Although Cyrus Mistry was on Thursday unceremoniously removed as chairman of Tata Consultancy Services (TCS) without even a board meeting called, he won the day as the independent directors of Tata Chemicals rallied around him much like the directors of IHCL had done on November 4. They unanimously affirmed their confidence in the board, its chairman (Mistry) and the management “in the conduct of the Company’s business”.

Tata Sons, however, was determined to remove Mistry from IHCL and has asked the firm to call for an extraordinary general meeting. It may do the same with Tata Chemicals, industry experts said, after independent directors Nusli Wadia, Vibha Paul Rishi, YSP Thorat and Nasser Munjee expressed their support for Mistry on Thursday. Mistry is chairman and non-independent, non-executive director of Tata Chemicals, in which Tata Sons has a 19.35% stake. He is the son of Shapoorji Pallonji Mistry, who owns an 18.8% stake in Tata Sons.

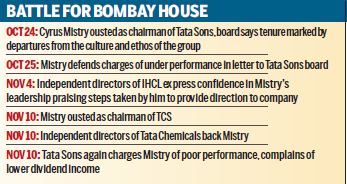

The vote of confidence from the IHCL directors had come as a major embarrassment for Ratan Tata and was the reason no TCS board meeting was called, legal experts said. Independent directors on the TCS board include Aman Mehta, V Thyagarajan, Clayton M Christensen, Ron Sommer, Vijay Kelkar and O P Bhatt. The Tata Sons board ousted Mistry as chairman on October 24 and since then has been attempting to dislodge him from other companies where he is chairman.

On Thursday, in another release, Tata Sons went to the extent of saying Mistry does not “really contribute materially to TCS’s management”. However, analysts pointed out Ratan Tata too had not contributed to TCS during his tenure as chairman of Tata Sons.

Tata Sons has complained that its dividend income from group companies fell from R1,000 crore in FY13 to R780 crore in FY16 — if TCS was excluded. An FE analysis found the dividend income of Tata Sons had seen only a minor fall under Mistry’s watch, despite the economic slowdown both overseas and at home, largely on account of Tata Motors. Of the top 10 dividend-paying firms, nine paid higher dividends in FY16 than in FY13.

In a fitting reply, Mistry’s office pointed out data was being used selectively. “To remove TCS from the data contending that Mr. Mistry does not really contribute materially to TCS and to blame him for all problems inherited by him such as Tata Motor’s passenger vehicle business in India is inherently fallacious to any unbiased observer.”

Tata Sons also alleged Mistry had ‘ulterior’ motives and wanted to take control of Indian Hotels. Mistry responded saying that “To allege ulterior motive of taking over control of companies, giving the example of Indian Hotels only because independent directors, one of whom is also a director of Tata Trust, demonstrated true independence is not in keeping with Tata governance standards.” Analysts have pointed out it was Mistry’s steps to turn the hotel chain around that had saved the company. IHCL reported a profit in H1FY17. Mistry’s office also pointed out the nomination and remuneration committee of Tata Sons had lauded Mistry’s performance on june28 and the report had been adopted by the board. “Tata Sons is yet to state what necessitated the replacement of Mr.Mistry on October 24 without any notice or an opportunity to defend himself,” the statement said.