By Aditya Modani

The Finance Minister was conscious that this is an interim budget and as per convention, the tax proposals shall be presented in the regular budget. However, the Finance Minister acknowledging the benefits achieved from tax reforms implemented by this Government in the past four years and to provide certainty and to pass on the benefits to the middle-class, pensioners and senior citizen taxpayers, did not fall short of announcing several tax proposals for them.

Though no changes are proposed to the basic exemption limit and tax rates, individual tax payer who has only salary income of INR 825,000 will not pay any taxes (table below), if the proposal of the Finance Minister to allow for a rebate of INR 12,500 and increase in standard deduction by INR 10,000 is approved by both the house of the Parliament and the President of the India.

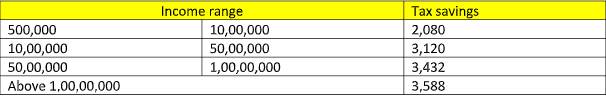

The changes proposed shall also result in tax savings for other income groups as well who are not eligible for the proposed increase in rebate as under:

Images are powered by EY

The Finance Minister also recognized the perils of imputing notional rent on second residential house left vacant by taxpayer due to employment and family reasons and thereby relaxed the rule of imputing a notional rental value for the second house as well. This will provide much-needed relief to the taxpayers who have got two residential houses, which cannot be occupied to various reasons.

To provide impetus to the housing sector, the Finance Minister has proposed to allow exemption of capital gains earned on sale of residential house if it is invested in two residential houses, instead of one as currently provided in the Income-tax Act. The aforesaid exemption is available to a taxpayer once and only applicable when capital gains are below INR 2 Crores. Similarly, the tax holiday available to taxpayers who execute housing projects has been extended by one more year and exemption of 2 years has been provided from levy of tax on notional rent, on unsold inventory of houses from the end of year in which project is completed.

The Government focus and vision on digital is truly being felt in the tax reforms being undertaken, wherein it is proposed that within the next two years, almost all verification and scrutiny assessment of tax returns will be done electronically through anonymised back office, managed by tax experts and officials, without any personal interface between tax payers and tax officers.

As said by the Finance Minister, the budget presented is not merely an interim budget but a medium of country’s development journey. The vision outlined by the Finance Minister in the budget speech provides insights on the key focus areas of the Government in the years to come. It will be worthwhile to look forward to the regular budget to see further incentives that will be provided to the taxpayers of the country.

(The author is a Director, People Advisory Services, EY. Views are personal)