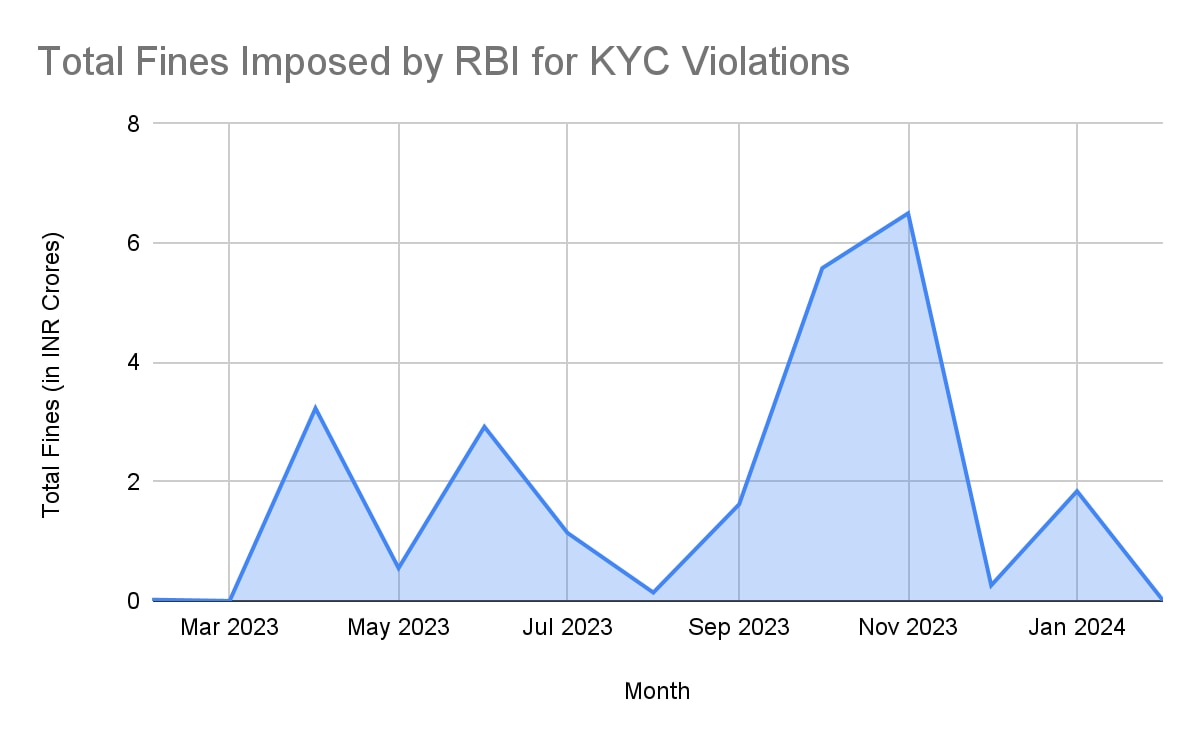

In the last few weeks, the RBI has asked VISA and Mastercard to stop supporting B2B transactions on corporate credit cards, citing concerns over inadequate KYC and violation of the payment system operation guidelines. What is often missed in the media flurry is that KYC has been a problem for quite some time now, and it is one of the most significant ironies of India’s fintech ecosystem. Since February 2023, the Reserve Bank of India (RBI) has collected INR 23.8 crores as fines for KYC violations across different financial institutions. This is despite India being one of the world’s most innovative financial technology ecosystems with the highest fintech adoption rate. Hence, it is fair to ask why financial institutions do not follow the fundamental norms of KYC in an innovative ecosystem like India.

The answer is simple: KYC is a norm with significant positive externalities. A system with robust KYC benefits the users of financial services and the larger society by reducing fraud and money laundering cases. This has created a trade-off for financial institutions and business entities between clocking in high and fast growth or spending more time and money to enhance compliance with an eye on long-term growth.

Also read: EXPLAINER: Uniform KYC to simplify customer onboarding

As in every well-regulated economy, non-compliance costs must be paid eventually. Financial services companies are now spending millions to ensure compliance is adhered to. However, the Big Indian KYC Problem can only be solved through a systemic change in how we do compliance in the country, and it needs a three-pronged approach.

Strengthening Public Systems

Compliance cannot come at the cost of growth for financial services companies in India. With a sizable underserved market, the development of financial services is inevitable, but to achieve this growth sustainably, we need to strengthen public systems that can enhance compliance through technology. An example of this already exists in the form of Digi Yatra. With the help of a private player, the government created a system that authenticated your identity and made entry into airports seamless and quicker. Building on this model, Digilocker can become the one-stop shop for KYC and be the best way forward. Uploading documents onto Digilocker can be tweaked so that users can do their complete KYC on the app, which financial institutions can then integrate into their systems. This will make the KYC process faster and more robust.

Adopting AI

Global banks have been using AI for anti-money laundering efforts since 2019, achieving an accuracy of up to 95%. While the RBI is experimenting with AI regtech solutions for effective regulations, these solutions can only be as good as the data fed to them. Coupling AI programs with an expanded Digilocker can be a possible solution to create a more robust regulatory framework for India. Industry players can find synergies with the government and public bodies to build such a framework. Government can come in with the extensive data that they collect and industry players can come in with strong analytics capabilities to create an AI framework that can counter anti-money laundering and conduct better KYC.

Adaptive Regulations

With granular data and robust AI programs, the ecosystem can move from a rule-based regulatory framework on KYC to a more incentive-based one. The regulator has done this by creating an extensive loan database called CRILC and forcing banks to declare bad assets as NPAs; this led the banks to recognize the problem as a problem and fix it systematically. Similar steps need to be taken to solve the KYC problem, and the industry can help greatly. The RBI and the industry players can build a fraud and AML exchange among different financial institutions, which everyone shares. Such exchanges can be experimented first in the RBI regulatory sandbox and then deployed to the more significant industry. With such reputational pressure, financial institutions will be incentivized to strengthen their compliance mechanisms, benefiting the system as a whole.

It is now time to invest in systems change for the KYC problem. The band-aid solutions era is over, and a more systematic approach is needed. It is the era of a sustainable financial system built on the fundamentals of a robust and compliant KYC journey.

(The author is Founder & CEO, Decentro. View expressed are personal and not necessarily those of financialexpress.com.)