Late last week, Punjab National Bank (PNB) raised interest rates on deposits by a fairly hefty 125 basis points for maturities between 180 days and one year. The return on these relatively shorter-term products is now a fairly high 8.75%. But it?s not just short-term money that banks are scrambling for; in mid-February, State Bank of India (SBI) offered its customers 25 basis points more if they left money lying with it for more than a year and up to 10 years.

SBI CFO Diwakar Gupta argues that SBI wasn?t exactly offering the best returns on longer-term deposits; so, it needed to tempt customers with a hike in the rate to 8.75%.

ICICI Bank, for instance, offers 9% for a tenure of between 390 days and two years. But it?s also true that had the system not been so short of money, SBI might not have needed to tweak that rate.

ICICI Bank, for instance, offers 9% for a tenure of between 390 days and two years. But it?s also true that had the system not been so short of money, SBI might not have needed to tweak that rate.

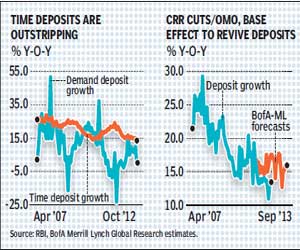

Unfortunately for banks, however, deposits have risen at a very slow pace for over a year now, even as loan growth has tapered off averaging some 16% year-on-year. In the fortnight to February 22, deposits grew at 12.7% y-o-y to R65,61,051 crore, a sharp drop from the end of 2011 when the growth was averaging as much as 18%.

Between April last year and now, the increase has been a much slower 7.6% than the 9.3% in the corresponding period of 2011-12.

In all this, it?s really the cheaper current and savings accounts that are fast vanishing as seen from the drop in the ratio of demand to time deposits that has been falling for over a year now.

While time deposits continue to clock a reasonably good 14.5%, the increase in demand deposits has been very subdued at 2-2.5%. That?s understandable since corporates are managing their funds more carefully given business is dull and individuals are compelled to hold on to more cash at a time when consumer inflation is running at 10%.

Which is why Bank of America Merrill Lynch (BofAML) believes that negative real rates are not really pulling down deposit mobilisation. In a recent report, BofAML points out that had households been breaking down fixed deposits to write checks to buy gold or real estate, the reverse would surely have been the case. While it?s a fact that financial savings have come off to 10.8% in FY12 from 17.8% in FY07, this reflects the deceleration of overall, and by extension, household deposit growth due to RBI tightening to contain inflation. With the Reserve Bank of India (RBI) expected to cut interest rates, the economy is expected to bottom out by mid-2013. That, together with further infusions of liquidity, by the central bank, should help push up deposit growth to levels of 15-16%. Meanwhile, banks might raise rates at the shorter end knowing they need to compete with fixed income products offered by mutual fund products.