Budget 2024: Union Finance Minister Nirmala Sitharaman on Wednesday spoke on the Union Budget in the Rajya Sabha. In her record-breaking seventh budget, Finance Minister Nirmala Sitharaman unveiled new economic roadmap of Modi 3.0 in the Lok Sabha on July 23. While presenting the Union Budget 2024, Sitharaman said that the Modi government will focus more on middle class and youth of the country. From abolishing angel tax in a massive boost for the startup ecosystem to revising new tax regime structure, Sitharaman announced a slew of schemes.

Shashi Kiran Shetty, Founder and Chairman, Allcargo Group, says, "By maintaining capital expenditure momentum in infrastructure development, focusing on education, employment, and skill development, and charting the roadmap for energy transition and security pathway, the budget has further strengthened the foundation for Viksit Bharat @2047 whilst staying on the strong fiscal glide path. The budget reinforces the government’s vision for transformative reforms and inclusive growth while maintaining a sharp focus on economic stability. The improved infrastructure will give the logistics industry the edge in the global landscape in terms of efficiency to contain the cost within 8% of GDP."

Anand Mahindra, Chairman of Mahindra Group, says, "The most important element of yesterday’s budget was strong evidence that the Government recognises this to be its most important mission."

We are the envy of the world in terms of our growth in GDP.

— anand mahindra (@anandmahindra) July 24, 2024

We are the preferred destination of the world for investment because of the belief in our future.

But the vital task ahead for us is to ensure that this growth is now accompanied by an explosion in job-creation.… pic.twitter.com/Z73BKJwWR1

Naveen Rathore (Head- Access Network & Strategic Projects, Atlantis Intelligence), says, "At Atlantis Intelligence, we commend the Union Budget 2024-25 for its strong support of the telecom sector. The substantial investment in 5G infrastructure and rural digital connectivity is commendable.

We particularly appreciate the emphasis on domestic manufacturing and propose increasing the BCD on PCBA of specified telecom equipment from 10% to 15%. The budget’s focus on R&D, support for startups, regulatory reforms, and cybersecurity will drive innovation and enhance network security.

These measures, along with initiatives for digital literacy and inclusion, promise a more connected and inclusive India. Atlantis Intelligence is excited about these developments and eager to contribute to their success."

Shantanu Bhargava, Managing Director, Head of Discretionary Investment Services, Waterfield Advisors, says, "Further tax simplification introduced in this year’s union budget further levels the playing field for other asset classes such as unlisted shares, gold, international equity/debt FoF, and real estate. We continue to believe that portfolios should be tax-informed, not tax-driven, and the finance minister's action is a positive step in that direction. At the industry level, we have observed that in the last 15 months, a large swathe of investors has made tax-driven portfolio allocations, in which they have allocated to riskier products due to changes in taxation of vanilla debt mutual funds, possibly, without carefully assessing and understanding the risks (market/credit) they have assumed in their portfolios by including such riskier products. Everything is fine in moderation, and we are confident that innovative products have a role to play in well-diversified portfolios; however, we continue to believe that portfolios should be tax informed, not tax driven.

The government has clearly been walking on the path to simplify the income tax system for some time, and the finance minister has made significant progress in this regard in this budget. The capital gains tax structure has been simplified, the dreaded angel tax has been eliminated, and there is a simplification of the withholding tax.

Given the weaker political mandate, there was widespread anticipation that the government would bite the populism bullet in this budget for pragmatic political reasons. However, the administration maintains the resolve seen in the interim budget, demonstrating impressive restraint by prioritizing fiscal prudence and broad policy continuity in areas such as capex and supply-side capacity creation."

"This Budget is discriminatory and unfair. BJP's saying that they allotted special package to Bihar to build roads but roads are built anyway. All of this is deceptive," says Congress chief Mallikarjun Kharge.

VIDEO | "This Budget is discriminatory and unfair. They (BJP) are saying that they allotted special package to Bihar to build roads but roads are built anyway. All of this is deceptive," says Congress chief Mallikarjun Kharge (@kharge) as INDIA bloc MPs protest over… pic.twitter.com/39290NfATm

— Press Trust of India (@PTI_News) July 24, 2024

Choas ensued in the House as Finance Minister Nirmala Sitharaman spoke on Union Budget in the Rajya Sabha. Trinamool Congress (TMC) Rajya Sabha MPs from West Bengal said that the state received "unfair" treatment in the Budget.

To watch the live updates of the Union Budget, one can see it in Doordarshan and Sansad TV. You can also watch it on the YouTube channel of Sansad Rajya Sabha TV. Read more.

A day after presenting the Union Budget in 2024 in the Lok Sabha, Finance Minister Nirmala Sitharaman is speaking in the Rajya Sabha on Wednesday.

Congress leader Manickam Tagore criticised the Budget 2024, describing it as discriminatory and unfair towards states that are suffering. He highlighted instances where states like Tamil Nadu, Telangana, and Himachal Pradesh did not receive adequate relief despite facing challenges such as floods. Tagore accused the budget of favouring BJP-ruled states, labelling it a 'Kursi-bachao Budget' aimed at securing the government's position rather than addressing the needs of the people.

He also expressed concerns over cuts in funds for schemes like NRGS, education, and education loans, predicting hardship for the middle class and asserting that the government has betrayed its promises to the people.

The government allocated Rs 6.22 lakh crore for defence spending in the fiscal year 2024-25, with Rs 1.72 lakh crore designated for military capital expenditures, primarily for acquiring new weapons, aircraft, warships, and other hardware.

Congress leader KC Venugopal said that the Centre has violated the principles to keep the federal system. "The Budget's aim was to protect the govt. Many sops were given to Bihar and Andhra Pradesh. We are not against giving money to them, but other states should also get justice. This Budget is also not a good Budget. That is why we are agitating. Our CMs will not attend the Niti Aayog meeting. We will participate in Budget discussion," he says.

JMM MP Mahua Maji says this is a discriminatory Budget as there has been a discrimination towards states that are not ruled by BJP government.

VIDEO | Union Budget 2024: "This is a discriminatory Budget. This Budget has only been allocated to protect their thrown. This was an effort to make the heads of Bihar and Andhra Pradesh happy. There is a lot of discrimination towards states that are not ruled by BJP government,"… pic.twitter.com/hZnhBuS9Dq

— Press Trust of India (@PTI_News) July 24, 2024

Revenue Secretary Sanjay Malhotra has said that the changes in capital gains taxes aim to simplify tax rates for better understanding among the public. "Our goal is to ensure simplicity and fairness," Malhotra told ANI in response to the announcements made.

In her Union Budget presentation, Finance Minister Nirmala Sitharaman announced that short-term gains on specific financial assets would be taxed at a rate of 20%, while other financial and non-financial assets would continue to be taxed at their existing rates. Additionally, she proposed a uniform long-term capital gains tax rate of 12.5% on all financial and non-financial assets. To benefit lower and middle-income groups, she suggested raising the annual exemption limit for capital gains on certain financial assets from Rs 1 lakh to Rs 1.25 lakh.

A day post budget announcement, Indian stock markets opened slightly lower today, with investor sentiment still subdued following the government's decision to increase taxes on equity investment gains. As of 9:15 AM, the NSE Nifty 50 declined by 0.14% to reach 24,444.95, while the S&P BSE Sensex dropped by 0.11% to 80,343.38.

Goa Chief Minister Pramod Sawant praised the Union Budget, emphasizing its broad focus across various sectors. He described it as a "pro-budget" that addressed the needs of villages, the poor, and the industrial sector alike. Speaking to the media on Tuesday, Sawant highlighted significant allocations towards defence, rural development, agriculture, education, IT, health, energy, software, commerce, and industry. He expressed confidence that these provisions would particularly benefit Goa, ensuring maximum advantages from the Budget's measures.

The US India Strategic and Partnership Forum (USISPF) praised a big change that was announced in the Union budget on Tuesday: removing the angel tax for all types of investors. This change is seen as a significant step as it is bound to benefit help India's startup companies a lot. USISPF said India has lots of engineering and tech talent, but there have been gaps in the innovation system in the past. By getting rid of the angel tax for everyone, the government wants to encourage more money for startups from both Indian and foreign investors, the forum said. It added this change should lead to more investment in India's growing startup industry.

Share market today is indicating a weak start. Traders weren't really excited by the federal budget announced the previous day, so they may likely fall back on other factors to guide their trading decisions.

The USA India Chamber of Commerce commented on Tuesday that the forward-looking budget presented by Union Finance Minister Nirmala Sitharaman aims to achieve the vision of 'Viksit Bharat' by increasing expenditure to create additional jobs and stimulate economic growth. They emphasized that the budget sets the economy on a sustainable growth trajectory by focusing on upskilling and reducing unemployment.

To enhance local manufacturing value addition, the government has allocated Rs 6,903 crore for semiconductor projects and reduced duties on raw materials for electronic components. As per the budget details, Rs 4,203 crore is designated for initiatives under a revised scheme aimed at establishing compound, discrete semiconductor manufacturing, and assembly units within India. Additionally, the Union Budget includes Rs 1,500 crore for electronic chip plants, Rs 100 crore for electronic displays, and Rs 900 crore for the modernization of the Semi-Conductor Laboratory in Mohali.

Industry leaders expressed their approval of the Union Budget's defence outlay of Rs 6.22 lakh crore, with some describing it as a "landmark allocation." They highlighted that the budget's outlined initiatives collectively represent a "robust blueprint" for India's forward-looking and inclusive development.

Ashish Saraf, Vice President and Country Director at Thales in India, commended the government and Finance Minister Nirmala Sitharaman for the substantial defence allocation in the 2024-25 budget, emphasizing its reflection of a firm dedication to national security and technological progress.

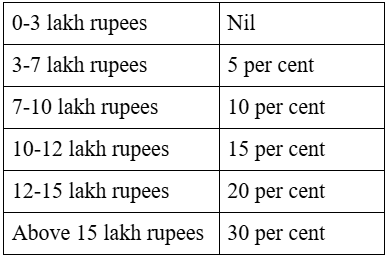

The Indian government concentrated on modifying aspects of the new tax system while leaving the existing one unchanged. Key updates include:

Following Union Finance Minister Nirmala Sitharaman's significant announcements for Bihar, Deputy Chief Minister Vijay Kumar Sinha commended the central government's decision, calling it a major step forward for the state's development.

"The Centre has taken a substantial step for the progress of Bihar. Various schemes have been announced for the welfare of the poor, farmers, youth, and women. This budget lays the foundation for the creation of a 'Viksit Bharat' and a 'Viksit Bihar'," said Sinha on Tuesday.

In a significant push to enhance local value addition in manufacturing, the government has allocated Rs 6,903 crore for semiconductor initiatives and reduced duties on raw materials used in electronic components.

The budget document reveals a plan to invest Rs 4,203 crore in establishing compound and discrete semiconductor manufacturing and assembly units across the country. Additionally, Rs 1,500 crore is earmarked for electronic chip plants, Rs 100 crore for electronic displays, and Rs 900 crore for modernizing the Semi-Conductor Laboratory in Mohali.

To support these initiatives, the budget proposes amending the First Schedule of the Customs Tariff Act, 1975, to introduce new tariff lines for products related to Indian semiconductor machinery, e-bicycles, and printer cartridges, effective October 1.

Finance Minister Nirmala Sitharaman also announced tax reductions on certain electronic parts and raw materials crucial for component manufacturing. “To boost value addition in the domestic electronics industry, I propose removing the BCD, subject to conditions, on oxygen-free copper for resistor manufacturing. I also propose exemptions for specific parts used in connector production,” Sitharaman stated.

Furthermore, the finance minister exempted 25 essential minerals, including lithium, copper, cobalt, and rare earth elements, which are vital for sectors such as nuclear and renewable energy, space, defense, telecommunications, and high-tech electronics.

In a move to bolster higher education, the budget has allocated ₹47,619 crore to the Ministry of Education's higher education sector, marking an 8% increase from the previous year.

The budget for the University Grants Commission (UGC) is divided into three key areas: UGC, Central Universities, and Deemed Universities. For the fiscal year 2024-25, funding for colleges affiliated with Central Universities will be shifted from the UGC Budget to the Central Universities Budget. This adjustment will raise the Central Universities Budget from ₹11,612 crore to ₹15,928 crore, while the UGC Budget will see a reduction.

Additionally, funding for Deemed Universities supported by the Central Government will rise from ₹500 crore to ₹596 crore. Overall, the UGC budget will increase from ₹17,473 crore to ₹19,024 crore, representing a 9% boost from the previous fiscal year.

In the Union Budget 2024-25, the Archaeological Survey of India (ASI) has been allocated ₹1,273.91 crore, an increase from the previous budget’s ₹1,131.08 crore.

With a legacy of over 160 years, the ASI is responsible for the protection, preservation, and conservation of centrally protected monuments and sites. The agency oversees 3,697 ancient monuments and archaeological sites.

The ASI, along with the Ministry of Culture, is hosting the 46th session of the World Heritage Committee at the Bharat Mandapam in Delhi from July 21-31.

Union Finance Minister Nirmala Sitharaman highlighted the government's focus on both development ("vikas") and heritage ("virasat") as key elements of the country's growth strategy in her Budget speech.

In a major boost for Andhra Pradesh, Finance Minister Nirmala Sitharaman announced a ₹15,000-crore allocation for the development of the state capital, Amaravati, on Tuesday. Additionally, she pledged to expedite the Polavaram Irrigation Project.

Chief Minister Chandrababu Naidu, whose party, the TDP, is a key ally of the National Democratic Alliance, has been urging the Centre to address long-standing commitments under the Andhra Pradesh Reorganization Act. Despite a decade since bifurcation, the state has yet to establish a capital city.

Sitharaman emphasized that the government is making dedicated efforts to meet these commitments, recognizing the urgent need for a capital. The allocated funds will be provided through multilateral development agencies this fiscal year, with promises of further support in the future.

The finance minister also highlighted the importance of the Polavaram Irrigation Project, calling it "the lifeline for Andhra Pradesh and its farmers" and linking its completion to national food security.

On Tuesday, the government announced the removal of the 2% equalization levy on overseas e-commerce transactions. This digital tax, which applied to the consideration received for e-commerce supplies of goods or services, will no longer be in effect starting August 1, 2024.

Finance Minister Nirmala Sitharaman explained that this decision aligns with ongoing negotiations on the Pillar 1 and Pillar 2 global tax framework. Pillar 1 focuses on reallocating additional profits to market jurisdictions, while Pillar 2 addresses a global minimum tax and subject-to-tax rule. The global minimum tax of 15% will be implemented next year, with almost 90% of MNCs with revenues exceeding 750 million euros being affected by 2025, as reported by the OECD to the G20 finance ministers last July.

In addition to this change, Sitharaman’s budget presentation included a hike in the standard deduction for salaried employees to ₹75,000 from ₹50,000 under the new income tax regime for FY25. The deduction limit for employers' contributions to the National Pension System (NPS) was also increased from 10% to 14%.

The budgetary allocation for the Ministry of Minority Affairs has been increased by ₹574.31 crore to ₹3,183.24 crore for 2024-25, up from the revised estimate of ₹2,608.93 crore in 2023-24. This marks a rise from the previous year's allocation of ₹3,097.60 crore.

Union Finance Minister Nirmala Sitharaman, in her seventh consecutive budget presentation—surpassing the record of former Prime Minister Morarji Desai—introduced the budget for 2024-25, the first under Prime Minister Narendra Modi's third term.

The new budget estimates allocate ₹1,575.72 crore for education empowerment within the Ministry of Minority Affairs. Specific allocations include ₹326.16 crore for Pre-Matric Scholarships and ₹1,145.38 crore for Post-Matric Scholarships for minorities.

Additionally, ₹2,120.72 crore has been set aside for major schemes and projects of the ministry, with ₹910.90 crore allocated to the 'Pradhan Mantri Jan Vikas Karyakram,' one of the ministry’s key programs.

FMCG industry leaders believe that the Union Budget will boost consumption, particularly in rural areas, thanks to its focus on agricultural schemes and rural development. HUL CEO and MD Rohit Jawa described the budget measures as "positive," noting that increased investment in infrastructure will have a multi-year impact and stimulate consumption.

During an earnings call on Tuesday, Jawa commented on the new announcements, highlighting the increased investment in rural development, support for urban poor, and schemes for youth and employment, especially in skills development. He emphasized that these measures are beneficial for businesses serving consumers, as they will encourage higher consumer spending and drive economic growth.

Parle Products Vice President of Marketing Mayank Shah also expressed optimism, stating that the budget's initiatives will significantly contribute to both infrastructure development and investment in the agriculture sector, thereby generating increased demand.

(With PTI inputs)