The consortium of 20 lenders to REI Agro have referred the Rs 4,400-crore account to the corporate debt restructuring (CDR) cell, according to bankers. Led by UCO Bank, REI Agro’s lenders include United Bank, Dena Bank, Bank of Baroda and Central Bank of India and the consortium has an aggregate exposure of R4,400 crore.

At the end of FY14, gross debt of REI Agro stood at R5,156 crore while the net debt was R4,787 crore, according to Bloomberg data. The company reported a net loss of R38.35 crore in the year ended March 2014, owing to an interest expense of R603.2 crore, against a net profit of R211.01 crore in the year ended March 2013. Led by chairman Sandip Jhunjhunwala, REI Agro is a basmati rice processing company with a market share of 22% globally, according to the company website and its net sales in FY 14 stood at R10,155 crore on a consolidated basis.

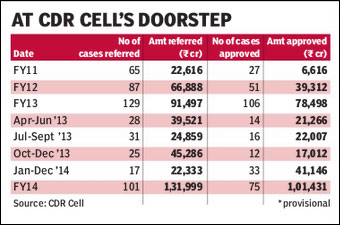

Bankers said the case has been just referred to CDR after the formation of a joint lenders’ forum (JLF), but added that the account could be discussed at the June-end meeting of the CDR cell.

The JLF was held on May 7, wherein the company was asked to present a revival plan. However, on May 10, Kolkata-based United Bank of India filed a winding-up petition against the company in the Calcutta High Court.

?United Bank of India has informed the BSE that the bank has filed the winding-up petition under Sections 433, 434 and 439 of the Companies Act, 1956, against REI Agro vide petition no. 436 (of 2014) in the High Court at Kolkata,? United Bank said in a notice to the BSE.

According to a BSE notification by the company on May 31, REI Agro’s board had consented initiating and finalising the corrective action plan (CAP) in accordance with RBI guidelines for special mention account (SMA) for the total debt of the company by the joint lenders forum representing all the working capital bankers, term lenders and NCD holders.

The company is now managed by Sandip Jhunjhunwala , after former chairman and director Sanjay Jhunjhunwala resigned on May 31 this year.

The Reserve Bank of India (RBI) has set out guidelines for early detection of stressed assets, which say that if the JLF decides on restructuring the account as a CAP, it will refer the account to the CDR cell for restructuring after preliminary viability study.

Corporate debt restructuring is a mechanism that works on the principle of approvals by the super-majority of 75% creditors (by value), which makes it binding on the remaining 25% to agree to the decision taken by the majority and covers only multiple banking and consortium accounts with exposure of R10 crore and above.