Good news for taxpayers! In her Budget 2025 speech on Saturday, Finance Minister Nirmala Sitharaman announced that under the new tax regime, income up to ₹12 lakh will now be tax-free as against income up to ₹7 lakh earlier. The move has come as a big relief for taxpayers, especially the middle class, as this will significantly reduce the financial burden on this income group which earlier expected the budget to provide significant tax relief to ease financial pressures caused by inflation and rising costs.

This bold move enhances disposable income, encourages spending, and promotes economic growth. By simplifying taxation and easing compliance, the government reinforces its commitment to a taxpayer-friendly system.

“This reform not only benefits salaried individuals but also supports businesses and investments, driving overall prosperity. With a focus on financial empowerment and ease of living, this tax relief is a major step toward a more inclusive and growth-oriented economy,” said Adhil Shetty, CEO of Bankbazaar.com.

According to Shetty, now with the standard deduction of ₹75,000, your tax-free income can potentially reach ₹12.75 lakh. This provides significant relief for middle-income earners, as it effectively increases the threshold for tax-free earnings.

However, don’t get too excited about it as there is a catch!

For example, if you are a salaried person and your annual gross income is up to ₹12.75 lakh, you pay no tax, thanks to the standard deduction. However, if your income exceeds ₹12.75 lakh, your income will be taxed. Also, those who are not eligible for this deduction—primarily due to it being available only to salaried individuals and pensioners—will be taxed if their income exceeds ₹12 lakh.

“Such income will be taxed according to the newly-revised tax slabs under the new tax regime. This ensures a progressive and simplified tax structure for all taxpayers,” added Shetty.

For instance, if your income is ₹12,00,001, the tax would be ₹62,400 based on the applicable slabs.

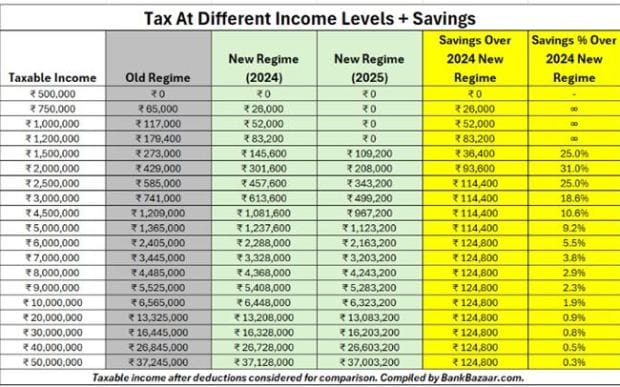

Preeti Sharma, Partner at Tax & Regulatory Services, BDO India, stated, “The changes in tax slab rates under the New Tax Regime will provide tax savings for all classes of taxpayers. The minimum income threshold for taxation has been raised from Rs 3 lakh to Rs 4 lakh. Additionally, the 30% tax rate will now apply to incomes above Rs 24 lakh, increased from the previous threshold of Rs 15 lakh.”