Page 20 of tamil nadu

Related News

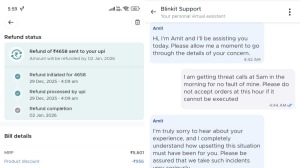

‘Getting threat calls at 5 am’: Blinkit customer alleges harassment over delivery dispute, tags Zomato CEO Deepinder Goyal

‘No job in Canada without…’: NRI who returned to India 1.5 years ago calls it ‘best decision’

Mark Zuckerberg’s Meta Superintelligence Lab goes global: Chief AI Officer Alexandr Wang announces new hiring in Singapore

AI will end work-from-home, says Google DeepMind Co-Founder Shane Legg

Stranger Things Season 5 finale release in India: Exact date and time to watch last episode of Netflix series