By Dr Sarika Rachuri and Dr Badri Narayanan

Every year, the finance minister presents a Union budget, which is not only a fiscal arithmetic but also a powerful and potent tool to allocate scarce resources to different sectors. It influences the different vectors of aggregate demand: Consumption, Investment, Government Expenditure, and Net Exports. The implicit and underpinning outcome of the union budget which is often not articulated is a default choice architecture of these public policies, that it creates for the public. All public policies provide a nudge in banning undesirable outcomes, (huge tax incidence on cigarettes) while promoting desirable ones (incentivising savings), channelising investments for underdeveloped regions, or even to promote balanced growth. One of the central themes of public finance and union budget is its ability to save and invest. Taxation plays a defining role in people’s ability and inclination to save and invest.

Tax Provisions

From time to time various tax provisions first enunciated in the budget, have provided tax rebates and exemption to the public. Section 88 allowed individuals to claim tax under PPF, NSC, life insurance premiums, Infrastructure bonds, and the like. This was supplemented by Section 80C, which expanded more options for the public to invest. Section 80C was the proverbial nudge to consumers to increase propensity to save and invest.

A tax prayer could claim exemption until Rs. 1.5 lakhs. There has been a steady rise in the number of tax payers from 2.69 crores in 2005-06 to 3.36 crores in 2013 to 6.77 crores on 31 July 2023, and many of these tax payers have enjoyed exemptions. Further, Income Tax provisions also helped tax payers to avail deductions for interest on home loans. Section 80EEA of theIncome Tax Act, 1961, came into effect from April 1, 2020. It allows a deduction for interest on a loan taken for specific house property. The Indian government provides tax benefits on home loans, primarily through deductions on the principal repayment and interest payment components. These tax incentives reduce the overall cost of homeownership, making it more affordable to borrowers.

Fig 1: Tax deductions allowed for home ownership

| Section 80C | Tax Deduction on Principal Repayment | Up to Rs.1,50,000 |

| Section 24B | Tax Deduction on Interest Paid | Up to Rs.2,00,000 |

According to Reserve Bank’s data, credit outstanding to the housing sector, primarily comprising home loans, has increased significantly by Rs 10 lakh crore during the last two years to a staggering Rs 27.22 lakh crore as of March 2024, marking a noteworthy rise from Rs 17.26 lakh crore recorded at the end of March 2022.

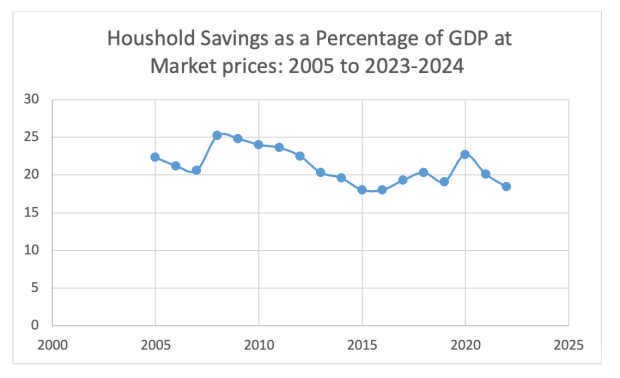

Fig 2: Household private savings as percentage of GDP

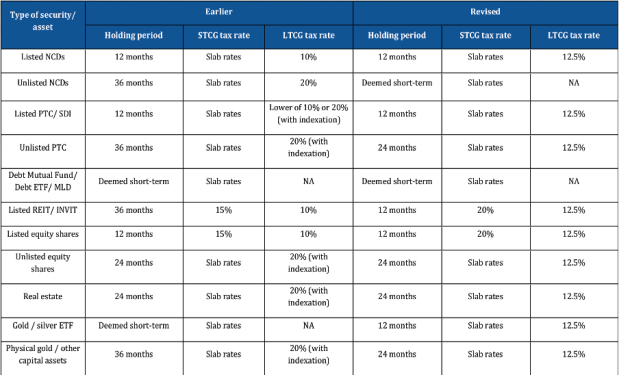

The July 2024 budget has changed all that. It has removed the indexation benefit available to asset classes like real estate and brought down the capital gains tax to 12.5% from the 20% with indexation available earlier.

Fig 3: New Tax treatment

This has ignited a debate on the purpose behind the government’s move, and its impact.

Impact of LTCG

A BankBazaar study used RBI’s House Price Index data for 10 major cities and found out that LTCG taxes on an average, increases 2.9 times without the indexation benefit. This study is based on RBI’s House Price Index (2011-2024) and the Cost Inflation Index. This report showed that without indexation, the long-term capital gains taxes rise significantly for all holding periods. The simulated holding periods for LTCG calculations in the study, range from 2 years to 13 years ending in March 2024. The report also shows that longer holding periods correlate with higher taxes with or without indexation. With indexation, the taxes are comparatively higher.

Also read: The case for international healthcare corridors

Another finding of the report is that the average indexed tax on LTCG in these 13 years (2010-2023) is 3.90. The report also shows that this average non-indexed tax rises 2.90 times to 11.34, implying additional taxes of 7.44. The report suggests that all taxes with indexation were 0 from 2016-17 whereas without indexation, the taxes rose considerably with values of 3.02 to 8.70. The report shows that because of indexation, there is no long-term capital gains from 2016-17. These seven years show long-term capital losses. Therefore, despite the 20 percent tax rate, the investor’s tax liability would be zero in these years. However, without indexation, there are huge leaps in the LTCG for all years including from 2016-17.

Impact on Savings

An NIPFP study estimates the effect of being in a taxable income bracket on the probability of having investments in specific financial products. They do this by examining portfolio formation using the CMIE Consumer Pyramids Household Survey Data for 2016–173. They find that the probability of investments in tax-favoured financial products is higher for households that are taxed. A disaggregated analysis of salaried households suggests that the tax-incentivised impact on saving is highest for salaried households in the income bracket of Rs 350,000 to Rs 500,000.

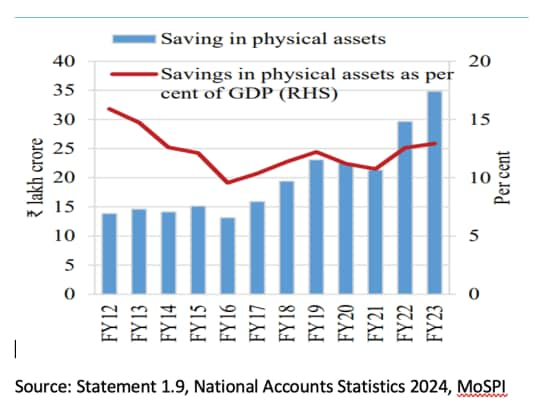

For households not subject to tax liability, household characteristics drive the probability of investments in insurance products. Thus, while aggregate financial saving has remained stable, tax breaks have been influential in driving savings into specific products, such as insurance and pensions. Till recently, physical savings of households were increasing. Now, with this new change in Long Term Capital Gains, there will be an impact.

Fig 4: Savings in physical assets

An appraisal of a capital gains tax includes particularly its effect on investment. Investment is one of the most important variables in economic development, and capital gains taxation is directly related to the supply of savings, the composition of investments, and the mobility of capital.

Conclusion

The union budget in the last few decades has played a defining role in providing through its provisions a discernible nudge to build public savings, the tax incentives due to savings have been provided across all asset classes, the PPF savings which are tax exempt indirectly support the bond markets, since a great chunk goes in investment in government securities. Other tax provisions have given tax exemptions in Equity-linked schemes. ULIPs are a dual instrument to help to insure and save. In few years reality sector got a boost, where money from the sale of property was incentivised to be invested back in the realty sector. Exempting interest on housing loans from taxation, and provision of tax treatment of repaying principal amount to be included for tax exemption. All this has helped real estate as an asset class to grow.

The history of incentivising savings, has since decades inculcated the habit of thrift among middle-class and lower-middle-class Indians. This has been the anchor and nest egg for the working-class population of India. Unlike the developed world, there exists no social security mechanism to buffer the middle class and poor. At best by incentivising savings the government nudged and encouraged the propensity to save. However, the new tax provision provides no such incentives. A demographic dividend where a large population is entering the workforce, will be left with no nudge to save is a failing indeed.

(The authors: Dr. Rachuri is a faculty member at ICFAI Business School, Mumbai and Dr. Badri Narayanan is a Fellow, NITI Aayog. Views are personal and not necessarily those of financialexpress.com)